GCC corporate earnings show mixed performance in Q4 and full year 2024

GCC Corporate Earnings Show Mixed Performance in Q4 and Full Year 2024

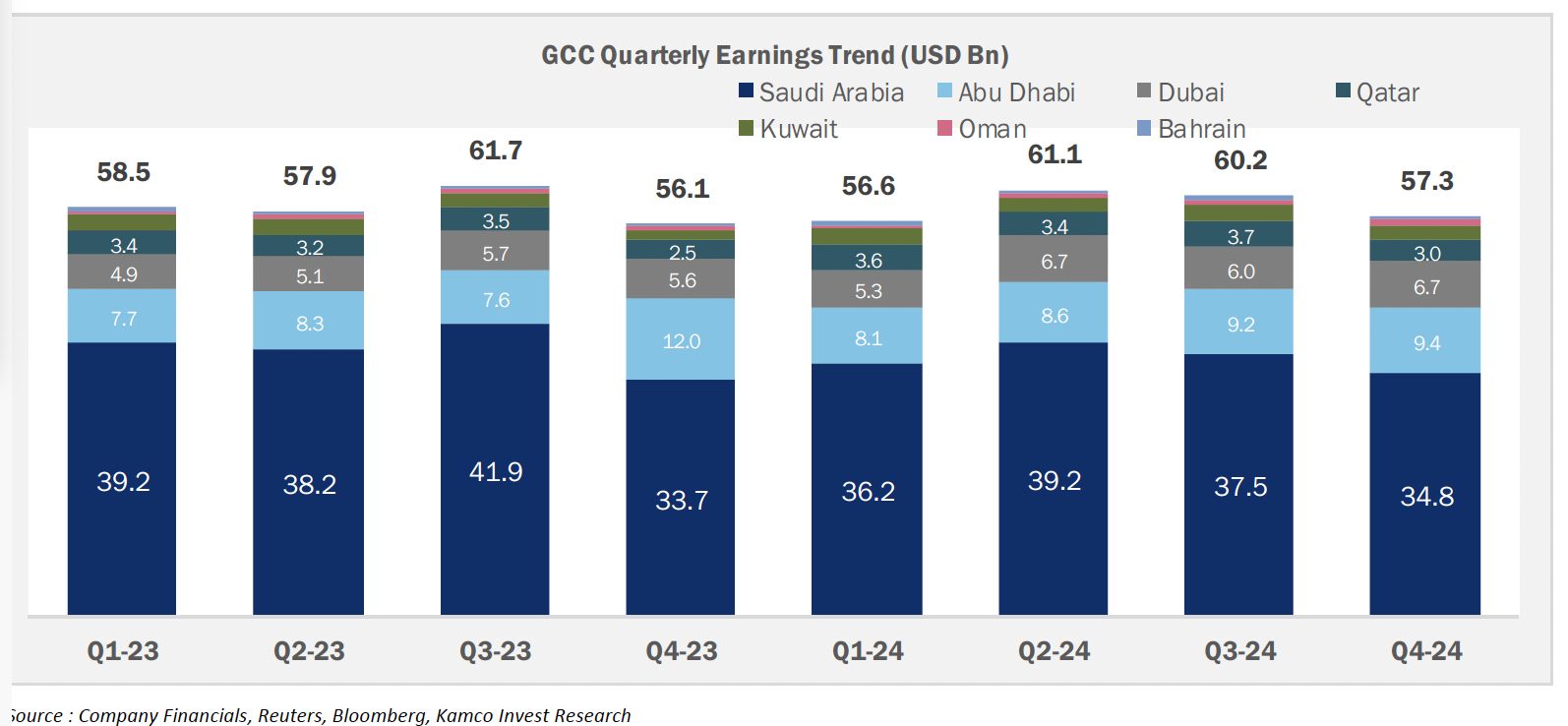

The fourth quarter of 2024 saw a slowdown in corporate earnings across the Gulf Cooperation Council (GCC), as a decline in energy and utilities sector profits weighed on overall results. According to Kamco Invest’s Q4 2024 report, aggregate net profits for GCC-listed companies dropped 5.0% quarter-on-quarter to USD 57.3 billion—marking a three-quarter low. However, compared to the same period in 2023, profits were up by a marginal 2.0%.

