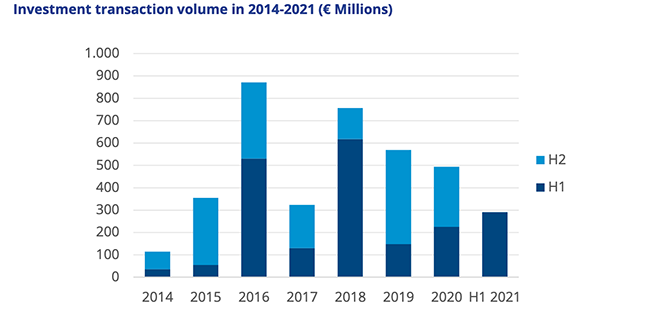

Croatia Deal volume & trends H1 2021

The investment transaction volume of commercial real estate exceeded €290 million in H1 2021, which represents a 30% increase year-on-year. Colliers recorded a good number of deals despite the inability of some foreign investors to execute deals due to travel restrictions. In comparison to 2020, there is more certainty in many sectors and the investor sentiment is positive.

The hotel sector made up 69% of the total volume, which was followed by office transactions with a 20% share; followed by logistics with 7% and finally, by the retail sector with a 4% share. Average deal size in 2020 and H1 2021 was in region of €9 million and €11 million respectively, excluding portfolio deals. The demand for bigger tickets exceeds the supply.

New lending typically has become more strict with less favourable conditions for buyers. LTVs are under pressure. The clear focus for banks, similarly to investors, is the sustainability of the underlying income and tenant risk (or operational risks for trade related properties). Debt underwriting has also been prolonged with

extensive due diligence activity required by banks holding back deals from quick completion.

Source: Colliers Croatia

Image: Colliers Croata

Full report can be downloaded in PDF format from the link below:

https://bit.ly/3i9fCQY