German real estate logistics market 2022 - New construction volume falls slightly

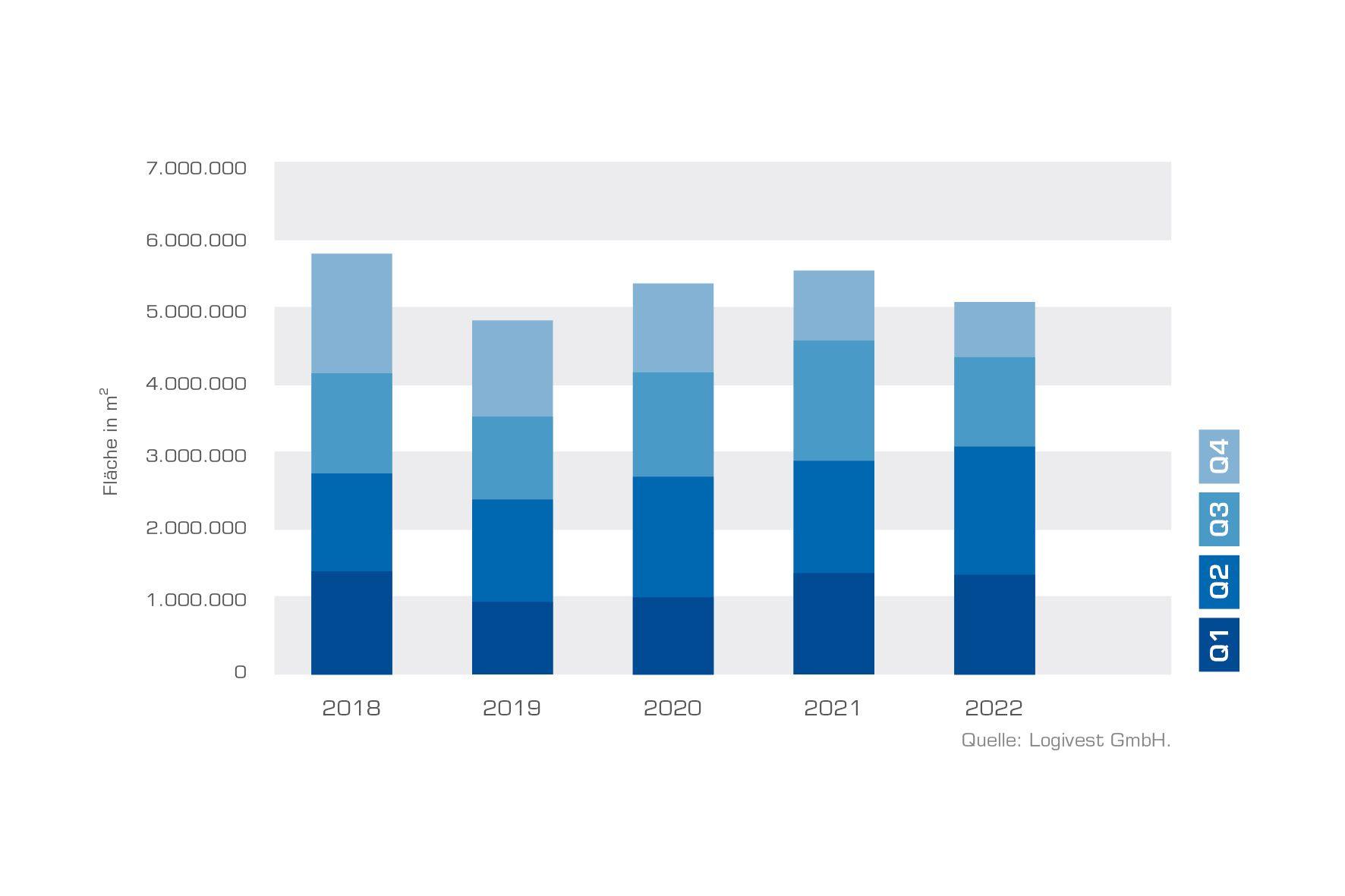

The logistics real estate market closed 2022 with a slight decline in terms of new construction volume. After evaluating its own research data as part of the annual logistics real estate seismograph, the consulting firm Logivest reports the start of construction of a total of around 5.1 million square meters of new logistics space in 2022 - around 400,000 square meters less than in 2021.