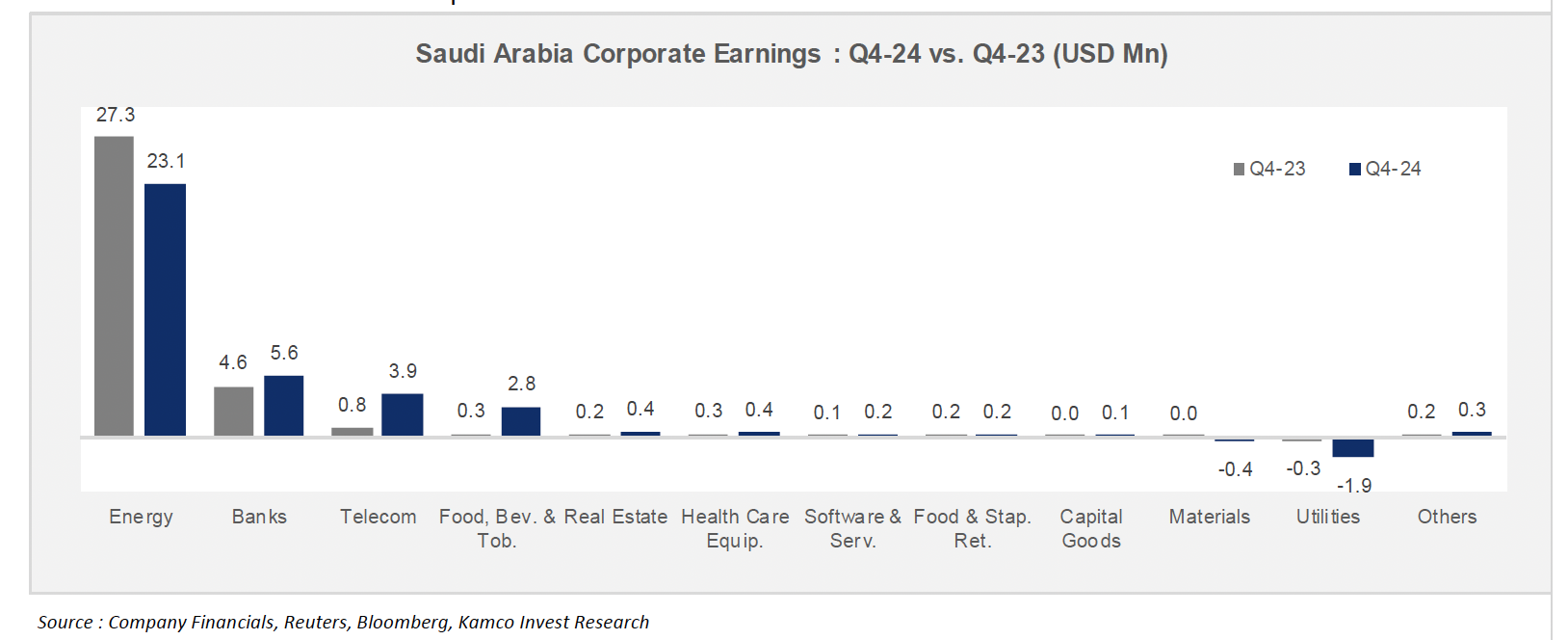

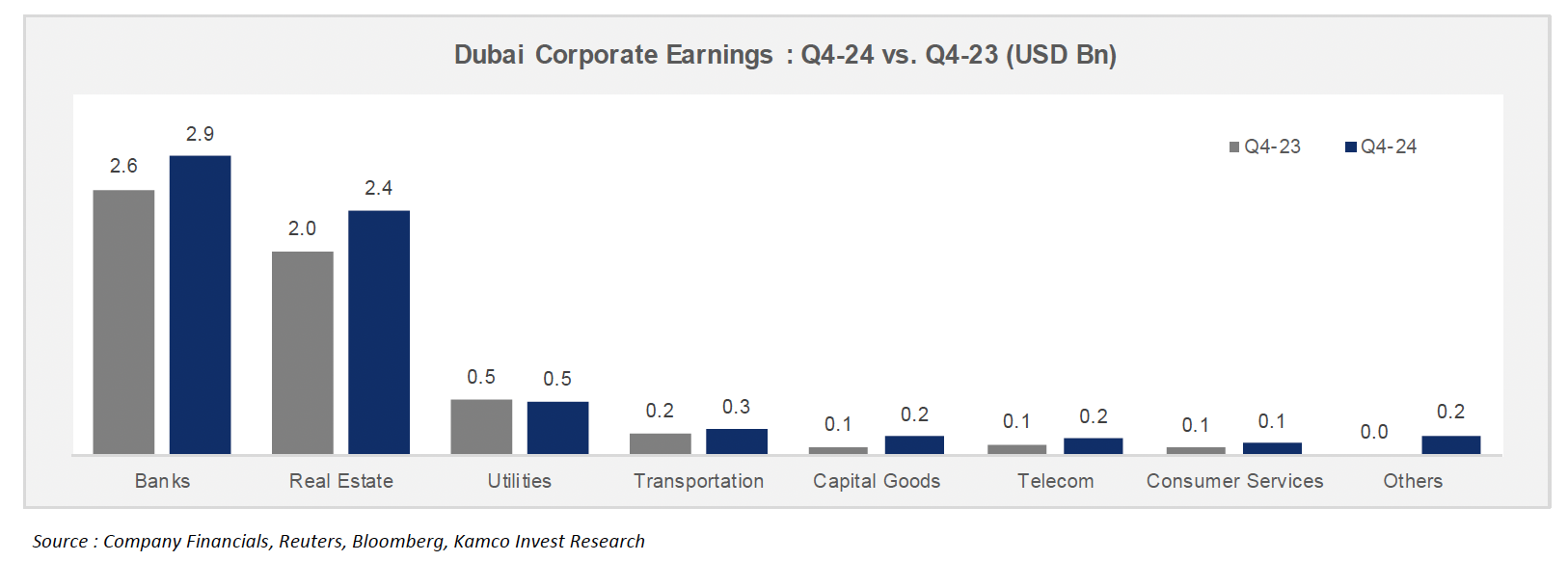

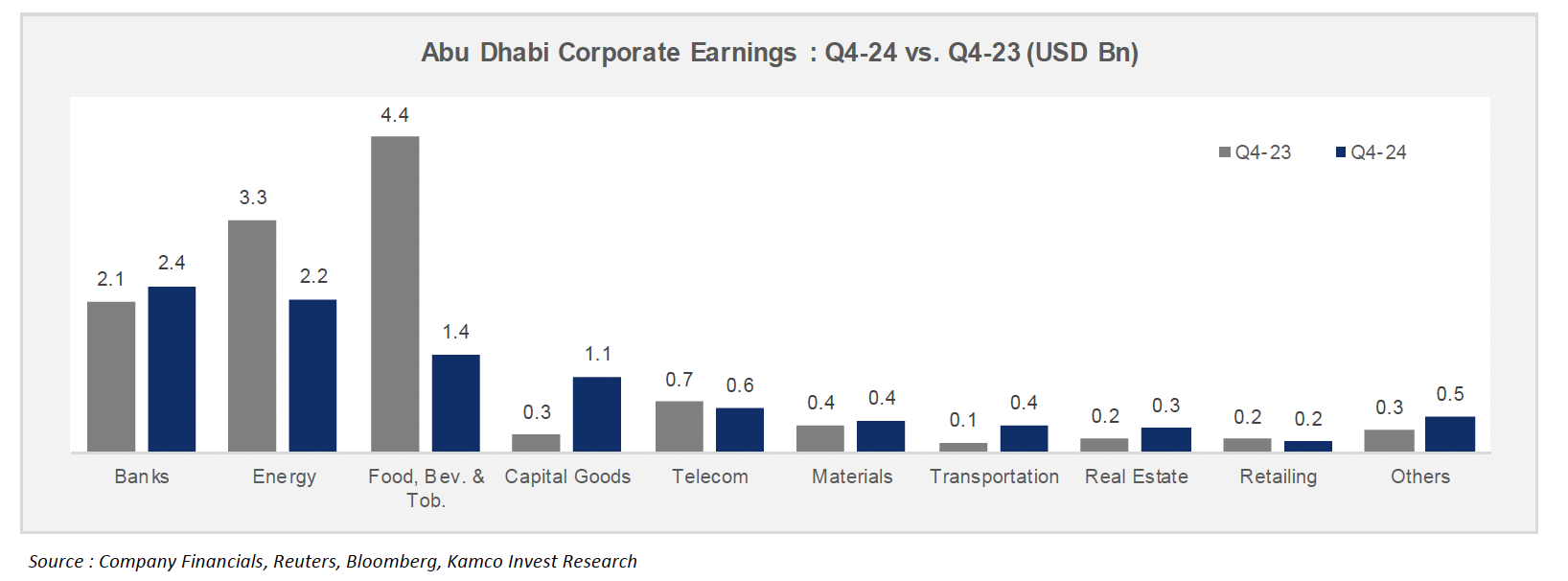

