Investors expect further price increases on real estate markets

According to a Universal-Investment survey, institutional investors are continuing to invest in real estate for lack of alternatives. The main focus has shifted back to real estate in Germany, but North America is also gaining in importance. Residential real estate is continuing to rise in investors' favour, while retail properties are scarcely featuring in new investments. At the same time, new types of use such as co-living, health care properties and public sector buildings are also in vogue. Investors are increasingly concerned about the development of real estate prices. Many prices are clearly too high and thus no longer acceptable. ESG remains a fundamental issue and is of “great” or “very great” interest to almost all investors. Institutional investors with total assets of around 65.1 billion euros and a real estate portfolio of around 14.8 billion euros took part in this ninth survey.

Renewed interest in German and North American real estate

At 61.7 per cent (previous year: 51.4 per cent), just under two thirds of those surveyed cited Germany as the main focus of their investment. Investment levels in other European countries have declined noticeably in comparison, accounting for only 14.8 per cent (previous year: 28.8 per cent). At 12.6 per cent (previous year: 8.8 per cent), there has been a significant increase in interest in new investments in North America, by contrast. Asia/Pacific, on the other hand, has lost some of its appeal. Only 4.6 per cent of respondents are still looking to make new investments there (previous year: 10.9 per cent).

Investors viewing price development with concern

The majority of respondents viewed the development of real estate prices as “critical” or “very critical”. In Germany, only 6.2 per cent (previous year: 7.1 per cent) still consider the prices acceptable. 75 per cent find the prices here too high, although still acceptable (previous year: 85.7 per cent). 18.8 per cent feel that the pain threshold has been exceeded and believe the price levels are no longer acceptable (previous year: 7.2 per cent). The prices for other European countries and the rest of the world are given a similar assessment. Meanwhile, 68.8 per cent expect prices to continue rising in the current year (previous year: 35.7 per cent).

As many as 25 per cent of those surveyed (previous year: 7.1 per cent) believe there is a danger of a bubble forming. Only 12.4 per cent remain entirely relaxed on this issue (previous year: 28.6 per cent), while a majority of 62.6 per cent see the danger of a potential bubble in individual markets, as in the previous year (64.2 per cent).

