Czechia: Growth driven by energy-efficiency renovation loans

The market growth was largely attributed to successful cooperation between building societies and the state, particularly in providing loans aimed at improving energy efficiency in real estate. Michael Pupala, CEO of Blue Pyramid and First Vice-Chairman of the Association of Czech Building Savings Banks (AČSS), highlighted the impact of the “Repair House after Grandma” program. This initiative, supported by the State Environmental Fund, offered preferential loans for extensive renovations of older properties.

“These discounted loans demonstrate how collaboration between the state and the financial sector can make modern, sustainable housing accessible to more people,” Pupala said, adding that he expects continued demand for such loans in 2025.

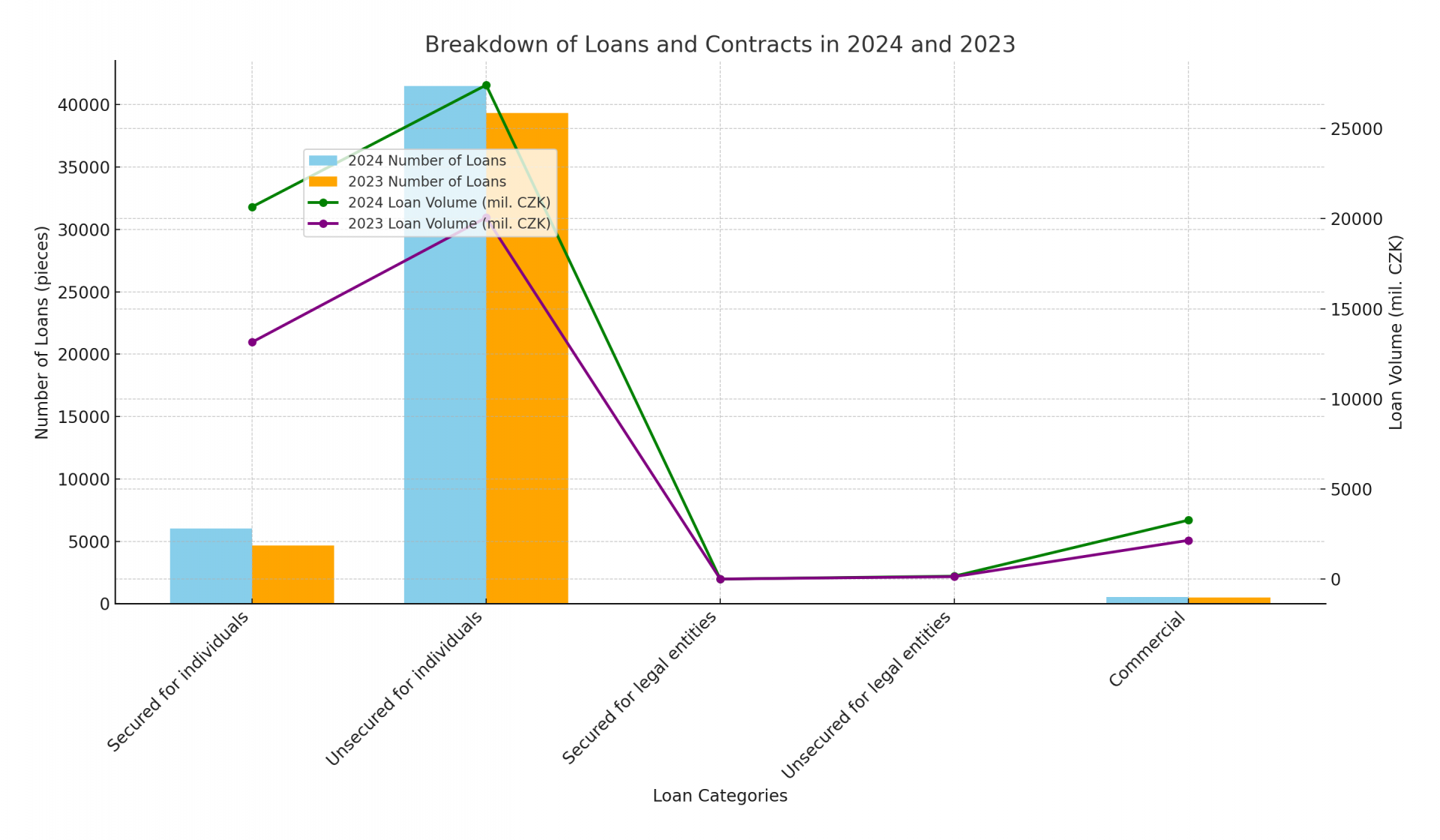

Of the 48,076 loans issued last year, up 8% year-on-year, the vast majority—41,472 loans worth CZK 27.4 billion—were unsecured. These loans, commonly used for housing renovations, saw a 36.7% increase in volume compared to 2023.

