Czechia: Older housing prices rise more slowly than expected

Current data shows a surprising trend: older housing prices are rising more slowly than anticipated, with many regions even reporting price drops. Indecisive buyers are largely to blame for this unexpected shift.

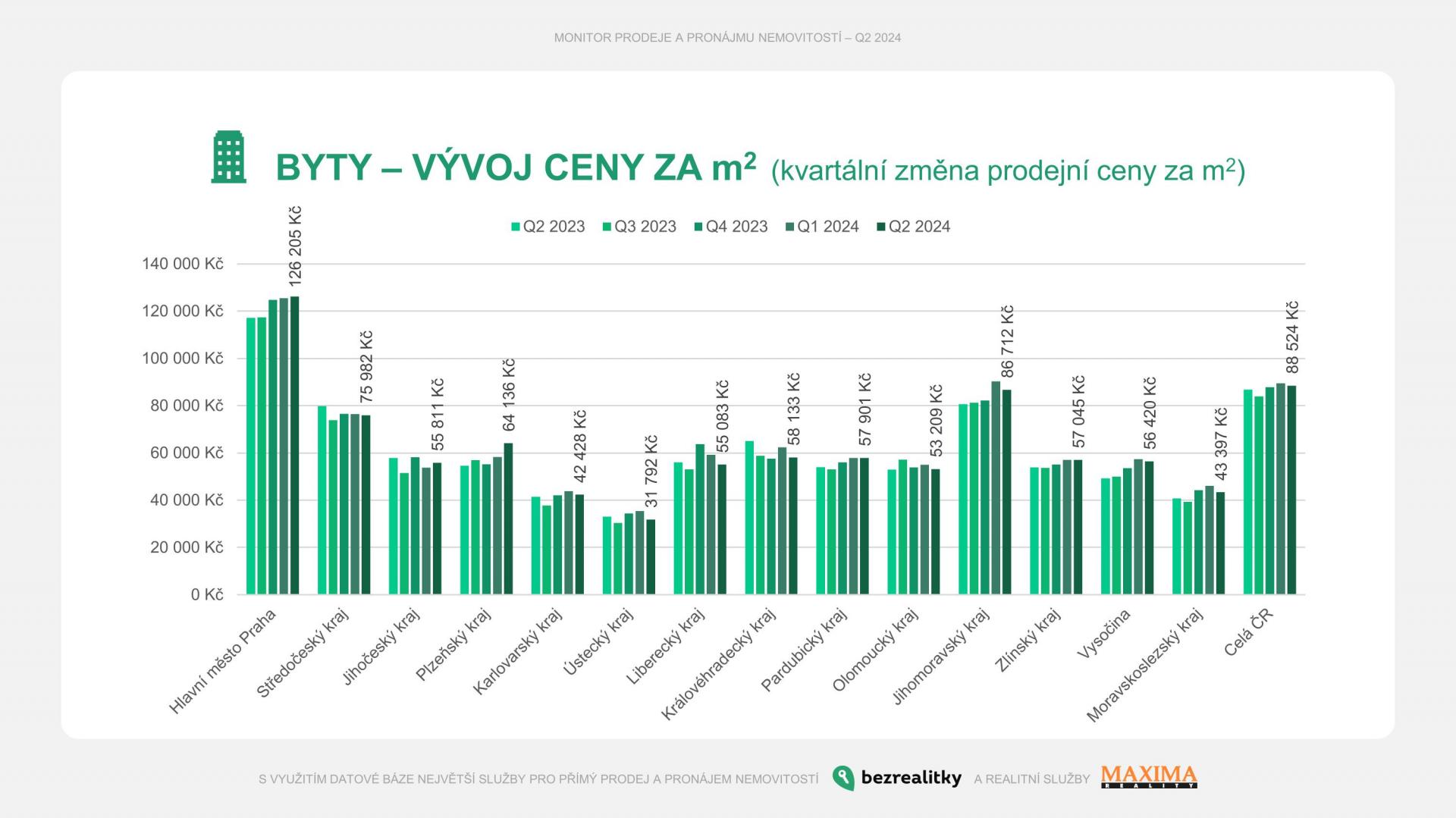

This is positive news for those planning to purchase a house or flat in the coming months. Earlier this year, it seemed that house and apartment prices had rebounded from a period of stagnation. However, this recovery now appears to have been a false start. In most regions, prices are falling quarter-on-quarter and are only slightly above the levels seen at the end of last year. This trend is evident even in large regions such as Central Bohemia and South Moravia, with the capital city reporting only minimal price increases.

