Boom in European Logistics Real Estate Continues Unabated

Users and investors are creating such high demand for European logistics real estate that project developers can hardly keep up. There are reasons for this: the flourishing online trade, leaps in last-mile requirements and the attractiveness of European distribution centres and warehouses in the face of global supply chain problems. The situation is increasingly attracting investors from outside the sector, but the excess returns over other asset classes have diminished or dissipated in many places.

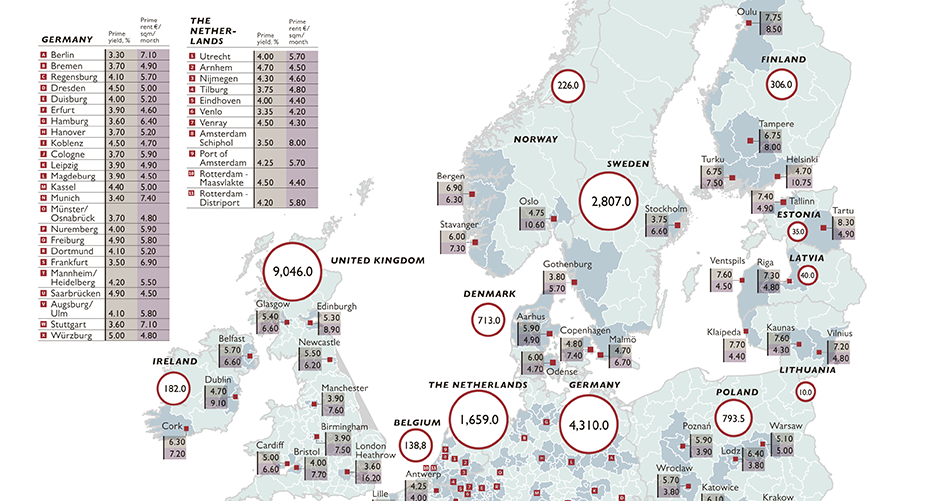

Prof. Dr. Thomas Beyerle, Head of Research at Catella Group, comments: "The Europe-wide dynamics on the market for logistics properties are reflected in our logistics map with 107 locations surveyed across Europe. The strong price dynamics are accompanied by falling yields in many places. Due to the high demand for space, we anticipate a further increase in investment activity, which will be concentrated primarily in urban and suburban areas. Given the congestion in global supply chains, we see no end to this dynamic market development."

Further results of the study:

- Currently, the European average yield is 4.98%, 43 basis points below the previous year's value, ranging from 3.3% in Berlin to 8.3% in Tartu.

- The sharpest decline was recorded in Vienna, where it fell by 1.6 percentage points to 3.4%.

- The current European prime rent averages €5.69/sqm, ranging from €3.70/sqm in Liège to €16.20/sqm in London.

- In Germany, France, the UK and the Netherlands, prime yields for logistics properties have now fallen well below the 4% mark. Individual transactions can often be observed close to the 3% mark.

- In Poland and the Czech Republic, rising prices can be observed across the board.

- We continue to find the highest yield values in the three Baltic countries with top yields around 7.2%.

- The Nordic markets still appear relatively cheap compared to their European counterparts, with Copenhagen (4.8%), Helsinki (4.7%) and Stockholm (3.75%) in particular experiencing dynamic yield compression.

- The European logistics transaction volume more than doubled in H1 2021 compared to the previous year's figure (€12.7bn) to around €26.3bn.

Download Catella logistics market map Europe 2021 with the below link:

https://www.catella.com/globalassets/global/mix-germany-corporate-finance/catella_logistics_market_2021.pdf