GCC banking sector posts robust growth in lending despite profit dip in Q4 2024

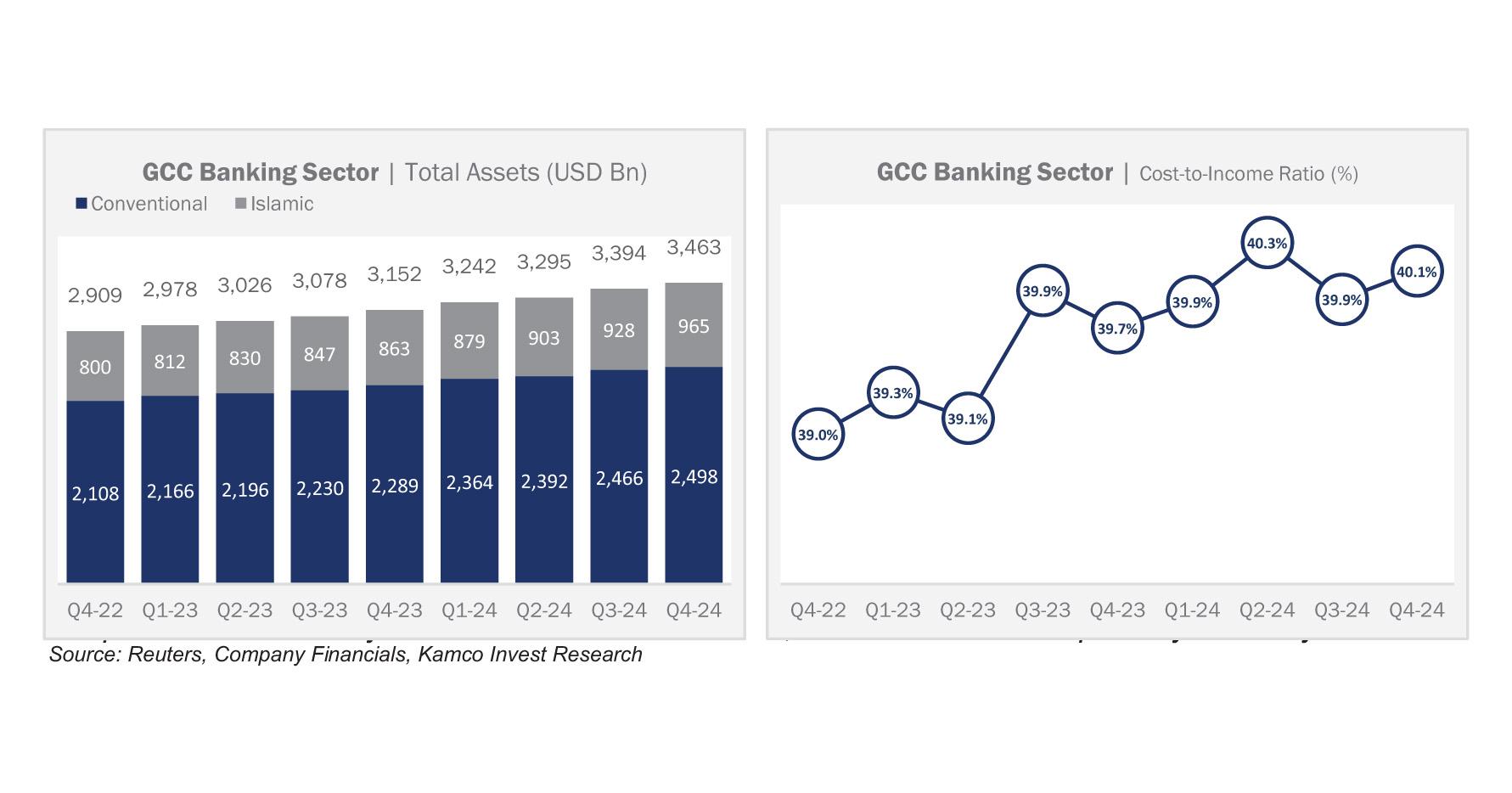

The GCC banking sector demonstrated resilience in the fourth quarter of 2024, registering a strong uptick in lending activity even as quarterly profits saw a slight decline. According to Kamco Invest’s latest “GCC Banking Sector Report – Q4 2024,” total net income for listed banks in the region fell marginally by 1.8% quarter-on-quarter to USD 14.6 billion, although annual growth remained solid at 12.8%.

The dip in profits was attributed to an increase in operating expenses and higher impairments, which offset gains from strong revenue growth. Aggregate operating expenses reached a five-quarter high of USD 14.2 billion, while loan impairments rose to USD 3.2 billion. Notably, impairments surged particularly in the UAE, Qatar, and Kuwait, while Saudi Arabia and Oman reported declines.

Despite the profit dip, revenues in the sector climbed to a record USD 34.5 billion, driven by increases in both net interest income and non-interest income. This growth was supported by all GCC countries except Qatar, which saw a slight decline. UAE-listed banks led in absolute revenue growth, followed by Kuwait.