Residential real estate remains primary focus of demand

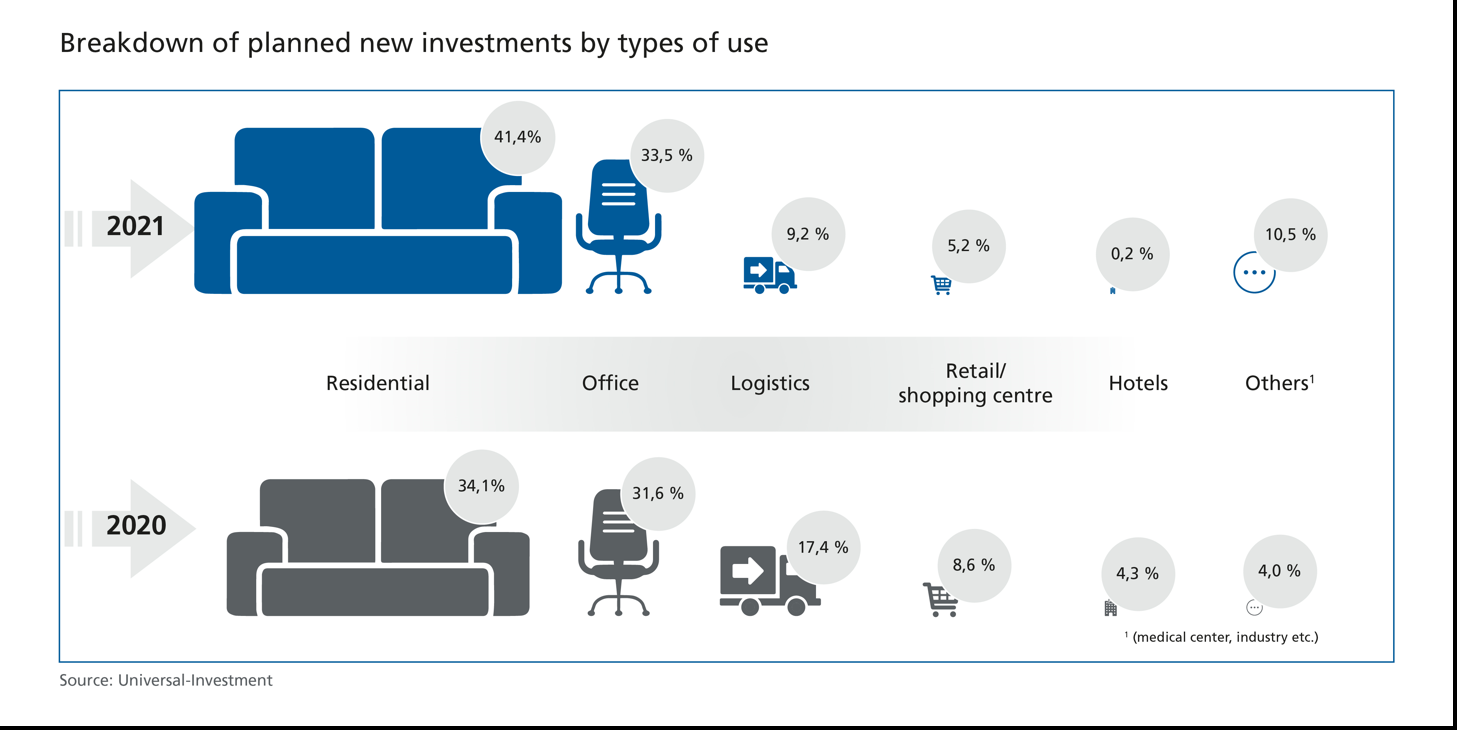

Retail properties have clearly lost in appeal since the first survey in 2013. Institutional investors are now only planning to invest 5.2 per cent of their funds in this segment (previous year: 8.6 per cent, in 2013: 70.6 per cent). As before, the greatest demand by far is for residential real estate. Around 41.4 per cent are looking to make new investments here (previous year: 34.1 per cent). Planned office investments remain very stable despite pandemic-related concerns, and have even increased slightly to 33.5 per cent (previous year: 31.6 per cent). The skyrocketing prices for logistics real estate have evidently resulted in only 9.2 per cent of the respondents still wanting to make new investments in this sector (previous year: 17.4 per cent). At 0.2 per cent, interest in hotels has dried up almost completely, as expected (previous year: 4.3 per cent).