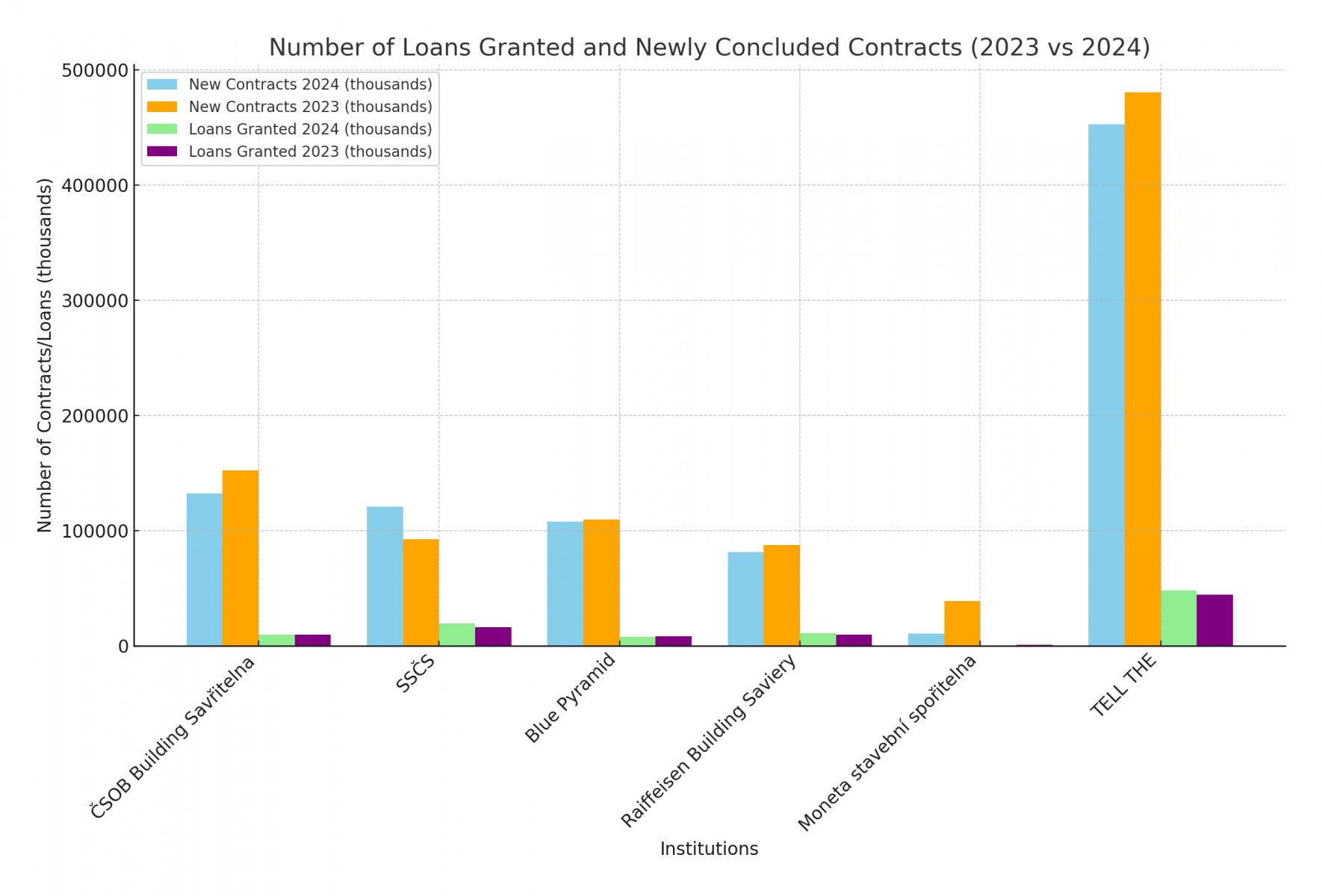

The number of new building savings contracts signed in 2024 reached 452,637, with a target savings amount of CZK 310.4 billion, representing a 9.8% decline year-on-year.

Despite the reduction in the state contribution to building savings (from CZK 2,000 to CZK 1,000 per year), fears of a significant drop in interest proved unfounded. “The expected dramatic decrease in demand did not occur. In 2024, building societies concluded nearly the same number of contracts as in 2023, when the state aid was higher,” Pupala explained.

