Deloitte report: Four Polish banks among the world’s 40 digital champions

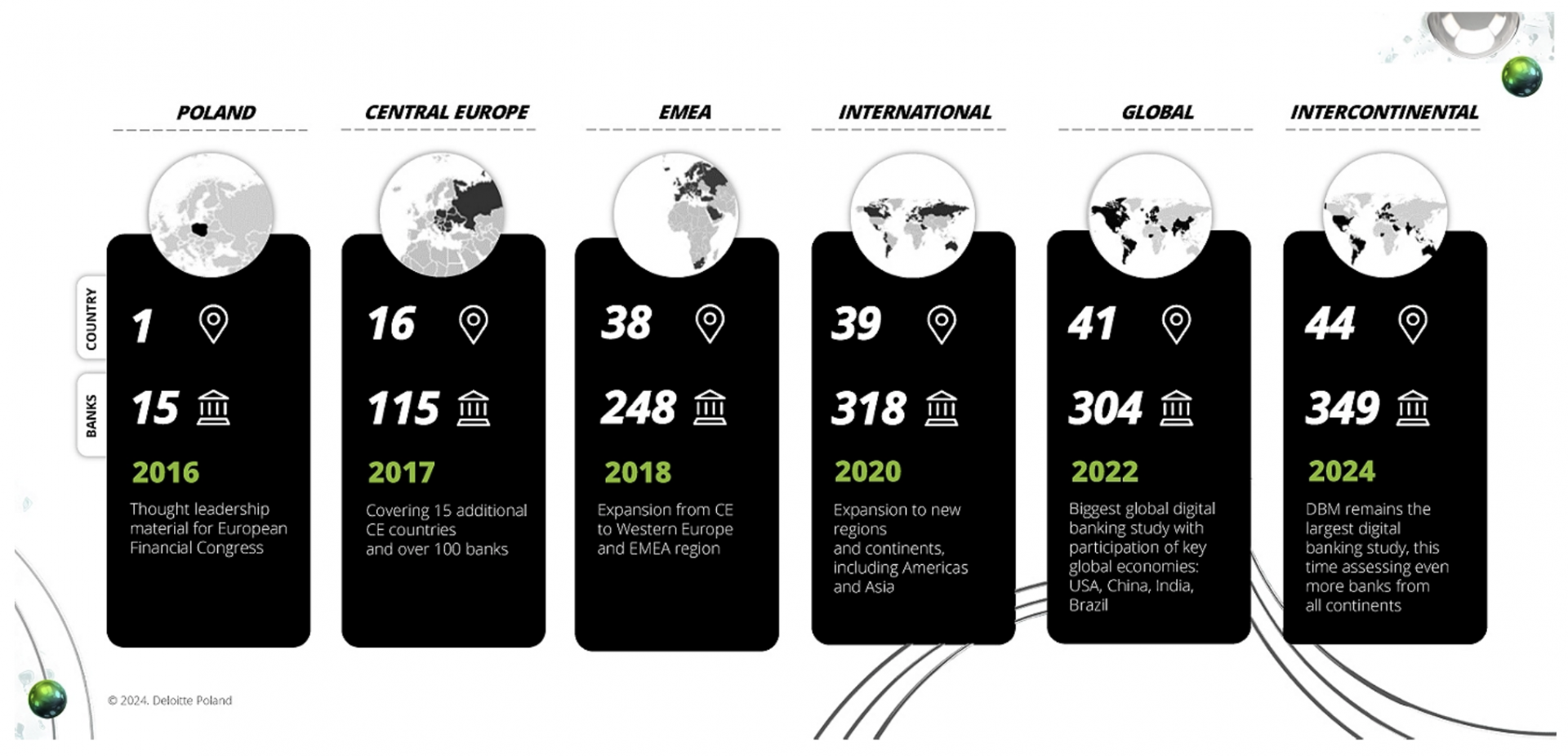

Four banks from Poland have been recognized as part of the 40 “digital champions” leading the way in the banking sector transformation, according to a new report by Deloitte. The analysis encompassed 349 banks across 44 countries.

The report highlights the rapid digital evolution in the banking industry in the wake of the COVID-19 pandemic, as institutions hurriedly integrated features to meet the changing needs of their customers. “Online banking platforms have become more sophisticated, mobile applications have expanded with new functionalities, and financial institutions have rushed to stay ahead of the competition,” the report states in its overview of “Digital Banking Maturity 2024.”

However, the evolving digital landscape has given rise to a new trend: rather than continually adding new features and overwhelming users with options, leading digital banks are now focusing on optimizing core processes and enhancing customer service. “Instead of cluttering their applications with an ever-expanding list of functionalities, banks are prioritizing the quality of the experience over quantity, concentrating on liquidity, personalization, and the performance of essential functions,” the report elaborates.

In this year’s sixth edition, nearly 349 financial institutions from six continents were surveyed, evaluating three key areas: an analysis of over 1,000 digital features, consumer preferences across 18 key banking activities, and principles and best practices in user experience design (UX).

The surveyed banks were categorized into four groups: the top performers, dubbed digital champions, are paving the way for the banking sector’s digitalization, which includes the four Polish banks. The second group comprises digital smart followers—institutions effectively implementing key solutions and striving to match the leaders. Following them are the imitators (digital adopters) in the process of adapting technology and developing their digital functionalities, with the final group comprising banks that are just beginning their transformation (digital laggards).

According to the report, Europe leads with the highest number of digital champions, followed by India, Turkey, and Brazil.

“Our research indicates that leading digital banking providers, most of which are based in Europe, have developed a significant advantage over their competitors in the past two years, offering more features that support long-term customer relationships,” commented Wiesław Kotecki, partner and head of Deloitte Digital’s customer strategy and design team. He noted that the most advanced firms offer services that extend beyond traditional banking nearly three times more frequently, and the gap is similarly significant in ecosystem and account aggregation categories.

Deloitte experts caution, however, that since 2022, there has been a certain stagnation in implementing new functionalities in banking applications. Increasingly, institutions are focusing on enhancing existing features and improving overall user experience rather than solely chasing new innovations.

In Poland, leading banks are increasingly focusing on redesigning their applications. The report’s authors point out a notable slowdown in introducing new functionalities in the domestic market, with some banks even reviewing and retracting less useful features.

“Polish banks can be divided into two groups. The first consists of established market leaders that, over the past two years, have focused on improving the design of their applications to support users in utilizing digital channels effectively. The second group includes institutions that previously had less developed digital channels, now attempting to add new functionalities and expand their offerings for customers, particularly in core banking functions. Undoubtedly, they are learning from the experiences of their higher-ranking competitors and introducing customer-centric services,” emphasized Przemysław Szczygielski, partner and head of financial services for Poland, the Baltic States, and Ukraine at Deloitte, as well as the leader of regulatory and risk advisory services.

Source: Deloitte and ISBnews

Images: Digital Banking Maturity 2024, Deloitte