European REITs show signs of recovery amid stabilizing conditions

The European real estate investment trust (REIT) sector has seen a significant shift in 2024, with improving funding conditions and stabilizing valuations across most asset classes. While 20 European real estate companies have been downgraded since 2022, the percentage of rated REITs with negative outlooks or on CreditWatch dropped to 27% in early 2024, compared to 33% the previous year. Bond issuances by rated European REITs rose to €19.3 billion in 2024, a substantial increase from €5.3 billion in 2023, signaling a resurgence in investor confidence.

Rental income is expected to continue growing in 2025, supported by improved consumption levels and rising GDP growth. Inflationary pressures are projected to ease, with Eurozone CPI inflation expected to decline to 2.1% in 2025 from 2.4% in 2024. The growth in rental income will be more moderate but bolstered by strong demand in residential segments, particularly in Germany and Sweden, where housing shortages persist. Retail landlords are also poised to benefit from rising disposable incomes as inflation subsides, following a successful period of rent adjustments linked to inflation.

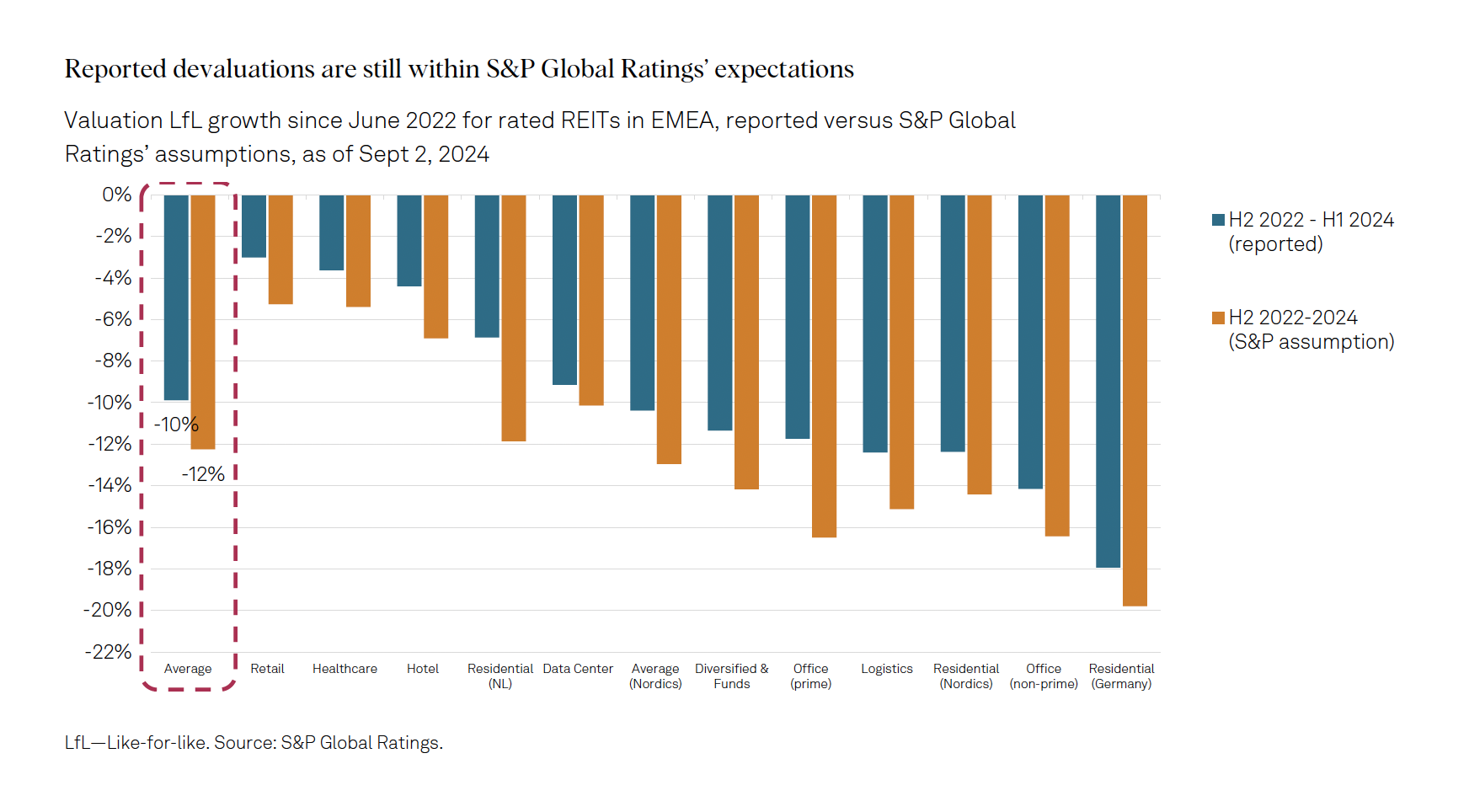

Valuations across most asset classes have stabilized, except for nonprime offices, which continue to face challenges due to rising vacancies and obsolescence. Since mid-2022, European REIT asset valuations have declined by an average of 10%, with nonprime offices experiencing the steepest devaluations. The European Central Bank (ECB) is expected to reduce its deposit rate to 2.5% by mid-2025, which should support stable long-term rates and limit further impact on property yields.