Building savings remain attractive due to higher returns on deposits and fixed interest rates over a six-year period, Pupala noted. Additionally, clients value the option to draw on favorable housing loans in the future, further enhancing the competitiveness of this savings product.

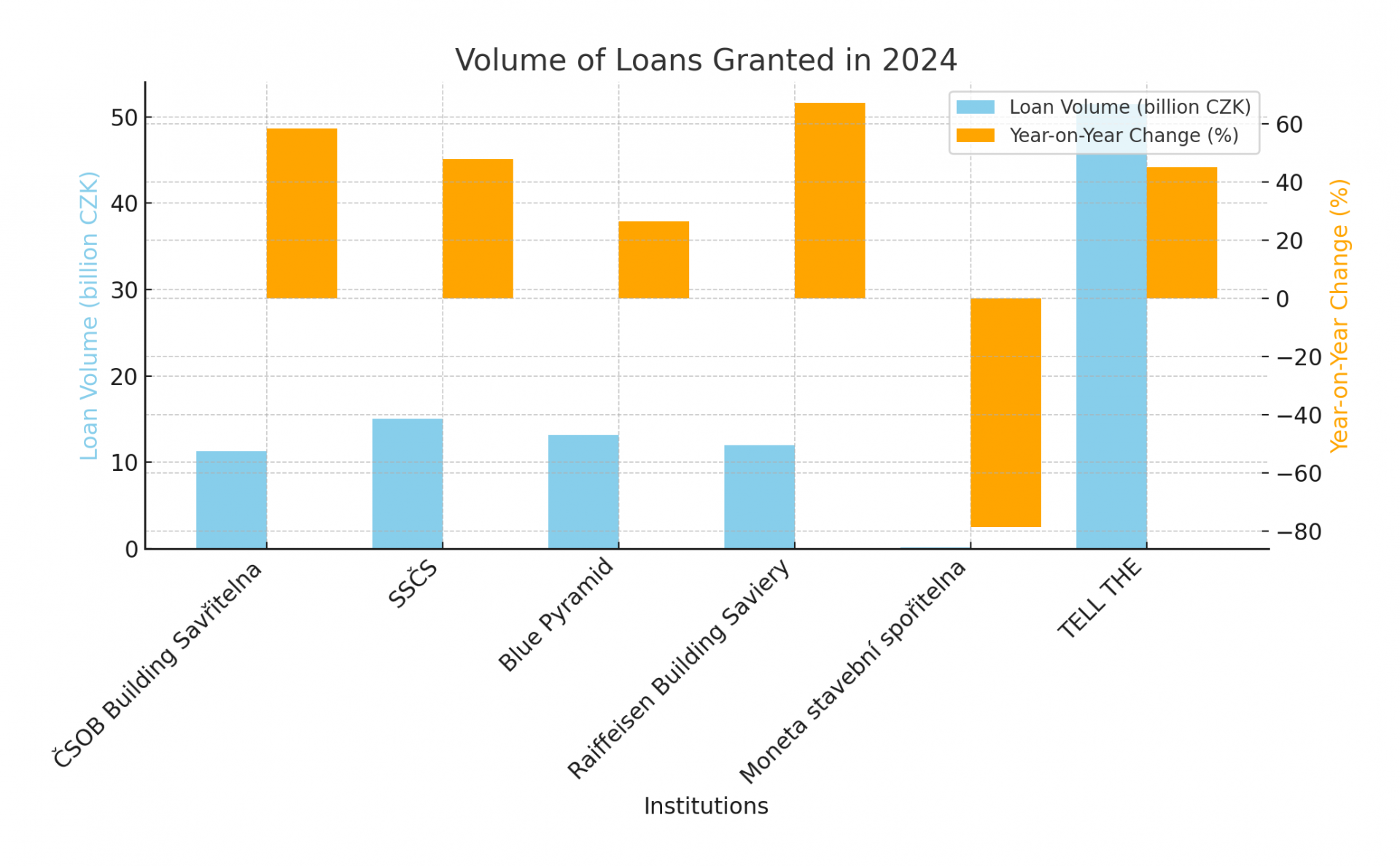

The strong performance in 2024 marks a recovery in the building savings market after a decline in 2023, when both new loans and savings contracts decreased. According to AČSS, last year’s downturn was linked to uncertainty about state aid and an overall slowdown in the mortgage market.

Looking ahead, the continued success of state-backed renovation loans and the sustained competitiveness of building savings products are expected to drive further growth in 2025.

Source: CTK