European retail markets hit new high in Global Retail Attractiveness Index

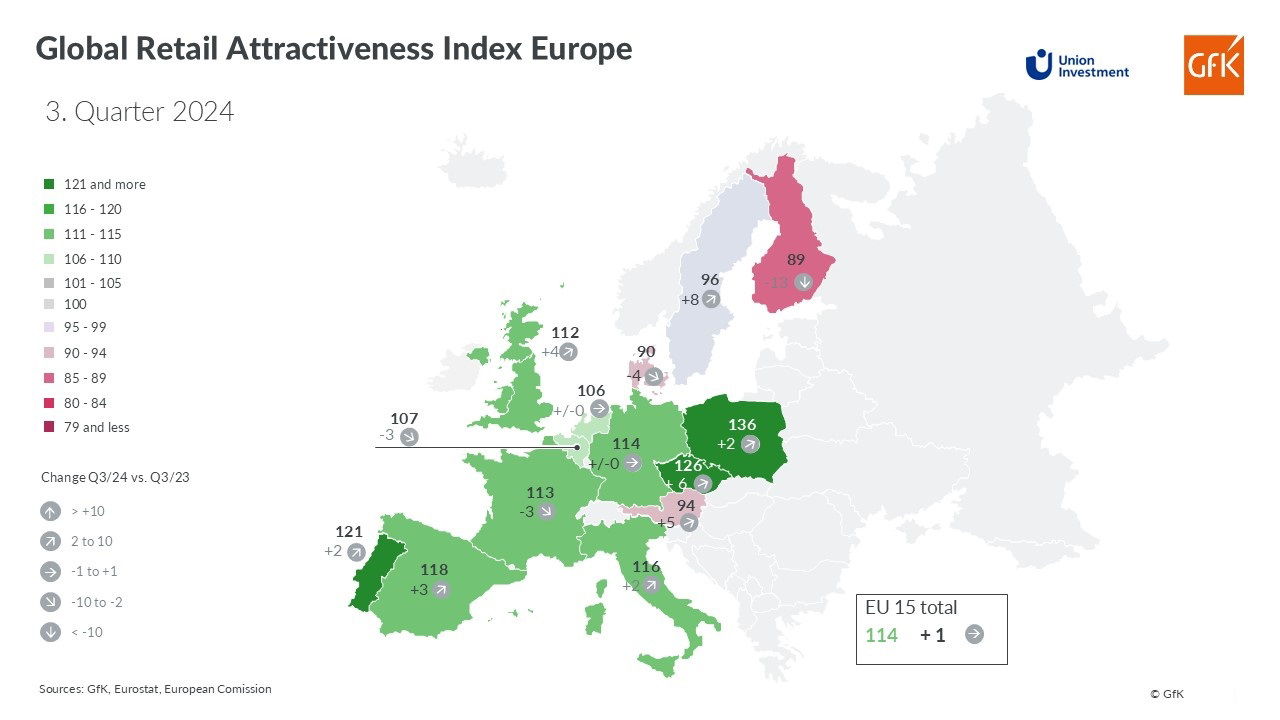

European retail markets are showing sustained recovery, as the Global Retail Attractiveness Index (GRAI) for Europe reached 114 points in Q3 2024, up from 113 points a year prior. According to Union Investment and GfK, consumer confidence is driving this growth, with eight European countries seeing moderate to strong gains. Sweden and the Czech Republic led the charge, posting increases of 8 and 6 points, respectively. However, declines were noted in Finland (-13 points), Denmark (-4 points), France, and Belgium (-3 points each).

The EU-15 ranking places Poland (136 points), the Czech Republic (126 points), and Portugal (121 points) at the top, with Spain (118 points) and Italy (116 points) close behind. Germany improved to 6th place (114 points), benefiting from a slight uptick in consumer confidence despite ongoing retailer caution. Finland, Denmark, Austria, and Sweden remained lower in the rankings, with Finland trailing at 89 points.

“European consumer sentiment continues to rise, but dips in retailer sentiment and labour market indicators are tempering the EU-15 index gains,” said Markus Diers, Head of Asset Management Retail at Union Investment. “Retailer optimism is cautious, yet the improved consumer outlook reflects resilience in Europe’s retail sector.”

Overseas Markets Stabilize but Lag Behind Europe

Overseas retail markets remain steady yet underwhelming, with North America and Asia-Pacific still trailing Europe. The GRAI for North America rose by a single point to 98, primarily driven by improved retail sales (up 4 points), though consumer sentiment dropped to 58 points. Asia-Pacific also saw slight gains, reaching 95 points, although a weak labour market (97 points) weighed on the region.

In North America, the U.S. gained two points, while Canada experienced the steepest decline (-5 points), securing its spot as the lowest-ranked country in the GRAI global ranking. Asia-Pacific’s performance was mixed, with Japan gaining 4 points and South Korea dropping by 6 points.

As European retail markets continue to show promise, global counterparts have significant ground to cover to match Europe’s upward trajectory in the GRAI.