Transaction volumes are predicted to increase in 2025 as funding conditions improve and repricing reduces the price gap between buyers and sellers. Although transactional activity in 2024 remained 41% below the five-year average, large institutional investors are likely to re-enter the market, reversing the low levels of activity seen in 2023. Improved liquidity and reduced risk of distressed sales are expected to further support market recovery.

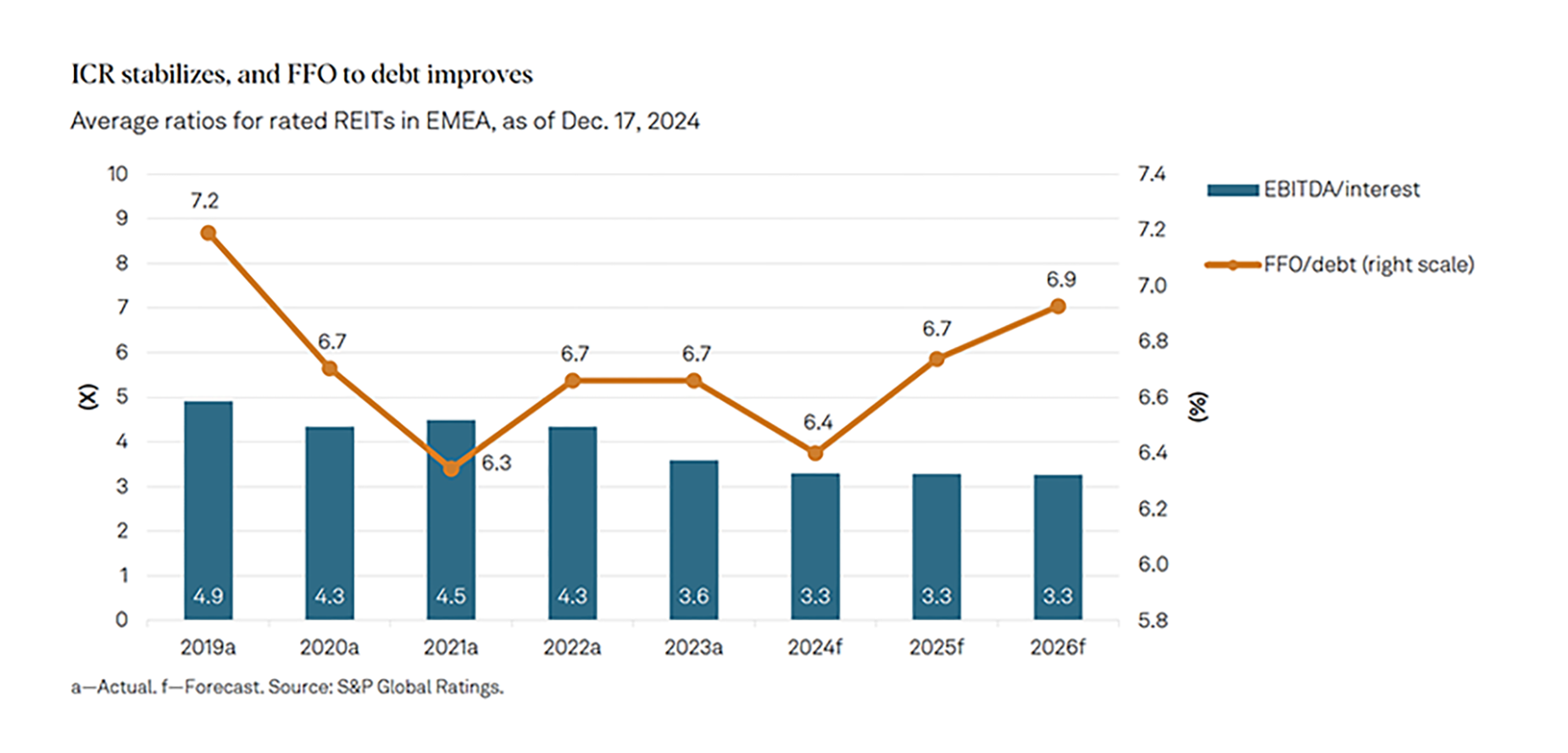

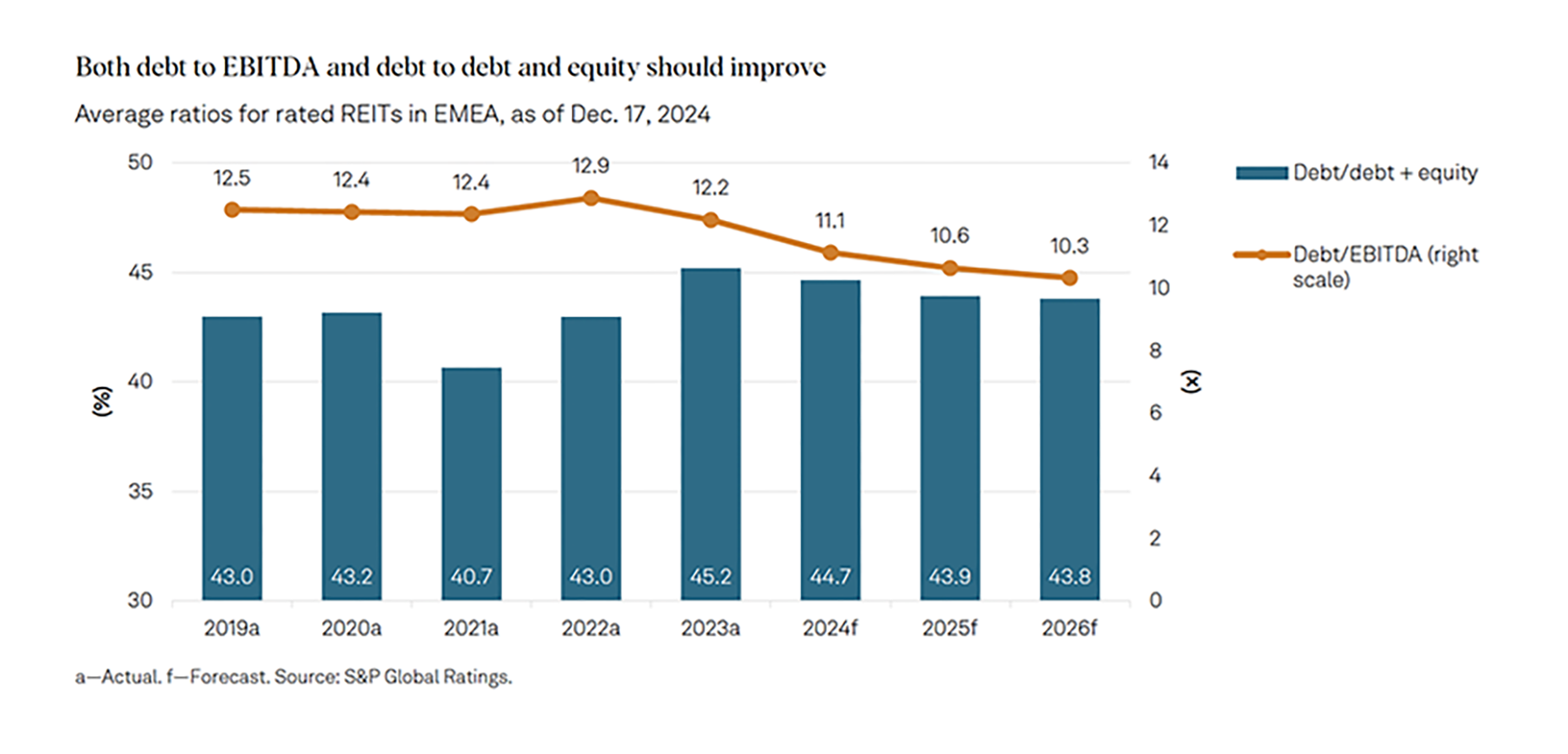

Despite challenges, credit metrics for European REITs show resilience. Interest coverage ratios (ICRs) are expected to stabilize around 3.3x by the end of 2025, reflecting hedged debt profiles and declining borrowing costs. Debt-to-EBITDA ratios are also projected to improve as rental income grows and debt-funded investments remain limited. However, risks remain, including the possibility of opportunistic acquisitions and dividend increases delaying deleveraging.

Environmental requirements pose additional challenges, as European REITs work toward ambitious decarbonization goals. The EU’s revised Energy Performance of Buildings Directive, effective since May 2024, mandates significant renovations to align with the bloc’s 2050 decarbonization target. These requirements could weigh on REITs’ balance sheets, necessitating substantial investments in the coming years.

While geopolitical and economic uncertainties persist, the sector is poised for continued recovery in 2025, driven by stabilizing valuations, improving credit conditions, and strong rental income performance across most segments.

Source: S&P Global Ratings