Government offices and health care properties top the list

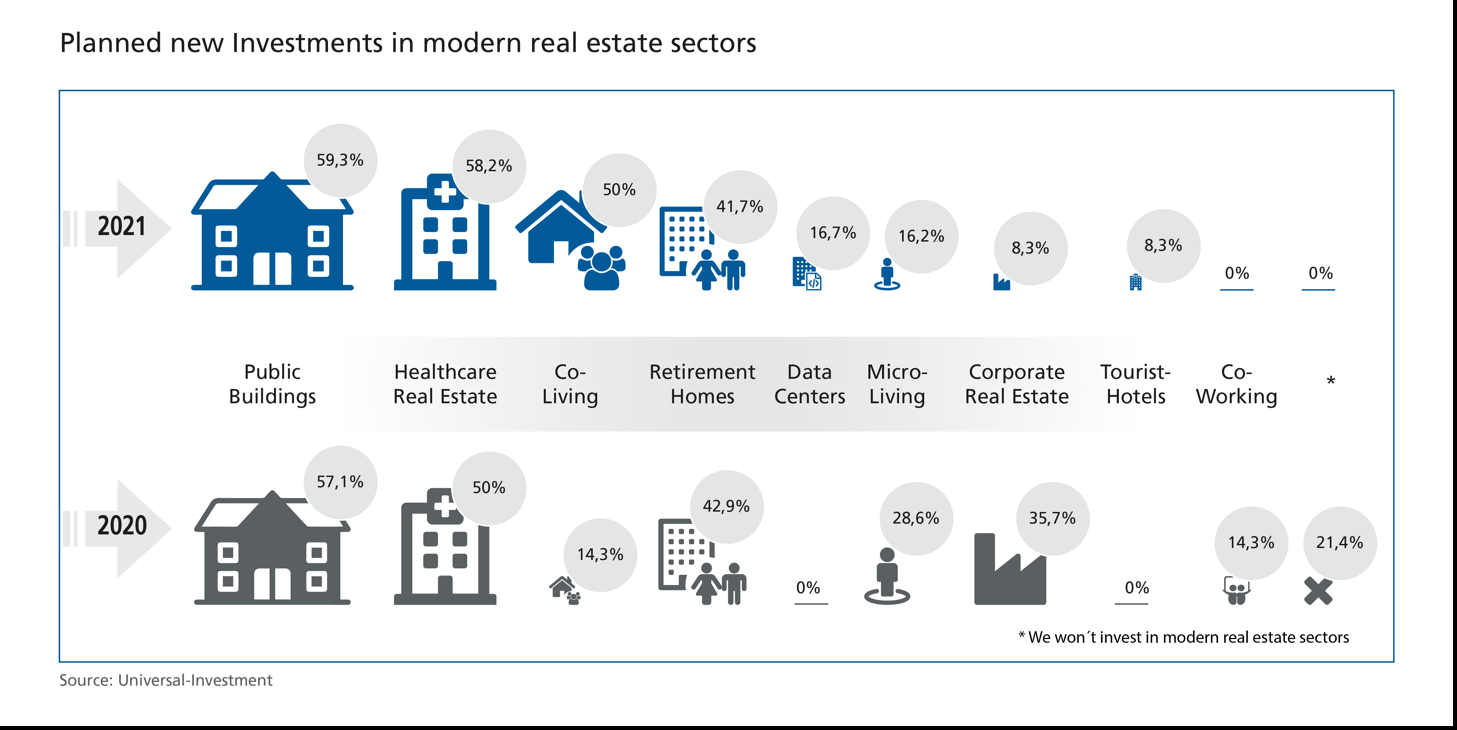

Many investors are also looking to invest in newer types of use beyond the classic residential, office and retail sectors. Public sector buildings – such as schools, kindergartens and government offices – head the list of new investments. 59.3 per cent of those surveyed stated an intention to invest in these in the next twelve months (previous year: 57.1 per cent). Health care properties have gained further in popularity. 58.2 per cent intend to buy real estate in this segment in the near future (previous year: 50 per cent). An interesting development is the jump in interest in co-living. Around 50 per cent are looking to invest in this area (previous year: 14.3 per cent). Demand for co-working, on the other hand, has collapsed to zero (previous year: 14 per cent); at only 8.3 per cent (previous year: 35.7 per cent), a similar decline has also been posted for corporate real estate. At 41.7 per cent (previous year: 42.9 per cent), senior citizens' residences continue to be in demand.

Real estate investments remain popular – despite falling yields

The majority of investors are looking to increase the share of real estate within their portfolios yet further. The majority of respondents are even planning to raise it to over 20 per cent (22.8 per cent, up from 15.3 per cent in the previous year) – despite the ongoing decline in expected returns. The expectation for the annual distributed interest (cash flow yield) on existing real estate is currently just 3.41 per cent (previous year: 3.58 per cent). For new investments, half of all the respondents expect a net initial yield of below 3 per cent, with only around 23.7 per cent hoping for a value of 3 to 3.5 per cent.

In terms of returns, around 31.3 per cent attach primary importance to the distribution yield, whereas a similarly high proportion of respondents have a preference for the realised total return following the profitable sale of the properties. "Rising real estate rates are a consequence of a market situation in which there are currently very few alternatives in the low-risk investment sector. This is why institutional real estate investors are also accepting lower yields," explains Axel Vespermann, Managing Director of Universal-Investment with responsibility for the Real Estate business segment.

