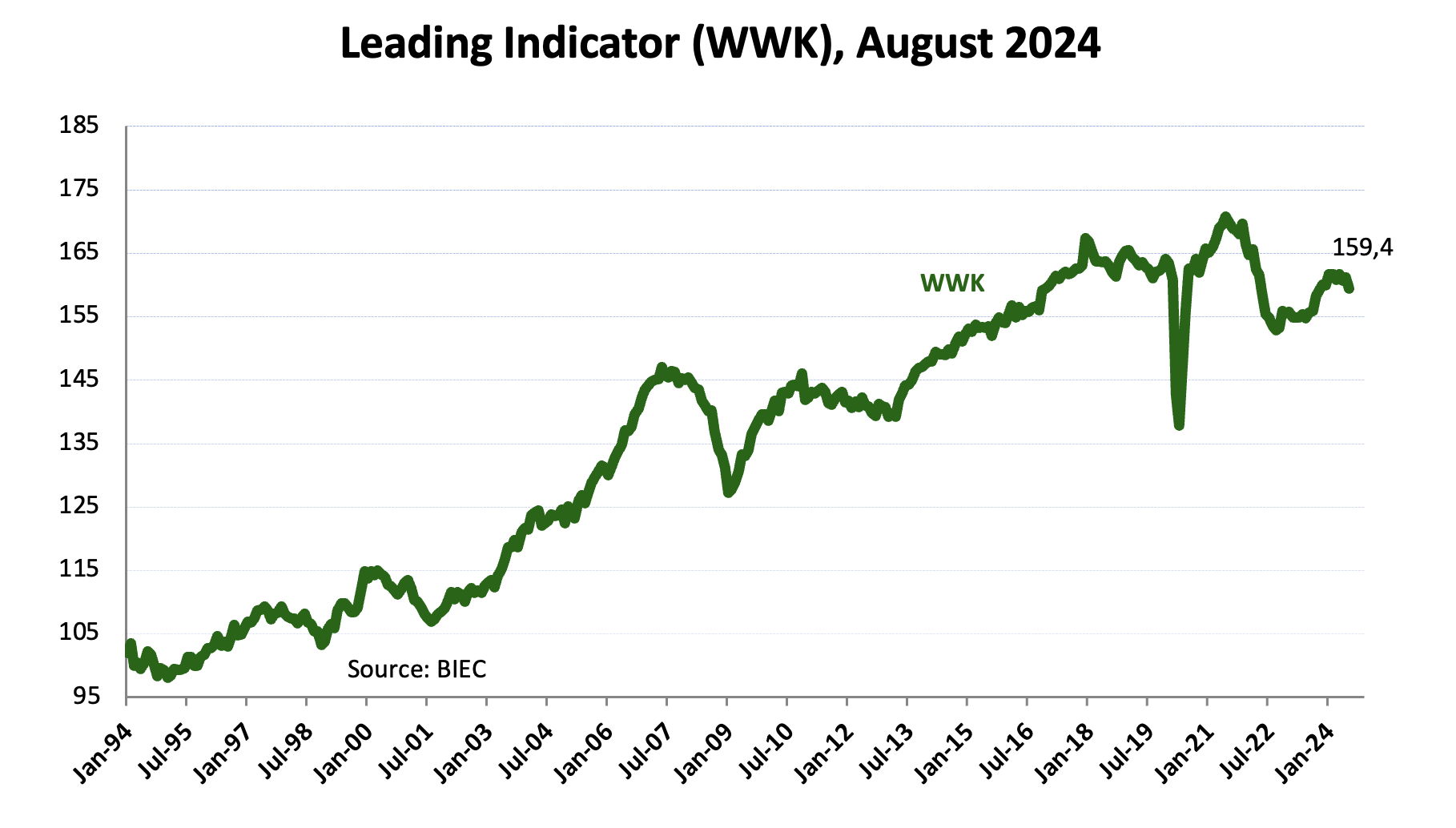

Economic slowdown signals intensify as key indicator drops in August 2024

The Leading Economic Condition Indicator (WWK), a key measure predicting future economic trends, showed a significant decline in August 2024, dropping by 1.8 points from the previous month and more than 2.3 points since the start of the year. This decline is accompanied by a concerning rise in the auxiliary index, which gauges the spread of negative economic trends, now approaching 70%. Earlier signs of a potential economic recovery have proven fleeting, with Poland’s internal economic challenges compounded by poor conditions and uncertainty in most developed nations.

Out of the eight components that make up the WWK, only one showed a slight improvement, while the rest continued to deteriorate. The industrial processing sector, a key driver of the economy, has seen a steady decline in the rate of new orders since the beginning of the year. This slowdown affects both domestic and export orders, with companies reporting a 14 percentage point gap between those experiencing a decrease in orders versus those seeing an increase. The automotive industry, particularly in the production of delivery vehicles, has been hit hardest, with output shrinking by over 30% over the past year. While the production and sale of passenger cars, especially electric vehicles, remain strong, other sectors, such as durable consumer goods and the clothing and textile industries, are also struggling with declining order volumes.

The financial health of companies is worsening as sales drop and the cost of doing business rises sharply. This trend has been highlighted by company managers in surveys conducted by the Central Statistical Office, with profitability in the manufacturing sector deteriorating over the past two years. Despite these challenges, there has not yet been a significant increase in payment arrears between contractors.

Labor productivity in the manufacturing sector has also been on a downward trend, with a notable 6% drop in July 2024 compared to June. Meanwhile, the Warsaw Stock Exchange’s main index, WIG, is attempting to recover some losses from earlier in the year. However, the real value of the index remains over 7% below its peak in April 2024, with no clear catalysts for a more substantial rebound in sight.

These indicators collectively point to a deepening economic slowdown, raising concerns about the near-term prospects for both businesses and the broader economy in Poland.

Source: BIEC