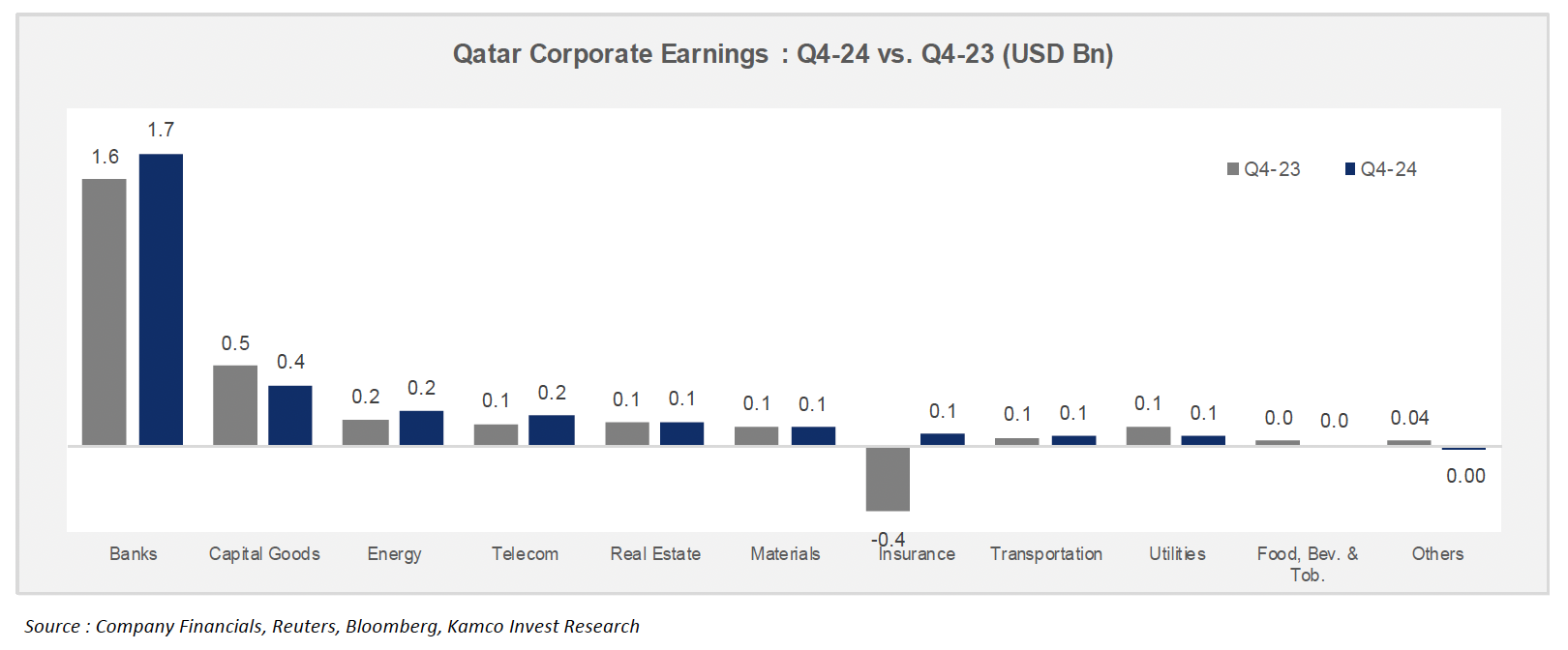

Country-Level Breakdown

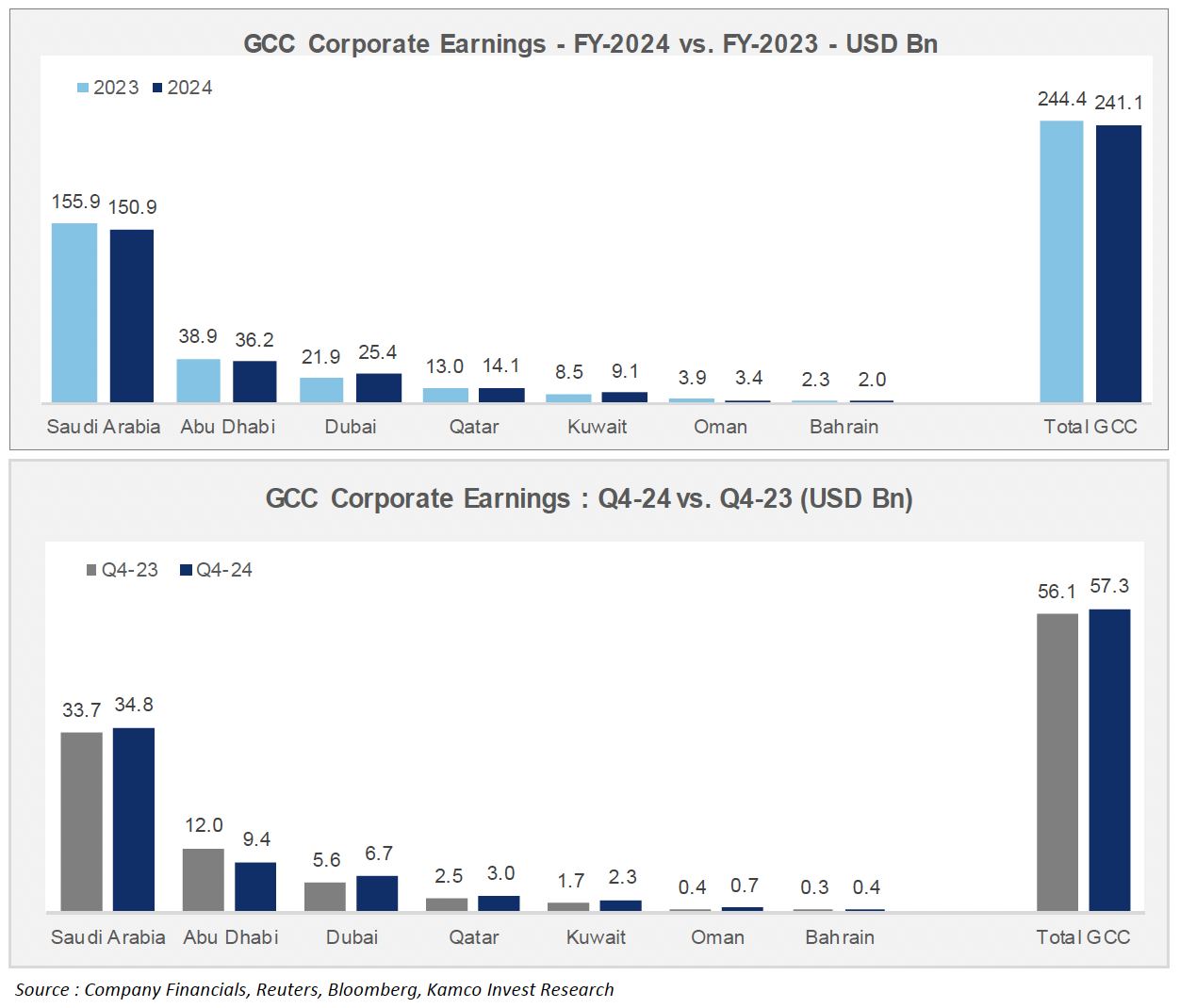

