Frontier markets critical for diversification, new research finds

Latest research* with institutional investors and wealth managers across Europe who collectively manage over $520 billion in assets under management, identifies frontier markets as vital for diversification.

The study, which was conducted for Dragon Capital, the largest independent asset management company in Vietnam, reveals more than half (53%) strongly agree and 46% slightly agree that frontier markets provide attractive diversification benefits from emerging and developed markets.

The majority of investors (85%) also agree that frontier markets offer some of the best opportunities to find hidden gems in the investment management world. More than two-thirds (67%) agreed, 18% strongly agreed.

Interest in frontier markets reflects impressive performance last year thanks to major changes in the investment universe.

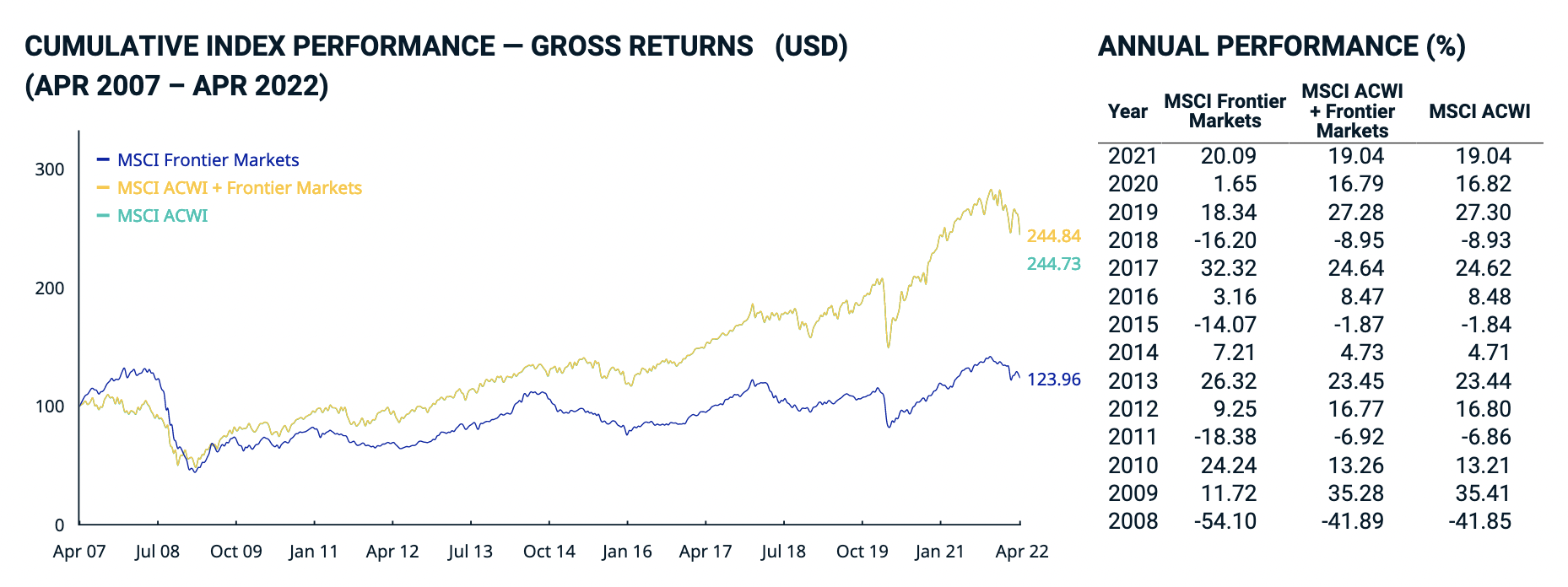

A shift from oil-price sensitive stocks based in the middle east, to manufacturing and expert led companies in Asia, contributed to returns from the MSCI Frontier market index of 20.09% in 2021, and an outperformance over the MSCI All World Index of 1.05%**. Meanwhile, Vietnam’s market returned 39% in 2021.

When asked which Asian market offers the most attractive long-term returns for investors, 26% chose Vietnam.

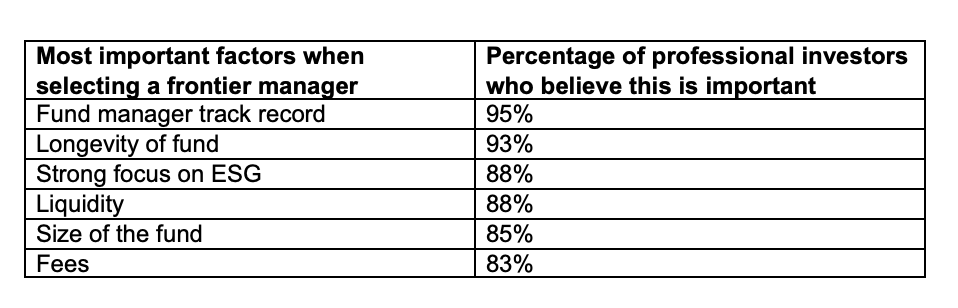

In terms of which factors were most important when selecting a frontier fund manager, more than nine out of ten investors said track record (95%) and fund longevity (93%).

Most important factors when selecting a frontier manager Percentage of professional investors who believe this is important

Fund manager track record 95%

Longevity of fund 93%

Strong focus on ESG 88%

Liquidity 88%

Size of the fund 85%

Fees 83%

Dr. Tuan Le Anh, Deputy CIO at Dragon Capital, Vietnam’s largest asset manager, said: “Frontier markets have high rates of GDP growth and enjoy periods of rapid urbanisation, growing middle class formation, increased domestic consumption, and elevated levels of foreign direct investment, all of which make for attractive investment opportunities.

And as respondents to the survey have found, the lack of coverage of companies in frontier markets means there are ample opportunities to find hidden gems.

As frontier markets continue to evolve and embrace digital technology, we expect to find an ever-larger pool of attractive stocks.”

Dr. Tuan Le Anh continues: “When investing in frontier markets it is beneficial to have boots on the ground in order to help mitigate risk, and so naturally it makes sense for investors to prioritise fund managers with a proven history and demonstrable experience of delivering consistent returns.”

*Independent research company PureProfile interviewed 100 institutional investors and wealth managers across the UK, France, Germany, Switzerland, Sweden, Finland, Norway, and Denmark in February 2022 using an online methodology.

See link below for MSCI Frontier Markets Index (USD).

https://www.msci.com/documents/10199/f9354b32-04ac-4c7e-b76e-460848afe026