INVESCO: Investing in climate - do we need mitigation and adaptation?

- Climate change will challenge and change the way we live

- The poorest countries in Africa are likely to be the hardest hit

- Need to invest in mitigation and adaptation strategies

Judging by the global rise in temperatures over the years, it is clear that climate change will challenge our way of life. Investing in mitigation and adaptation strategies is essential to address these risks.

Why do we need to invest in climate?

In July 2023, UN Secretary-General Antonio Guterres declared, "The era of global warming is over; the era of global boiling has arrived."

His comment was in response to the news that last July was the hottest month on record. The European Union's climate change service, Copernicus, reported that the average global surface air temperature in July 2023 was 16.95°C. This was the highest value for any month since detailed records began in 1940.

Symbolically, it was 1.5 °C warmer than the estimated average July temperature from 1850-1900. The Paris Agreement aims to limit the temperature rise from 1850-1900 to just 1.5 °C.

The situation has barely improved since then, with the Copernicus Climate Change Service reporting that March 2024 was warmer than any previous March in the data record. It was also the tenth month in a row that was the warmest on record. However, the increase that represents the trend of recent months may also be due to an El Nino phenomenon.

Unfortunately, future climate change has probably already been factored in to some extent, as models link temperature change to CO2 emissions, at least over the last 100 years.

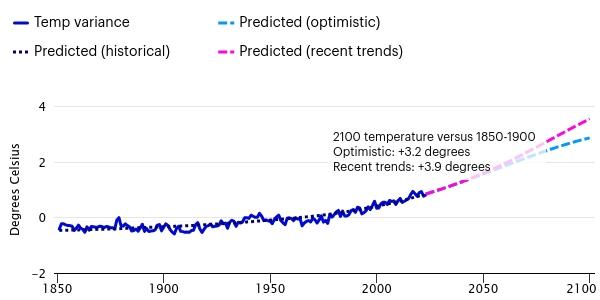

"Based on UN population estimates, my expectations of future income growth, and the assumption that technological innovation (as measured by the rate of CO2 reduction per unit of GDP) will continue at the rate it has to date, my model predicts a temperature change of 3.9°C by the end of the century compared to the 1850-1900 average," explains Paul Jackson, global head of asset allocation research at Invesco.

This is shown in the 'Recent Trends' section in Figure 1.

Such a temperature change would likely have a dramatic impact on weather patterns. Previous UN reports suggest that such temperature changes could bring a large increase in climate-related deaths and migration flows that could run into the hundreds of millions.

Some regions, such as low-lying coastal areas, will simply become uninhabitable. Meanwhile, most financial centres, such as New York, London, Tokyo and Hong Kong, are located in coastal areas.

As an example of the consequences of a 2-4 °C temperature rise, the Stern Review (2006) estimated that extreme weather changes could cost up to 0.5-1.0% of annual global GDP, up from 0.1% in 2005. A permanent GDP loss of 3 % could occur with a temperature increase of 2-3 °C, and a loss of up to 10 % above 5 %.

Investing in mitigation strategies

But it does not have to be that bad. Major investments are already being made to mitigate climate change. In Germany and the UK, for example, more than 40% of electricity comes from renewable sources.

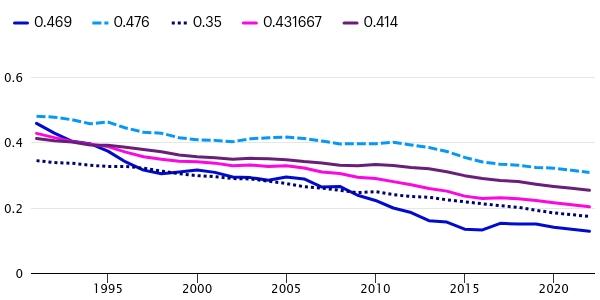

Technology will be key, and Figure 2 shows one way in which things are moving fast. If we want to reduce CO2 emissions while allowing income and population growth, we need to reduce the CO2 intensity of economic activity, which is what we are trying to do.

