GCC markets kick off 2025 with strong gains despite mixed performance across sectors

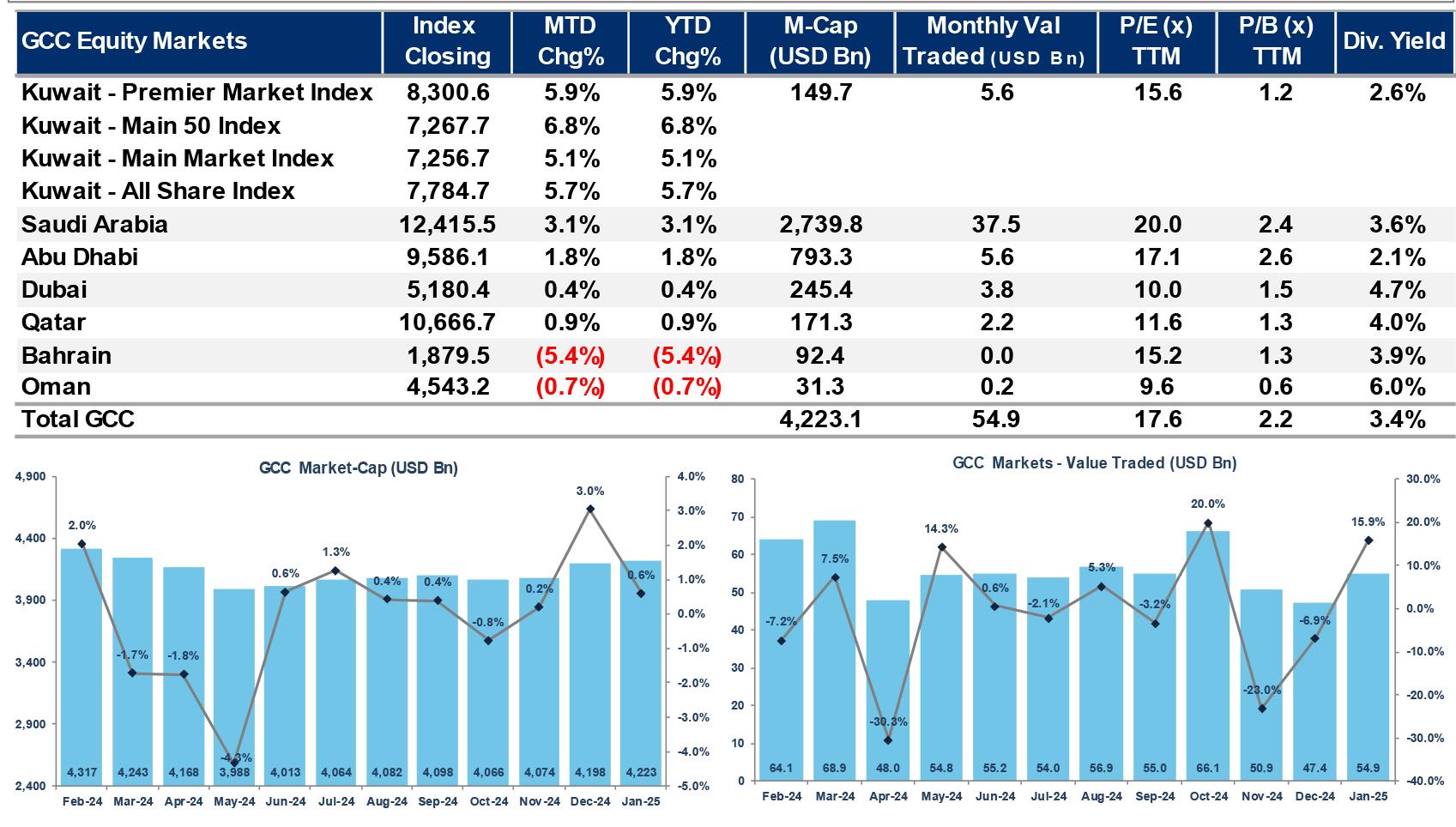

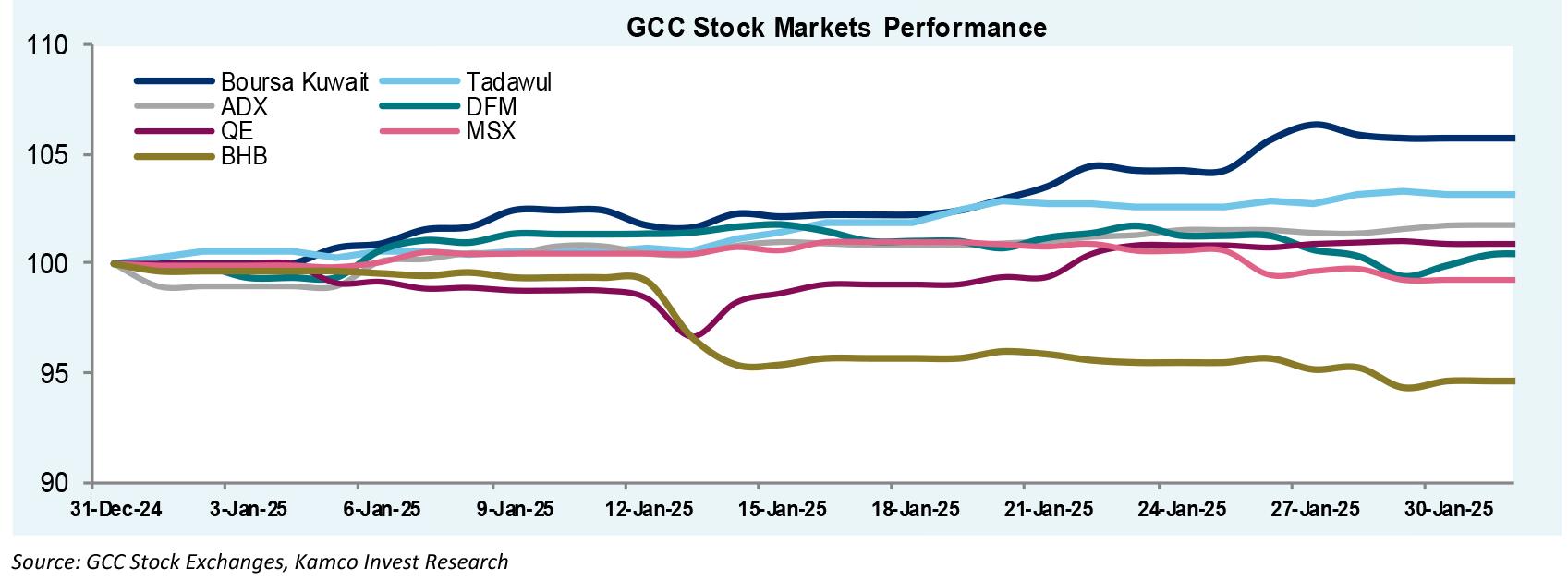

The GCC equity markets started the year on a strong footing, mirroring global trends and rebounding from the declines witnessed in December 2024. According to the latest GCC Markets Monthly Report – January 2025 by Kamco Invest, most regional stock markets recorded gains, with Kuwait leading the pack with a 5.7% surge—the highest monthly gain in a year.

Saudi Arabia’s Tadawul followed with a 3.1% rise, while the UAE’s Abu Dhabi and Dubai stock exchanges saw more modest increases of 1.8% and 0.4%, respectively. However, not all GCC markets fared well; Bahrain’s All Share Index posted the sharpest decline, plummeting 5.4% to a 25-month low, driven by an 18.5% drop in Aluminum Bahrain’s shares after merger talks with Saudi Arabia’s Maaden fell through.

Sectoral Performance: Retail and Pharma Outperform

January saw broad-based gains across most market sectors, with only the Utilities and Energy indices registering slight declines. The Retailing index led the charge with an 8.6% increase, followed by a 7.0% rise in Pharma stocks, reflecting strong investor confidence in consumer-driven businesses. The Telecom sector also posted a 6.2% gain, buoyed by positive movements in shares of major players like STC, Ooredoo, and Vodafone Qatar.

Global Market Trends and Oil Prices

On the global stage, equity markets witnessed a solid start to the year, with the MSCI All-Country World Index (ACWI) climbing 3.3% in January. European markets recorded their strongest rally in over a year, led by Germany’s DAX index, which jumped 9.2%, alongside gains in France and Italy. The UK’s FTSE 100 also registered a notable 6.1% increase. Meanwhile, crude oil prices saw a 6.4% gain during the month, despite a weaker performance in the latter half.

Outlook: Investor Sentiment Remains Positive

Market analysts anticipate continued momentum in the GCC’s investment landscape, with expectations of steady capital inflows into key sectors. While macroeconomic uncertainties persist, particularly in inflation trends and monetary policy adjustments, the region’s equity markets remain well-positioned for growth in 2025