European logistics real estate market shows signs of recovery, yield decline signals trend reversal

The European logistics real estate investment market is showing signs of recovery, with average prime net initial yields declining for the first time since Q2 2022. Investor confidence is gradually returning, particularly in the Benelux region, Spain, and Eastern European markets like Poland and Romania, where yield compression is most evident. However, the decline remains moderate, with the European average dropping by just four basis points from 5.65% to 5.61%.

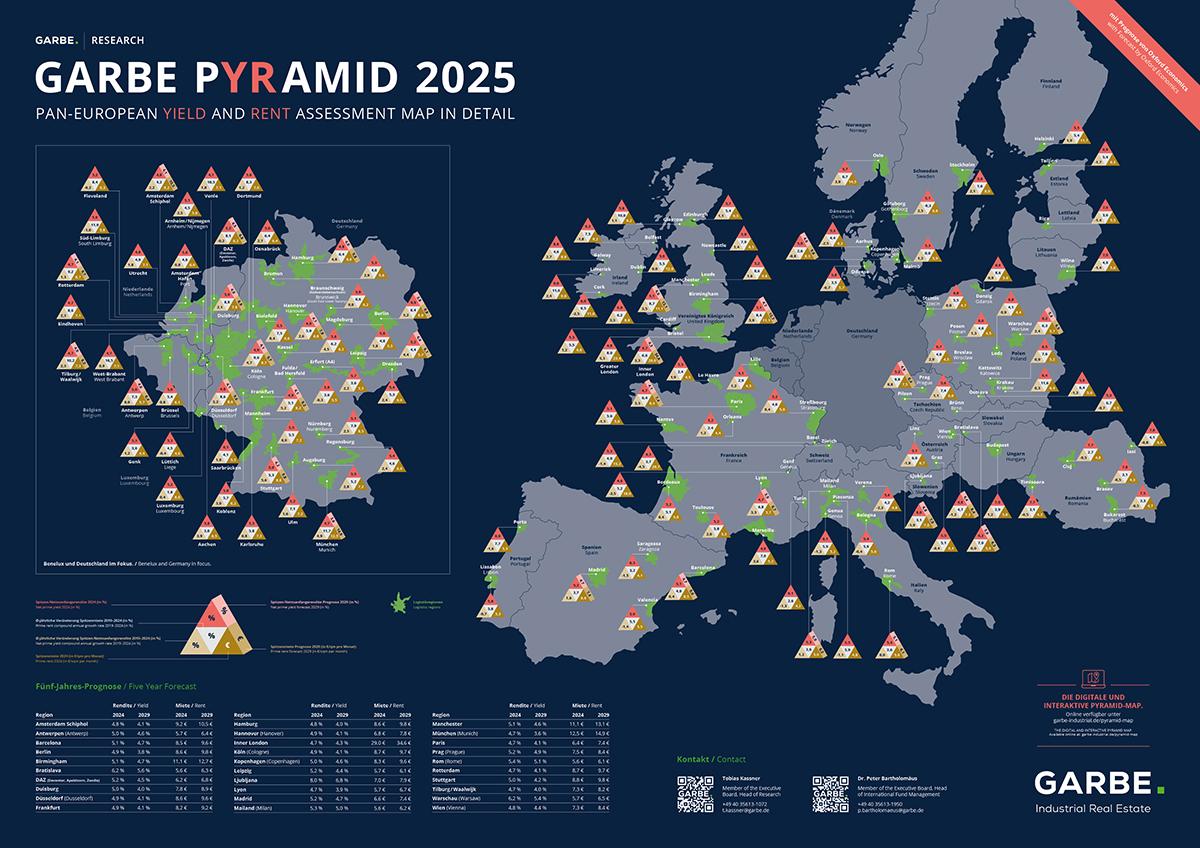

According to Tobias Kassner, Head of Market Intelligence and Sustainability at GARBE, the latest GARBE PYRAMID MAP indicates an incipient trend reversal in logistics real estate investment. While geopolitical and economic uncertainties continue to influence investor sentiment, demand remains strong for assets in prime locations with long-term leases. Sustainability and energy availability are also playing a key role in investment decisions, as ESG compliance remains a top priority.

The GARBE PYRAMID MAP, which analyzes 121 key logistics submarkets in 25 European countries, reveals that yields remained stable or declined in 111 regions. In 46 of these areas, net initial yields fell by 10 to 20 basis points in the second half of 2024. In 65 regions, yield levels were unchanged, while only ten locations, including seven in Germany, recorded a modest yield increase.

Kassner noted that investor confidence in logistics real estate is returning, as pricing adjustments are largely complete and values have stabilized. This, combined with lower key lending rates, led to an increase in European investment volumes in 2024. However, ongoing geopolitical uncertainties continue to temper overall market momentum.

Established markets such as Germany, Italy, France, and the United Kingdom remained stable, with only minimal yield fluctuations. However, other European regions experienced more dynamic movements. In Spain, significant yield compression occurred in Madrid, Barcelona, and Valencia, while similar trends emerged in the Dutch cities of Rotterdam, Eindhoven, Tilburg, and West Brabant. Eastern European markets, which generally have higher yield levels, also saw declines of up to 20 basis points in Warsaw, Gdańsk, and Bucharest, though most reductions were closer to 10 basis points. Markets with already low yields, including the Czech Republic and Slovakia, remained largely stable.

A joint forecast by GARBE and Oxford Economics projects a continued decline in prime yields, with an expected reduction of 10 to 20 basis points in 2025. Assuming stable geopolitical and financial conditions, this trend is likely to persist in the coming years. Yield compression is expected to occur most rapidly in Germany, the Netherlands, and France, while Italy, the UK, and the Czech Republic are predicted to experience slower changes.

Kassner emphasized that accurate market assessments are essential for identifying opportunities and risks. While understanding current conditions is crucial, he highlighted the importance of forward-looking insights to develop effective investment strategies in the evolving logistics real estate landscape.

Further information can be found on the link below:

https://www.garbe-industrial.de/en/research/pyramid-map