Catella reports worsening housing shortage across Europe as rents rise and overcrowding grows

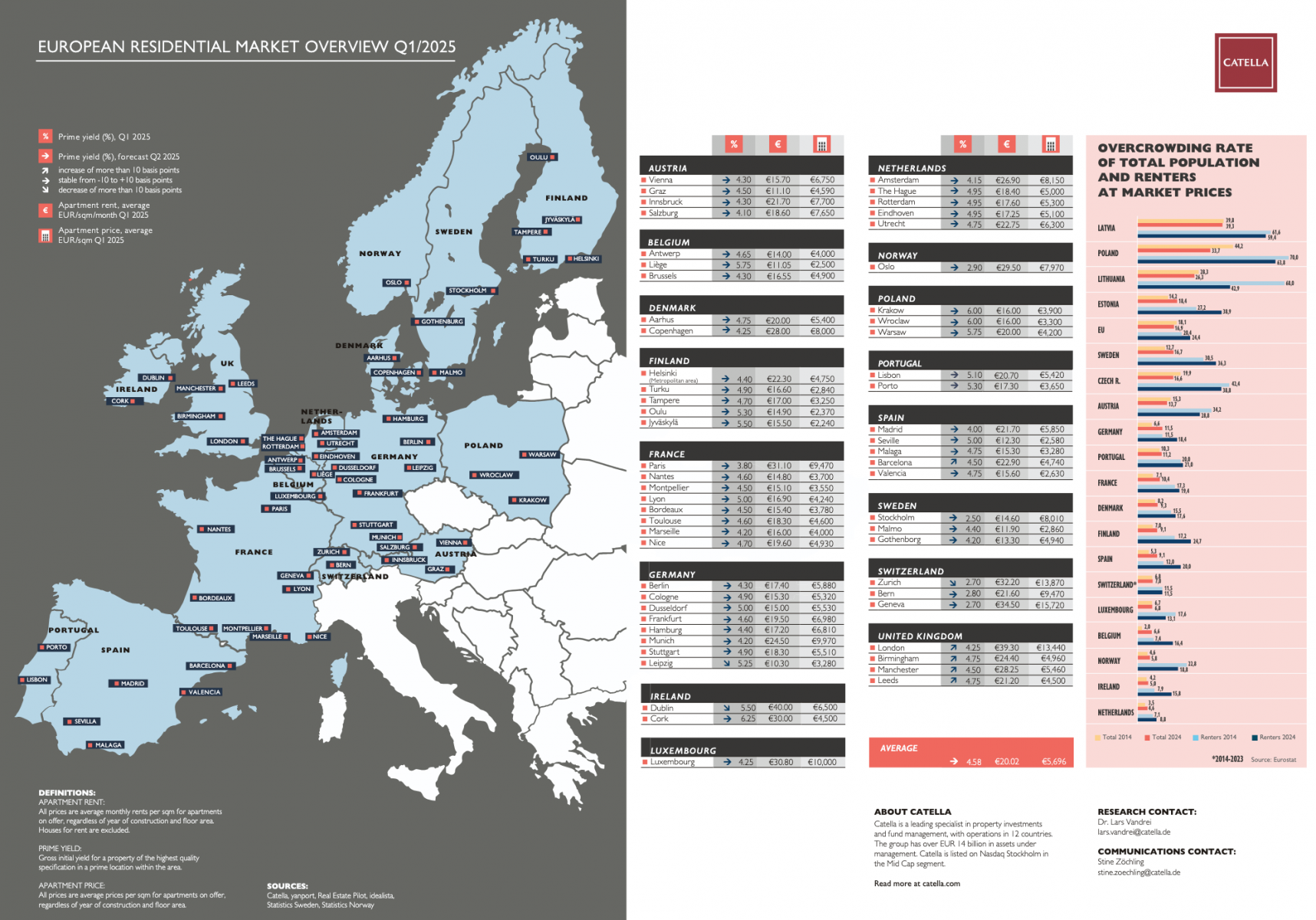

Rental prices in Europe continued to climb during the first quarter of 2025, while housing supply remained constrained and overcrowding in rental apartments increased. According to the latest Catella Residential Market Overview Q1/2025, covering 59 cities in 16 European countries, low construction volumes and sustained demand are putting further pressure on already tight markets.

Catella Investment Management’s Head of Research, Dr. Lars Vandrei, noted that despite persistent uncertainty in the broader economic and geopolitical context, the real estate market showed signs of modest price growth and yield stability. However, high demand for rental housing remains a dominant factor, reflected in both rising rents and a growing number of households facing overcrowded living conditions.

In the rental market, prices increased in 48 of the cities surveyed. The average monthly rent across Europe reached €20.02 per square metre, marking a 2.4% increase since the third quarter of 2024. Dublin recorded the highest average rent at €40.00 per square metre, also representing the steepest increase. London followed at €39.30, while Geneva registered €34.50, slightly lower than the previous period. At the lower end of the rental scale were Leipzig (€10.30), Liège (€11.05), and Graz (€11.10).

On the ownership side, prices for condominiums rose in 31 of the 59 cities analysed. The average price across these cities now stands at €5,696 per square metre, a 0.9% increase from Q3 2024. Geneva remains the most expensive housing market at €15,720, followed by Zurich (€13,870) and London (€13,440). In contrast, the most affordable home prices were found in Finnish cities such as Jyväskylä (€2,240) and Oulu (€2,370). Among the cities with the highest relative price increases were Madrid (+11.9%), Gothenburg (+10.5%), and Copenhagen (+9.6%).

Prime residential yields averaged 4.58% across the surveyed markets, unchanged from the previous reporting period. The lowest yields were reported in Stockholm (2.50%) and in Zurich and Geneva (2.70%), while higher returns were observed in Cork (6.25%) and major Polish cities including Krakow, Wroclaw (6.00% each), and Warsaw (5.75%).

In Germany, rents rose across all cities included in the study. Munich remained the country’s most expensive rental market at €24.50 per square metre, followed by Frankfurt (€19.50) and Stuttgart (€18.30). On the ownership side, Munich maintained the highest prices at €9,970 per square metre, just below the €10,000 mark reached in 2022. Frankfurt and Hamburg followed, while Leipzig remained the most affordable among Germany’s largest cities with an average price of €3,280. The lowest yields were also recorded in Munich, at 4.20%, while Leipzig offered the highest returns at 5.25%.

A special focus of the report highlights the rising levels of overcrowding in rental housing across Europe. Overcrowding is defined by the number of rooms available relative to the size and composition of a household. While the overall rate of overcrowding in the EU has slightly declined from 18.1% in 2014 to 16.9% in 2024, overcrowding among renters has increased significantly—from 20.4% in 2014 to 24.4% in 2024.

The issue is most acute in Northern and Eastern Europe but is increasingly visible in Western and Southern European countries as well. Germany saw a 4.9 percentage point increase in overall overcrowding between 2014 and 2024, while Belgium (4.6 pp), Spain (3.8 pp), and Sweden (4.0 pp) also recorded notable increases. Among renters, the figures are higher: Belgium (+9.0 pp), Spain (+8.0 pp), and Ireland (+7.9 pp) showed some of the steepest rises. In Germany, 18.4% of renters now live in overcrowded homes, compared to 11.5% a decade ago.

The data suggest that Europe’s rental housing crisis is deepening, with insufficient new construction and strong demand continuing to drive prices upward and limit available space. Without policy interventions or significant increases in housing supply, these trends are likely to persist.

https://nl.rueckerconsult.de/img/European_Residential_Market_Overview_Q1_2025_2552142652025.pdf