GCC markets rebound in June despite global volatility

GCC stock markets recorded strong gains in June 2025, recovering from earlier declines and showing resilience despite geopolitical tensions and fluctuations in oil prices, according to the latest monthly report by Kamco Invest.

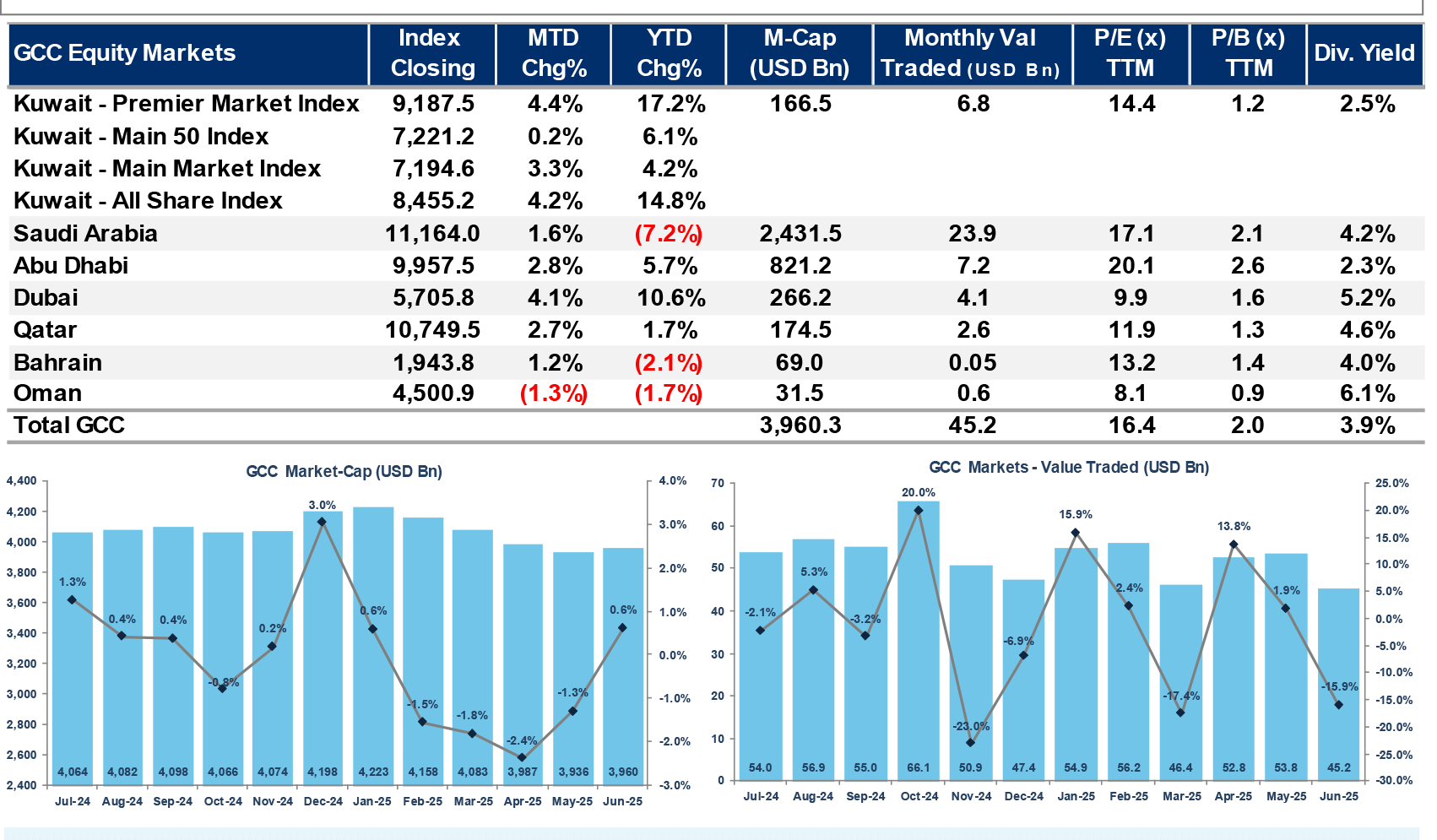

The MSCI GCC index rose 3.1% during June, driven by broad-based growth across most markets, except for Oman, which slipped by 1.3%. Kuwait led the region’s performance with a 4.2% monthly gain, followed closely by Dubai, which increased 4.1%. Abu Dhabi and Qatar recorded gains of 2.8% and 2.7%, respectively, while Saudi Arabia advanced 1.6%.

Sector-wise, Insurance stocks were the top performers, rising 8.2%, followed by Consumer Durables & Apparel (+6.7%) and Banks (+4.0%). Only the Energy sector posted a slight decline of 0.6%.

The positive June results pushed the GCC’s year-to-date performance into positive territory, with a cumulative gain of 1.5% for the first half of 2025. Kuwait stood out as the best-performing market so far this year, with a 14.8% increase, primarily driven by large-cap stocks. Dubai has grown 10.6% year-to-date, while Abu Dhabi and Qatar gained 5.7% and 1.7%, respectively.

In contrast, Saudi Arabia posted the region’s steepest year-to-date decline of 7.2%, while Bahrain and Oman saw smaller declines of 2.1% and 1.7%. Among sectors, Telecoms (+13.7%) and Banks (+9.9%) led gains for the year, whereas Utilities, Food & Beverage, and Healthcare recorded double-digit losses.

Global markets showed mixed results, with European indices declining while US and emerging market indices achieved moderate gains. Crude oil traded below USD 70 per barrel as geopolitical risk premiums eased, and gold prices remained largely stable.

The report highlights that despite geopolitical risks, the GCC markets have shown underlying strength, driven by resilient sectors and investor interest in diversified industries beyond oil.