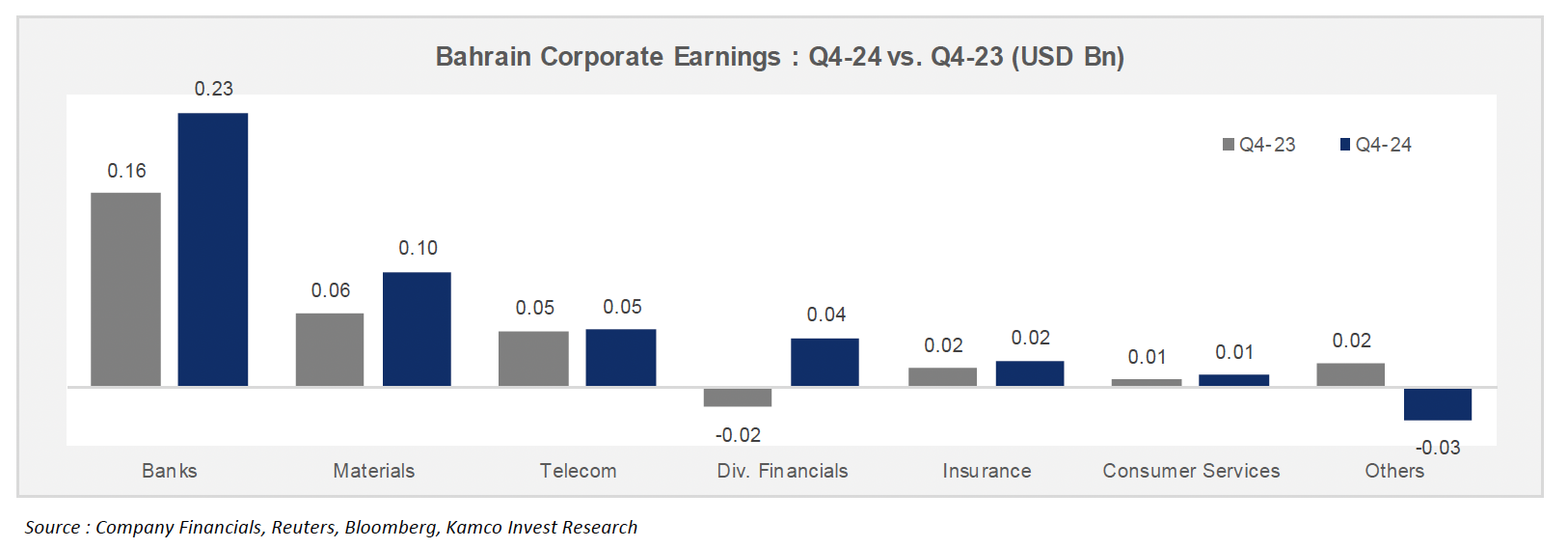

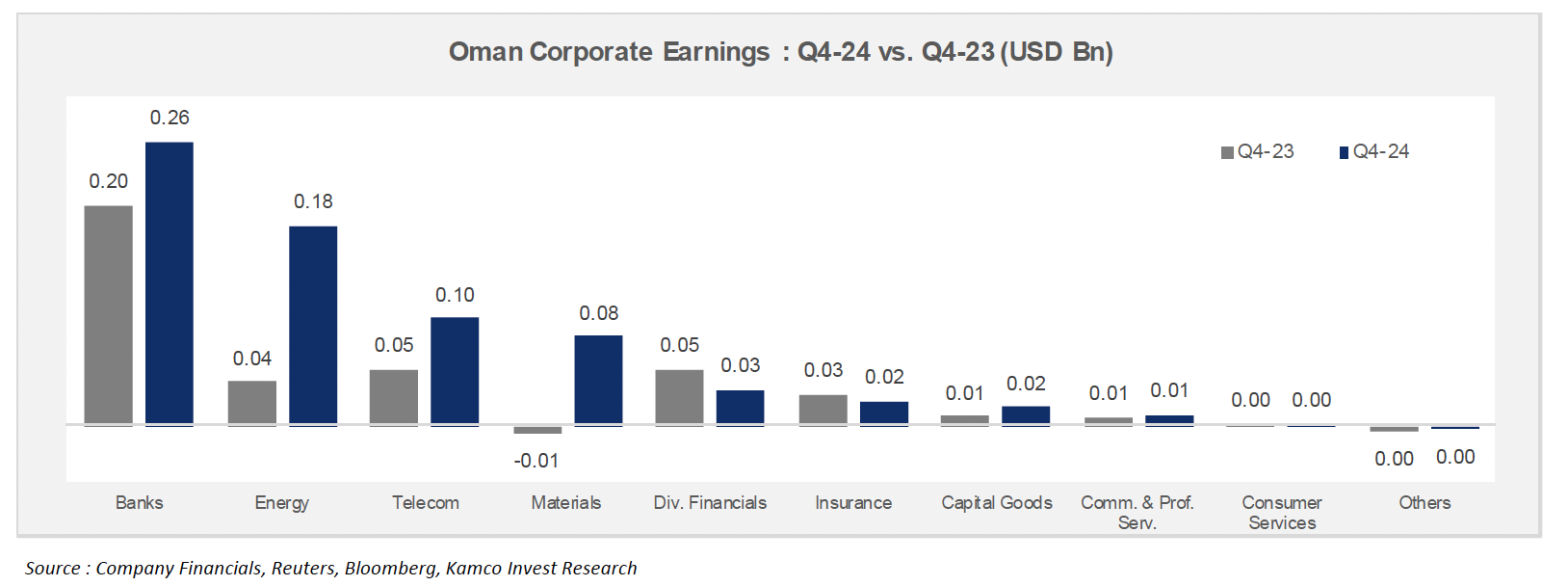

Oman led the region in year-on-year Q4 profit growth at 83.4%, followed by Bahrain (43.2%) and Kuwait (37.1%). Saudi Arabia, the region’s largest market, posted modest growth of 3.1%, while Dubai and Qatar saw earnings rise around 20%.