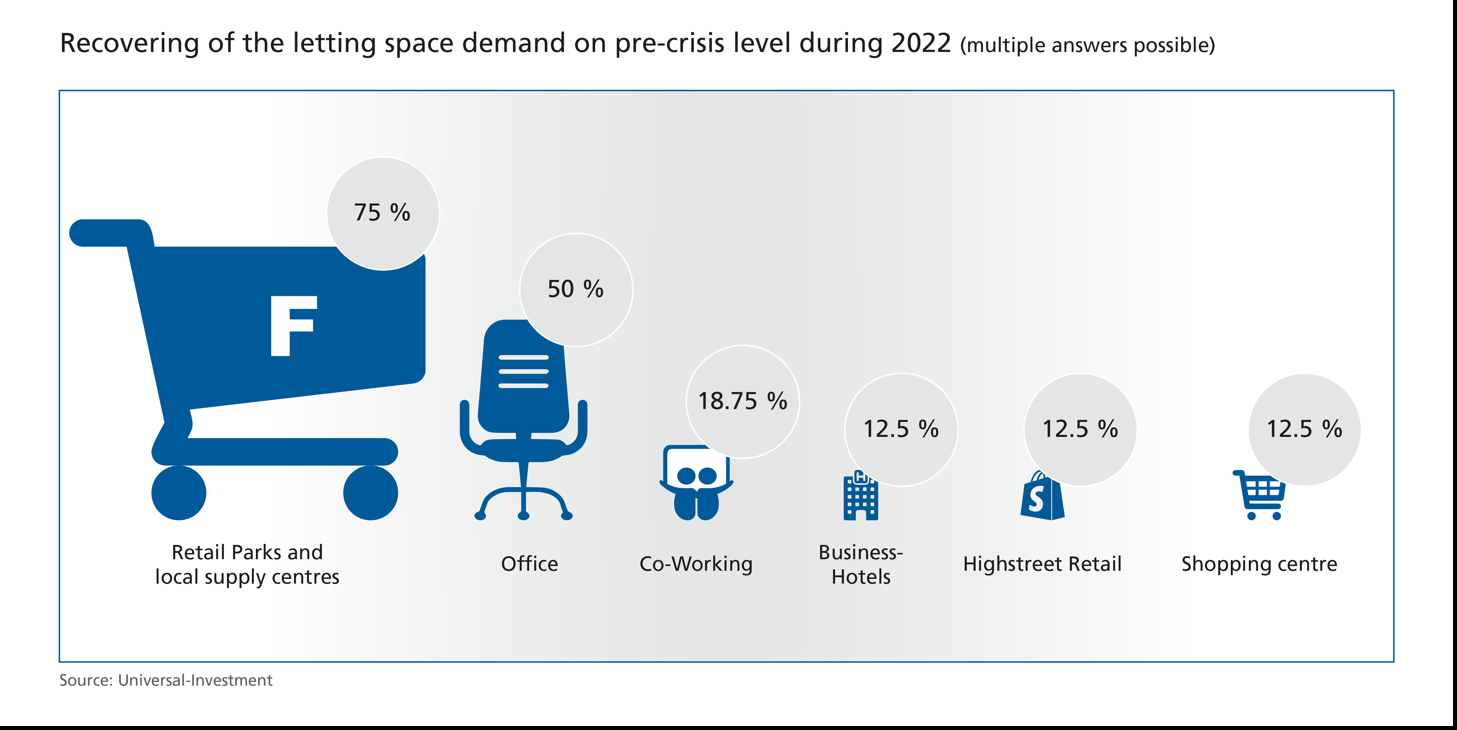

As in the previous year, the survey included questions about the impact of the pandemic. The majority (68.7 per cent) expect to see declining demand for space in certain sectors, including offices and hotels. Around 56.3 per cent report experiencing negative effects on their real estate investments due to slumps in individual sectors, and around 25 per cent fear risks from the overall economic situation. Nevertheless, half of the respondents expect demand for office space to recover to pre-crisis levels by 2022. This figure rises to 75 per cent for retail parks and local shopping centres. Just under 90 per cent of the respondents expect a slower recovery in the shopping centre, business travel hotel and high street retail sectors.

"Alongside residential real estate, local outlets and food retailing have once again shown themselves to be sources of stability in times of crisis. These sectors are almost completely independent of the economic cycle. Other types of use, however, have been hit hard, such as shopping centres and hotels. With regard to the main office sector, the crucial question remains: How quickly will companies return to pre-crisis levels and how high will the demand be?" says Axel Vespermann. "Today, no-one can estimate with any accuracy how many employees will be working from home on a permanent basis in the future, thereby reducing the demand for office space," Vespermann continues.

Less appetite for risk-taking – Main focus clearly on Core

The majority of those surveyed continue to favour Core properties (46.5 per cent), followed by Core+ (36.9 per cent). This preference has reversed in the space of just one year: twelve months ago, 85.7 were interested in Core+ and only 57.1 per cent in Core real estate. Investors' appetite for risk-taking has also decreased significantly in the “Value-add” and “Opportunistic” sectors. "In real estate, there is currently greater interest in investments which function as anchors of stability than in opportunity aspects," says Vespermann.

ESG remains a major challenge for investors

Almost 69 per cent of institutional real estate investors feel that ESG is of “great importance”, with just under 19 per cent saying it is of “little importance” and the rest stating it is of “no importance” to them. 69.2 per cent have already implemented their own in-house ESG strategy and 61.5 per cent have appointed an ESG team or an ESG officer. Around 38.5 per cent are now measuring their carbon footprint, and around 31 per cent have implemented initial ESG optimisation measures. The switch to green leases, the issuing of building certification for the entire portfolio or even the use of benchmark and scoring systems such as GRESB remain largely unaddressed. Here there was no significant feedback from respondents.