But continuing recent trends predict temperature changes of 3.9°C. "We need to accelerate technological innovation to 'bend these CO2 curves downwards'," says Paul Jackson.

The optimistic scenario in Figure 1 effectively assumes a doubling of the rate of decline in CO2 intensity and reduces the projected temperature change to 3.2 °C by 2100 (compared to the 1850-1900 average).

This is still not much, but importantly, it gives hope that changes after 2100 will be more dramatic compared to the "recent trends" pathway. This is because what we are doing today will not be fully reflected until about 100 years from now.

It is easy to assume a doubling of the rate of technological innovation, but much more difficult to achieve. It will require major investment in research and development, and will probably need a lot of support from governments. It is not easy to spend money now for the benefit of our great-grandchildren.

Key areas of innovation in the near future will include the development of battery technology and energy storage. Other innovations will involve the use of marine energy sources or the use of hydrogen as a fuel source. Advances in agricultural technologies will reduce methane emissions, while the shift to electric aircraft is gathering pace. So, too, is air conditioning powered by solar energy.

Unfortunately, climate change is already happening and will get worse. But the impacts of this change are unlikely to be evenly distributed. Temperatures will change closest to the poles, but areas close to the equator are already experiencing high temperatures and any increase there could already be critical.

In addition, a large proportion of the population living in the tropics is poor, and poorer countries are often expected to bear the brunt of climate change. There will be floods in some places, droughts in others, unbearable temperatures, water and food shortages. These areas will be the least able to defend themselves.

Africa needs time to adapt to meet the climate challenge

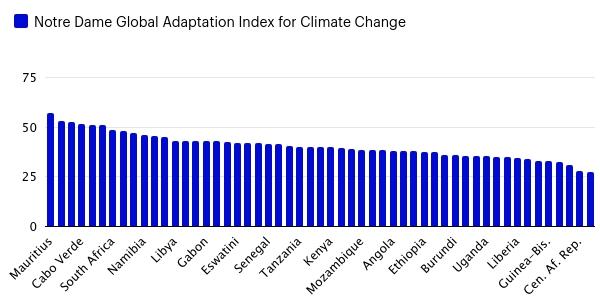

Africa is an example of this problem - Figure 3 shows the Notre Dame Global Index illustrating adaptation to climate change in 53 African countries, excluding South Sudan.

The Adaptation Index assesses a country's vulnerability to climate change and its preparedness for climate change (lower scores indicate less preparedness). Chad has the lowest score of any country in the world at 26.9, while Norway has the highest at 75.0. Of the 185 countries included in this index, only one African country, Mauritius, is in the top third.

A further 11 African countries are in the middle and the remaining 41 countries are in the most vulnerable third of countries. Yet Africa contributes less than 3% of cumulative CO2 emissions by 2022, but seems destined for the worst consequences.

UN estimates suggest that Africa will have 41% of the world's working-age population (15-64) in 2100, compared with 15% in 2020. It is possible that these potential workers will already be looking elsewhere for opportunities, so to avoid staggering migration flows to the rest of the world, much of Africa may need to be prevented from becoming uninhabitable.

Spending on climate change adaptation is likely to involve a wide range of measures around the world, from building protective barriers in the sea, to shifting settlements within countries, to investing in water capture and desalination.

Investments are also needed in agrochemicals, drought-resistant crops, innovations in improving building standards to prevent flood zones, and storm-resistant buildings.

Climate change represents both a threat and an opportunity. "Investors are already faced with economic losses and rising costs such as insurance. This is only likely to get worse. It's probably the biggest externality we will ever face, but the nature of externalities makes them difficult to address because the polluter is not forced to pay. However, measures that are taken now can limit future damage. Investors can be part of the solution and climate change is likely to become the dominant investment theme for the rest of the century," concludes Paul Jackson.

Risk warnings

The value of investments and their returns are subject to fluctuations. This may be partly due to changes in exchange rates. Investors may not get back the full amount invested. Past performance is not a guide to future returns.

Important information

This press release is intended for professional use only. This document is for informational purposes only. Views and opinions are based on current market conditions and are subject to change.