For the full year 2024, total net profits across the GCC declined 1.4% to USD 241.1 billion. This marks the second consecutive annual drop, driven mainly by declines in Saudi Arabia and Abu Dhabi, which offset gains in Dubai, Qatar, and Kuwait.

Sector Performance

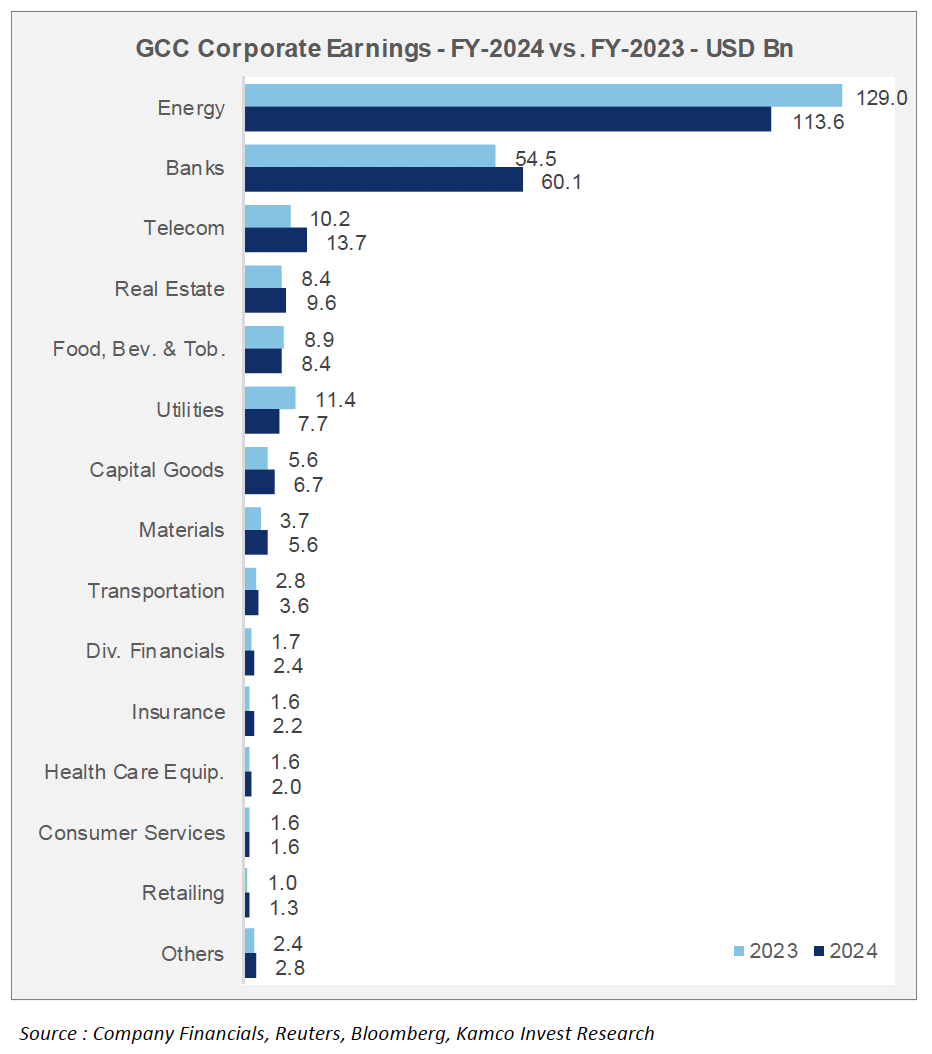

• Energy: The energy sector experienced the steepest decline in Q4, with profits falling 16.6% year-on-year to USD 25.7 billion. For the full year, Saudi Aramco’s profit alone declined 13.0% to USD 105 billion due to lower crude oil prices and refining margins.

• Utilities: The sector posted a net loss of USD 1.3 billion in Q4, largely due to increased losses at Saudi Electricity Co., which reported a Q4 loss of USD 2.0 billion.

• Telecoms: This sector recorded the strongest year-on-year growth in Q4, up 171.0% to USD 5.3 billion, mainly due to gains from Saudi Telecom Co. Annual profits in the telecom sector rose 78% across the GCC.

• Banking: Banks in the region saw a 16.2% increase in Q4 earnings to USD 14.4 billion. Full-year banking sector profits reached USD 60.1 billion, a 10.3% increase year-on-year, with gains spread across all markets except Bahrain.

