EBA publishes the results of its 2021 EU-wide stress test

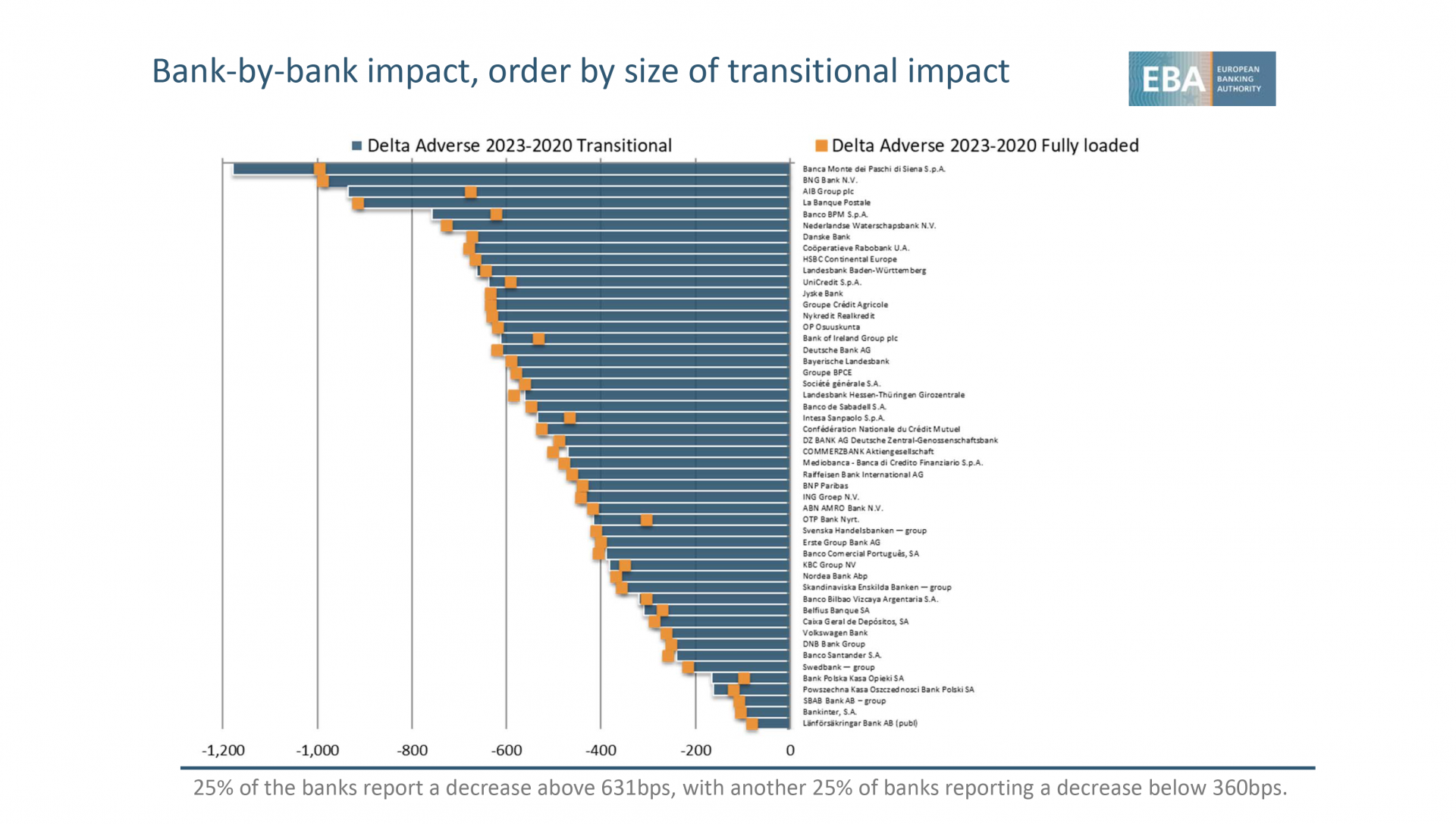

The European Banking Authority (EBA) published today the results of its 2021 EU-wide stress test, which involved 50 banks from 15 EU and EEA countries, covering 70% of the EU banking sector assets. This exercise allows to assess, in a consistent way, the resilience of EU banks over a three-year horizon under both a baseline and an adverse scenario, which is characterised by severe shocks taking into account the impact of the pandemic. The individual bank results promote market discipline and are an input into the supervisory decision-making process. The adverse scenario has an impact of 485 bps on banks’ CET1 fully loaded capital ratio (497 bps on a transitional basis), leading to a 10.2% CET1 capital ratio at the end of 2023 (10.3% on a transitional basis).

Source: EBA (European Bank Association)

Photo: EBA 2021 EU‐wide stress test

Download link: 2021 EU‐wide stress test - Summary of results, including bank by bank results

https://bit.ly/3if2n1c