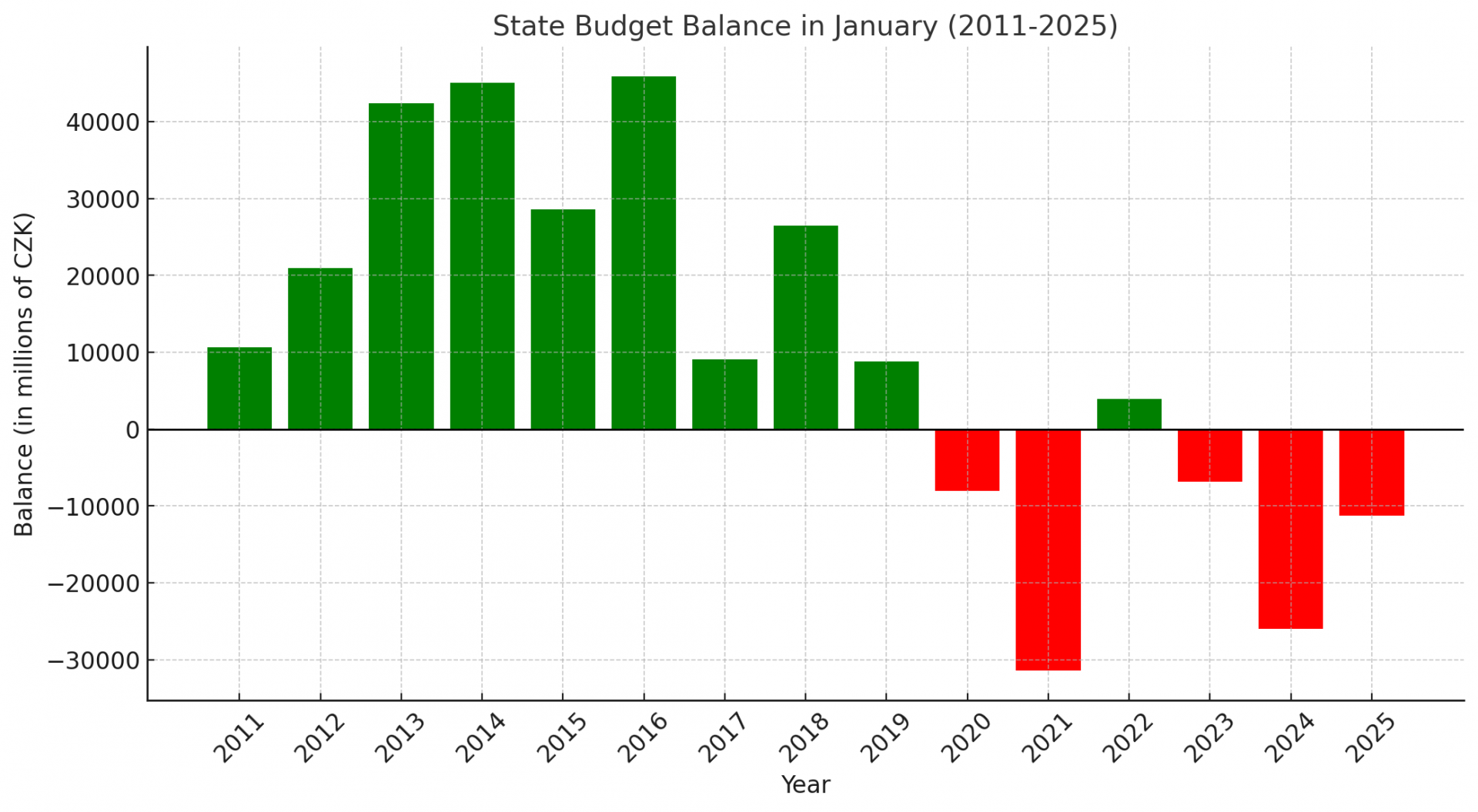

Czech state budget deficit shrinks to CZK 11.2 billion in January

The Czech Republic’s state budget recorded a deficit of CZK 11.2 billion in January, a significant improvement compared to last year’s CZK 26 billion shortfall, the Treasury Department reported on Monday. Despite the improvement, this remains the third-largest January deficit since the country’s founding. The reduction was largely driven by higher tax revenues, while government expenditures remained stable.

According to the Ministry of Finance, budget revenues in January reached CZK 161.8 billion, marking a 9.7% year-on-year increase. Meanwhile, expenditures slightly decreased by 0.3% to CZK 173 billion.

Finance Minister Zbyněk Stanjura (ODS) attributed the improvement to stronger tax collection but cautioned that January is a volatile month due to delayed tax inflows, seasonal spending patterns, and pre-financing of certain expenditures. He pointed out that government investments tend to be lower in January, while payments to regional education and research programs temporarily impact spending levels.

Historically, January budget figures have often shown a surplus. However, since 2020, only one January ended in positive territory—2022, during a budgetary provisional period. Martin Kron, an analyst at Raiffeisenbank, warned against drawing conclusions from the January data, stating that it remains uncertain whether the planned CZK 241 billion deficit for 2025 will be met. He emphasized that the Czech economy’s performance in the coming months will be a key factor, noting that weaker-than-expected growth and potential U.S. tariffs on European goods could negatively impact state revenues.

The year-on-year improvement in the budget balance was primarily due to higher tax collections, which rose 15.5% to CZK 80.7 billion. Revenue from value-added tax (VAT), the largest tax source, grew by 9.8% to CZK 42 billion. Personal income tax collections rose by 11.5% to CZK 16.1 billion, while excise tax revenues increased by 10.2% to CZK 15.6 billion. The government also collected CZK 63.3 billion in compulsory insurance premiums, representing a 6.5% annual increase.

Conversely, contributions from the European Union decreased by CZK 3 billion to CZK 10.3 billion, highlighting a decline in external funding.

On the expenditure side, social benefits remained the largest budgetary item, with the state spending CZK 79.7 billion, an increase of 3.4% year-on-year. Of this, CZK 62.3 billion was allocated to pension payments. The most significant expenditure increases were related to education, particularly pre-financing for regional schools and universities.

Government capital expenditures stood at CZK 2.3 billion, down CZK 0.5 billion year-on-year. The Ministry of Finance noted that investment spending is typically low in January, as most infrastructure and development projects take place later in the year.

For 2025, the Czech government has planned total revenues of CZK 2.086 trillion and expenditures of CZK 2.327 trillion, leading to a target deficit of CZK 241 billion. Last year, the state ended with a CZK 271.4 billion deficit, which, while the lowest since the COVID-19 pandemic, was still the fifth-largest deficit in Czech history.

Despite the positive start, analysts caution that economic uncertainties, shifting tax revenues, and potential global trade disruptions could still challenge the government’s ability to meet its fiscal targets for the year.

Source: CTK and Czech Ministry of Finance

Photo: Finance Minister Zbyněk Stanjura (ODS)