As early as the middle of the year, it became apparent that the Russian war of aggression on Ukraine and the accompanying inflation would also leave their mark on the logistics real estate market. "Especially in the saturated markets, the economic uncertainties start to show in the third quarter of 2022. Those who could economically represent postponed their project directly to 2023. However, considering the situation with massively increased construction costs, a very dynamic interest rate development and low sales factors, we can still speak of a stable market from my point of view," says Kuno Neumeier, CEO of the Logivest Group.

Established markets occupy the top ranks

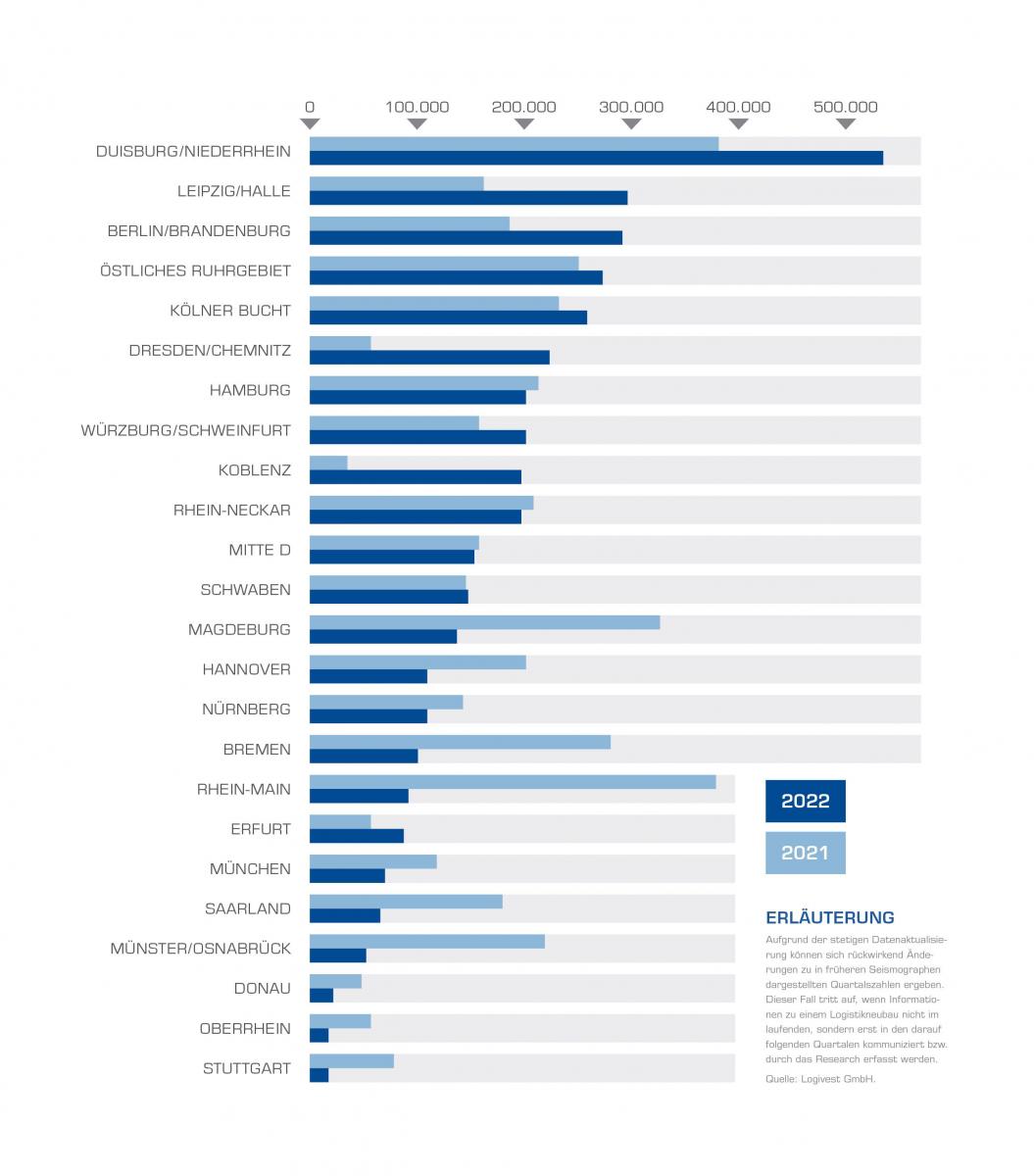

Duisburg/Lower Rhine, Leipzig/Halle and Berlin/Brandenburg - the top 3 rankings from 2022 hold no major surprises. However, with a considerable amount of around 535,000 square meters, Duisburg/Lower Rhine is far ahead at the top of the most dynamic logistics regions in Germany, followed by Leipzig/Halle. The top one region from 2020 can now take second place with around 300,000 square meters after a slight downturn in 2021. The capital region of Berlin/Brandenburg is only just behind with circa 295,00 square meters.

While these markets benefit from project launches in the first and second quarters, the Rhine-Main region is probably the most striking example of the aforementioned project shifts. Ranked No. 1 in 2021 with around 380,000 square meters, the region records only around 95,000 square meters in 2022, ranking No. 17 out of 24 logistics regions for the first time.

Dresden/Chemnitz and Koblenz in the top 10

The Koblenz region, on the other hand, is a positive surprise. Always in the bottom third in recent years, the region catapulted to ninth place in 2022. This is due to projects such as the 60,000-square-meter logistics property in Polch, southwest of Koblenz, which is already fully leased and is being developed by Lang & Cie, and a 55,000-square-meter logistics center being built by Dietz AG for Wacker Neuson in Mühlheim-Kärlich, northwest of Koblenz.