“At the beginning of this year, there was significant optimism in the real estate market. However, it has become clear that this optimism was somewhat exaggerated. While the number of viewings is increasing, households’ ability to invest in housing remains limited. This is most evident in larger cities, where spring prices tested buyers’ purchasing power and found it lacking,” said Hendrik Meyer, head of European Housing Services. “Interestingly, this situation could benefit both owners and buyers.”

Meyer explained that the downturn is due to unrealistic pricing for lower-quality properties, where real estate agents raised prices in the spring without justification. This prolonged the sales period and missed the initial wave of buyers who secured mortgages earlier in the year. These unrealistic expectations led to an overall market price increase through a domino effect.

Flat prices are stagnating even in the largest market, Prague. The average price here increased by only one percent to CZK 126,000 per square meter, showing an 8% year-on-year increase. In contrast, Brno saw a 4% price correction, with older flat prices falling to approximately CZK 87,000 per square meter. Despite this, Brno still reported a 7% year-on-year increase. In the Central Bohemian Region, flat prices have also declined, selling at a similar price to the spring, CZK 76,000 per square meter, and showing a 5% year-on-year decrease.

“It turns out that households’ financing options are still not strong enough to drive the market forward. This is evident from the highest number of viewings in the last 24 months, but with a disproportionately lower number of closed sales,” Meyer explained. “Household caution, linked to the slower economic recovery, is likely to influence the market in the second half of the year. Owners should consider this and prepare for negotiation.” Meyer also noted that adjusting prices slightly could accelerate sales significantly.

Prices of detached houses have also retraced their steps. The average price across the Czech Republic fell by 2%, returning to the level seen at the end of last year. Factors such as insufficient housing finance options and growing concerns about additional costs, particularly for renovations or energy efficiency improvements, are contributing to this trend. Nonetheless, in a year-on-year comparison, house prices remain higher across most regions, in some cases by more than 10%.

In South Moravia, house prices have only slightly dropped compared to spring, by 1% to CZK 55,500 per square meter. The same decrease is reported for the Central Bohemia Region, which is closely connected to Prague. Here, prices stabilized at CZK 68,000 per square meter, with a 5% year-on-year growth, indicating that the Prague market has not yet significantly influenced regional prices.

“Significant changes are also occurring in other markets. For instance, the Olomouc region, which saw a substantial year-on-year growth, is now experiencing a 9% price reduction compared to spring. This indicates that household interest is temporarily waning after a brief upswing. Similarly, prices in and around Plzeň have fallen by 4%,” Meyer said. “In several regions, there is a notably low interest in detached houses as second homes or holiday properties, impacting prices.”