Country Highlights

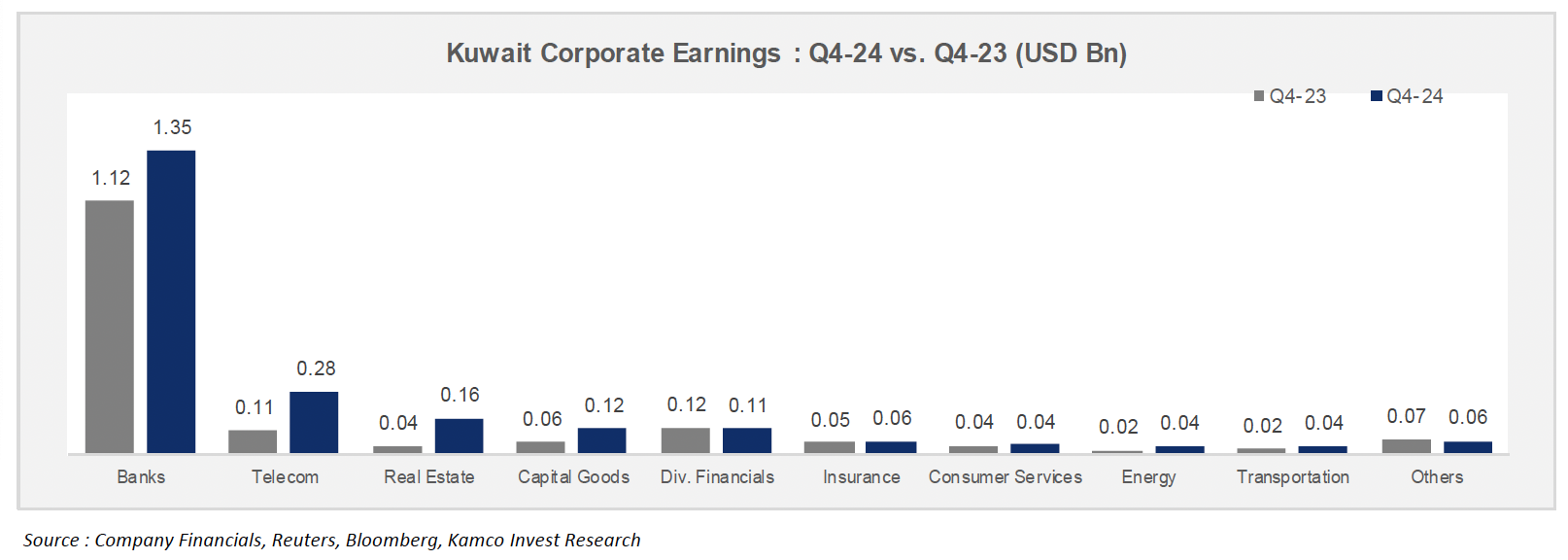

• Kuwait: Full-year profits grew 7.1% to USD 9.1 billion. The banking sector contributed the most, led by National Bank of Kuwait and Commercial Bank of Kuwait. Real estate and diversified financials also showed strong performance.

• Saudi Arabia: FY 2024 profits dropped 3.2% to USD 150.9 billion. The energy sector was the main drag, while banks and telecoms (particularly STC and Mobily) posted robust growth.

• Dubai: Companies listed in Dubai recorded a 16.0% profit increase to USD 25.4 billion in 2024, driven by the banking, real estate, and utilities sectors. Emaar and Dubai Islamic Bank were among the top performers.

• Abu Dhabi: Profits fell 7.1% year-on-year to USD 36.2 billion. The drop was mainly due to a sharp decline in the Food, Beverage & Tobacco sector. Banks in Abu Dhabi, however, posted strong growth.

• Qatar: FY 2024 earnings rose 8.5% to USD 14.1 billion, thanks to solid performances from the banking and energy sectors. QNB and Qatar Islamic Bank led the gains.

• Bahrain: Annual profits declined by 12.5% to USD 2.0 billion due to lower banking sector earnings. However, the materials sector, led by Aluminum Bahrain, posted strong growth.

• Oman: Oman’s listed companies saw a 13.7% drop in full-year earnings to USD 3.4 billion, mainly due to a 43.8% decline in energy sector profits. However, banking and utilities showed notable growth.

Outlook

While banking and telecom sectors helped stabilise regional earnings in 2024, volatility in energy prices and cost pressures in utilities affected overall performance. The report suggests that sector-specific developments and macroeconomic conditions will continue to shape earnings in 2025.

Source: GCC Corporate Earnings Report – Q4 2024, Kamco Invest.