But the Dresden/Chemnitz region, named the 24th top logistics region by the Fraunhofer Institute just last year, is also one of the year's winners. With around 225,000 square meters of new construction space, the region in the east of the republic occupies sixth place and impresses with large-volume developments such as the Central Saxony logistics center covering around 72,000 square meters, which the project developer Fuchs Immobilien is building on behalf of Invesco Ltd. in Hainichen, and also the new logistics property with around 28,000 square meters that VW will be moving into in Meerane.

Sustainability defies inflation

Another positive development can be seen in the area of sustainability. The question is no longer whether, but to what extent energy-efficient construction will take place. Thus, even the largest project developments of the year are characterized by a high degree of sustainability. The largest project development in 2022, with around 94,000 square meters, which consists of two halls, is being built to ESG standards on a brownfield site in Dettelbach in the Würzburg/Schweinfurt logistics region. The project developer Panattoni is developing the logistics park for the customers S.Oliver as well as Dachser.

BEOS Logistics is building an 85,000-square-meter logistics center for logistics service provider Rhenus at the Rhein-Lippe port in Wesel that will set new standards in terms of energy supply for logistics properties. The aim is to make the property completely independent of fossil fuels by means of geothermal energy, photovoltaic systems and heat pumps. And Garbe Industrial Real Estate's third-largest development of the past year, a logistics park in Bitterfeld-Wolfen with around 82,000 square meters, is also to meet the highest energy requirements. For example, the building will be constructed in accordance with the KfW40 standard. A photovoltaic system will be installed on the roof area to generate renewable energy.

"For a few years now, the issue of sustainability has been playing an increasingly important role in the logistics real estate market," says Neumeier. However, according to the logistics real estate expert, in 2022 there has been a real competition in terms of energy efficiency. "Of course, the increased energy prices give the topic a new explosiveness. However, it can also be seen that sustainability has become an important quality criterion." For Neumeier, the main challenge in 2023 is to continue this momentum under the current framework conditions. "In order to continue to be financially feasible, sustainability must also be considered above all from the point of view of economic efficiency."