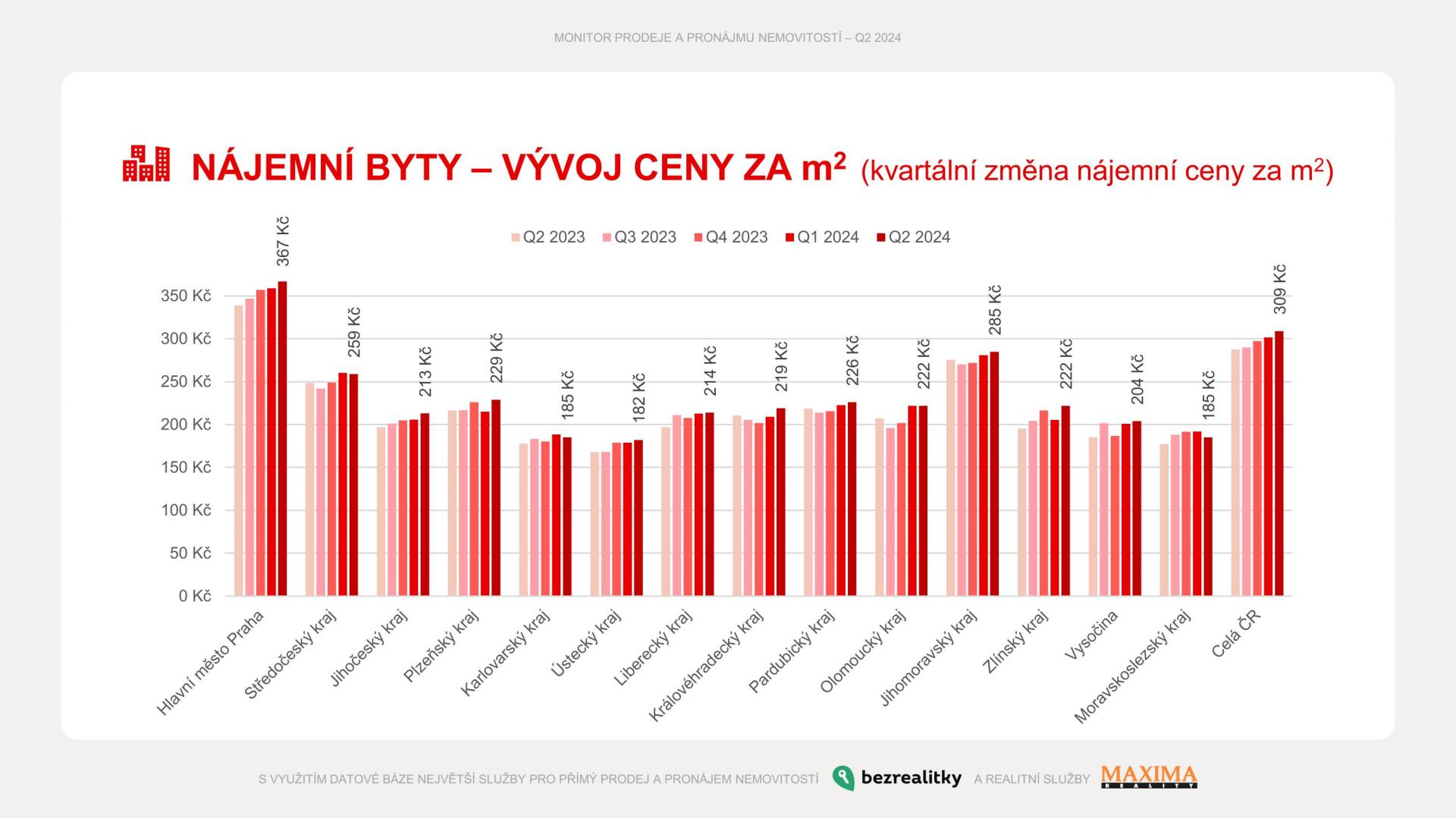

The demand for rental properties has increased again, although this brings a higher risk of fraud. Rental price growth has accelerated, with a significant surge expected in mid-summer and likely in September, coinciding with the peak in demand from university students and regular households. Currently, demand is high, with over 25 applicants per rental apartment across the Czech Republic.

In Prague, where the demand is traditionally highest, there are currently 51 applicants per apartment. Consequently, prices have increased by 2% to CZK 367 per square meter. Year-on-year, households will pay nearly CZK 1,850 more per month for a typical 65-square-meter flat. In Brno, rental prices have risen by 1% to CZK 285 per square meter, with a year-on-year increase of about 3%, equating to an additional CZK 620 per month for a 65-square-meter flat. Cities in the Central Bohemian Region have seen a drop to CZK 259 per square meter, though prices are 4% higher year-on-year, costing an additional CZK 685 per month for a 65-square-meter flat.

“A lower number of sales is starting to impact rents. The next generation, especially young households postponing home purchases, is entering the rental market. Additionally, the number of interested singles of various ages is increasing,” said Martin Ponzer, director of Bezrealitka. “There is also growing interest in rentals in regional cities like Plzeň, Olomouc, and České Budějovice.”

Ponzer warned that the Czech rental market is not prepared for such a surge in interest, leading to short-term actions by owners who often underestimate the screening of prospective tenants. The increased number of applicants raises the risk of fraud, particularly with rentals arranged through social networks or bazaar platforms.

“As part of our safety measures, we regularly analyze fraudulent advertisements and the number of risky housing applicants. The risk is currently the highest in the past three years,” Ponzer concluded. “This is why Bezrealitky has introduced instant applicant checks in several registers, allowing us to identify potential problems effectively.”