Lending activity remained a bright spot. Aggregate gross loans increased by 2.4% quarter-on-quarter and 10.4% year-on-year to reach USD 2.17 trillion. Saudi banks contributed the most to this growth, adding USD 22.3 billion in loans. Islamic banks saw stronger loan growth (4.9%) than conventional banks (1.3%).

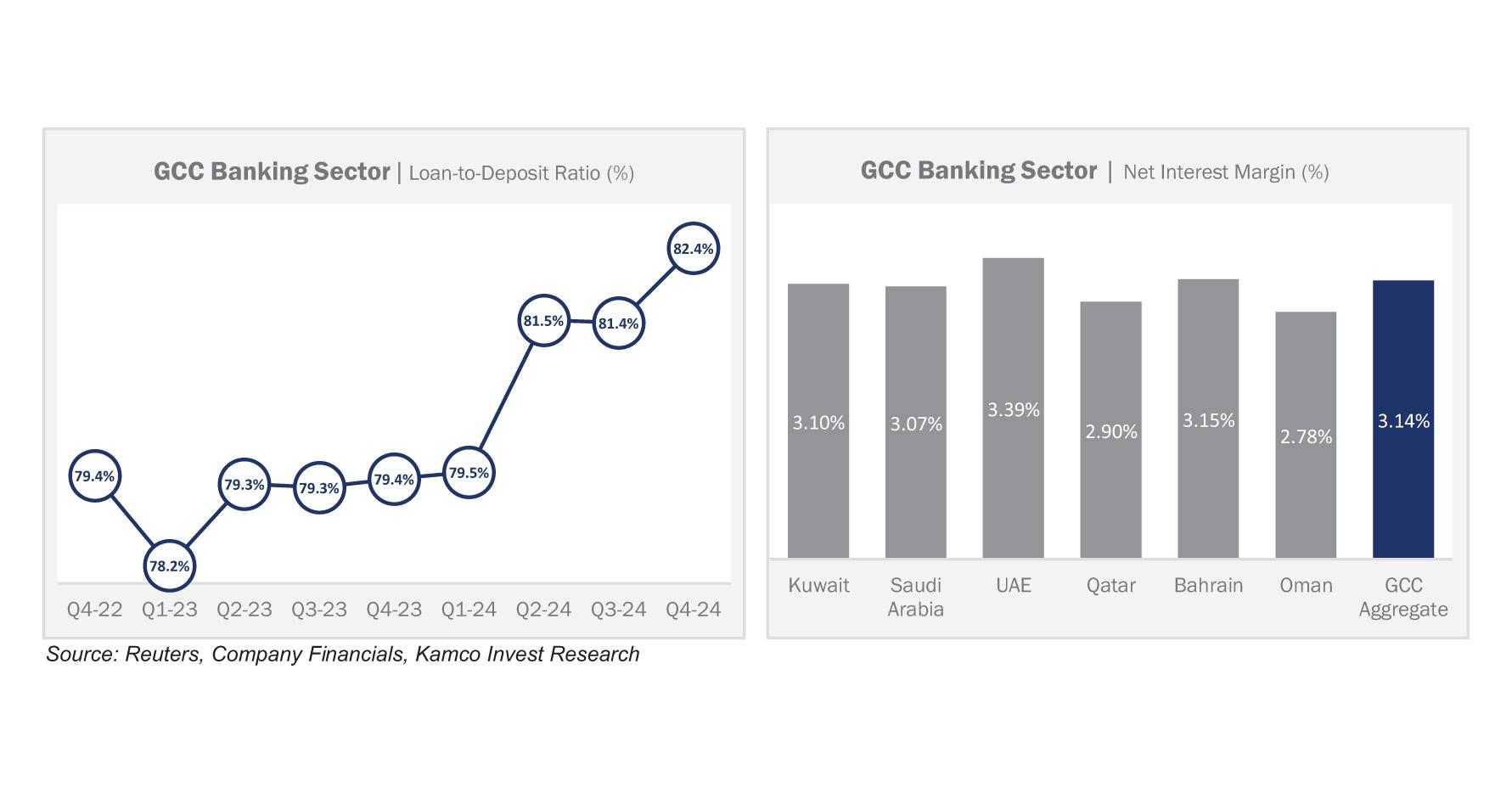

Customer deposits also hit a new record of USD 2.52 trillion, with the UAE and Kuwait reporting the highest quarterly increases. However, Qatar experienced a 2.6% decline in deposits. The loan-to-deposit ratio for the GCC reached 82.4%, its highest level since Q1 2018, with Saudi Arabia leading at 94.8%.

Net interest income surged to USD 23.2 billion, the highest on record, despite central banks across the region implementing rate cuts. Yield on credit remained stable at 4.2%, and net interest margins dipped slightly to 3.1%.

Return on equity for the sector improved to 13.7%, bolstered by rising profitability and a moderate increase in shareholder equity. UAE banks recorded the highest ROE at 16.7%, while Omani and Bahraini banks posted ROEs below 10%.

Looking ahead, the report notes that while policy rate cuts may continue to pressure interest margins, the region’s strong project pipeline and resilient economic growth, especially in Saudi Arabia and the UAE, are likely to sustain lending and revenue growth in the near term.