Labour market index declines in January amid structural challenges in Poland’s employment sector

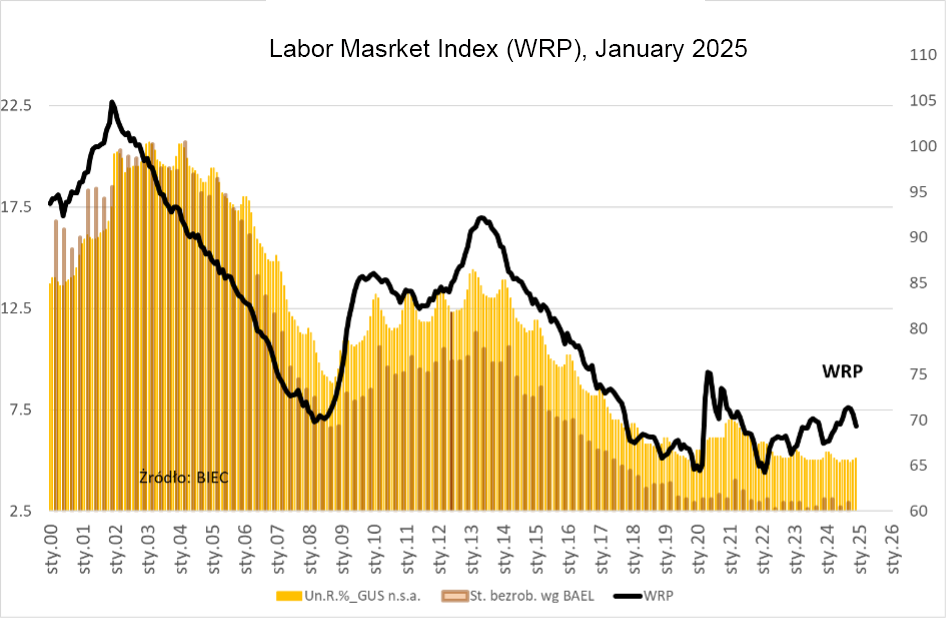

The Labour Market Index (LMI), an early indicator of future changes in unemployment levels, fell by 1.3 points in January 2025. Despite this monthly decline, 2024 was marked by a general upward trend in the index, suggesting a slight increase in unemployment over time. However, the overall scale of unemployment remains low, positioning Poland among the countries with the lowest unemployment rates in the European Union. The greater challenge lies not in joblessness itself but in labour shortages, low female workforce participation, early retirements, and a mismatch between available workers and employer needs.

Since mid-2022, the registered unemployment rate has remained relatively stable, fluctuating within a narrow band. In December 2024, it stood at 5.1%, rising by 0.1 percentage points from the previous month. While most components of the LMI suggest a decline in unemployment, only one factor—the number of people leaving the unemployment register due to securing jobs—indicates a potential increase in the unemployment rate.

The number of newly registered job offers plays a crucial role in reducing unemployment. In December 2024, Polish labour offices recorded 19% more job offers than in the same month the previous year. However, compared to November 2024, the number of new postings fell by 13%, indicating a slowdown in labour market activity. Year-over-year data suggests that fewer job offers are gradually entering the market, further complicating employment prospects.

Another significant factor influencing the labour market is the decline in newly registered unemployed individuals. While this reduces the overall unemployment stock, it also limits turnover, making it harder for job seekers to find work. Long-term unemployment remains an issue, as fewer job opportunities mean less movement within the labour market. In December 2024, the inflow of unemployed individuals decreased by 7% compared to the previous month and was also 7% lower year-on-year.

Business sentiment toward hiring remains pessimistic, with more companies planning job cuts than those considering workforce expansion. The energy and clothing industries anticipate the largest layoffs. Out of 22 industries surveyed by the Central Statistical Office (GUS), only two—transport equipment manufacturing and the electronics and optics sector—plan to increase employment in the short term.

The weak inflow of job offers, low vacancy creation, and declining unemployment registrations are making it increasingly difficult for district labour offices to facilitate job placements. In December 2024, the number of people leaving unemployment due to securing a job dropped by nearly 6% month-over-month and by just over 4% year-over-year. This suggests growing inefficiencies in job matching, further complicating Poland’s already strained labour market.