Completing the European Banking Union could reduce financing costs and boost investment

Efforts to finalize the European Banking Union have faced repeated delays, despite being a long-standing priority for federal governments. However, the recent attempt by UniCredit to acquire Commerzbank has reignited discussions about the need for greater financial integration within the European Union. A fully integrated banking system would not only improve resilience against future crises but also increase competition among banks, leading to lower financing costs for businesses and stronger economic growth.

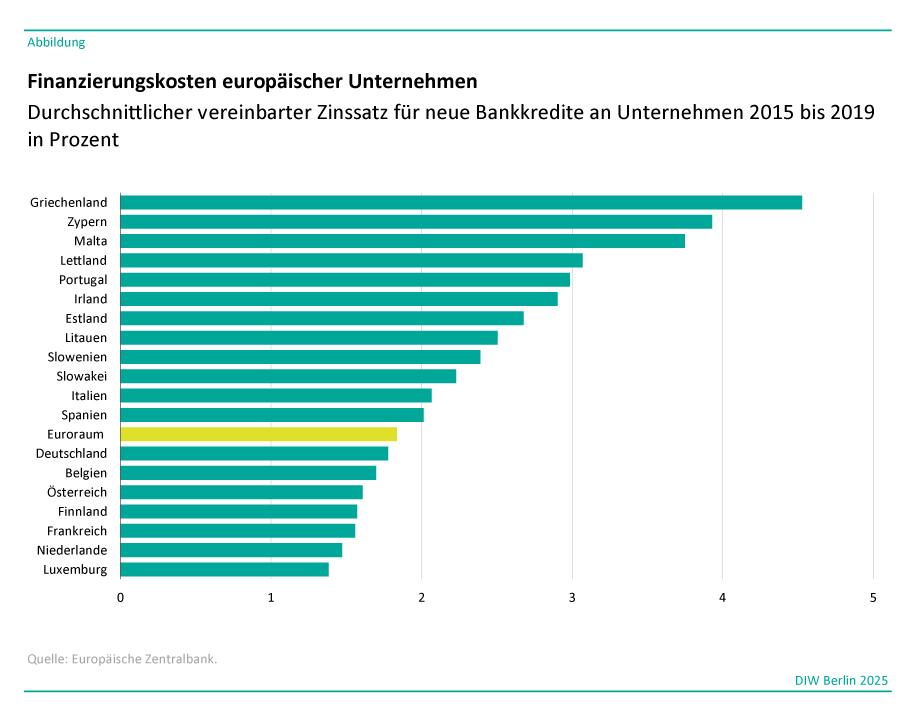

Although the European Monetary Union allows for the free movement of capital, financial integration across borders remains limited. Banks still primarily lend within their national markets rather than across EU countries. This fragmentation was evident during the European debt crisis between 2010 and 2012, when businesses in certain countries struggled to access credit as local banks faced liquidity shortages. Small and medium-sized enterprises were particularly affected, as their ability to secure loans depended heavily on the financial health of their domestic banking sector. A fully integrated banking union would reduce this dependence by allowing companies to seek financing from banks across the EU. This would foster competition within the banking sector and lower borrowing costs, ultimately stimulating investment.

The Banking Union was initially conceived as a response to the financial crisis and is based on three key pillars. The Single Supervisory Mechanism (SSM) was established to shift banking oversight from national regulators to a centralized European authority, ensuring more consistent supervision. The Single Resolution Mechanism (SRM) was designed to create a framework for handling failing banks at the European level, although it still lacks a common resolution fund to prevent the use of taxpayer money in bank bailouts. The third pillar, a common deposit insurance scheme, remains unimplemented due to political disagreements, leaving deposit protection fragmented across member states.

Further financial integration would require harmonizing national insolvency laws and reducing banks’ exposure to domestic government bonds. This would help prevent national governments from pressuring banks to purchase sovereign debt, which has historically led to financial instability in times of crisis. Establishing a more unified banking system would create a stronger financial foundation across the eurozone, ensuring that lending decisions are based on economic fundamentals rather than political influence.

A fully integrated banking union would not only enhance financial stability but also encourage investment. Studies suggest that a ten-basis-point reduction in interest rates could lead to a five percent increase in investment in Germany over a two-year period. By expanding businesses’ access to competitive financing options beyond their home countries, financial integration could help address stagnation in European economies and promote long-term economic growth.

Successive German governments have played a role in delaying the completion of the Banking Union, often citing concerns over financial risk-sharing. However, moving forward with integration would provide significant benefits, including better protection for savers through a common deposit insurance scheme and reduced government influence over national banks by limiting their exposure to domestic debt. Harmonizing insolvency regulations would also facilitate cross-border lending, making the European financial system more efficient and transparent.

Finalizing the Banking Union would go beyond resolving debates over bank takeovers, such as the UniCredit-Commerzbank case. It would strengthen financial stability, increase competition in the banking sector, and create better financing conditions for businesses across the eurozone. In addition to reducing systemic risk, greater financial integration would allow capital to flow more efficiently across borders, supporting investment and economic development in both Germany and the wider European economy.

Source: DIW Berlin