Moldova’s Housing Market Surges as PAS Win Points to Stability Ahead

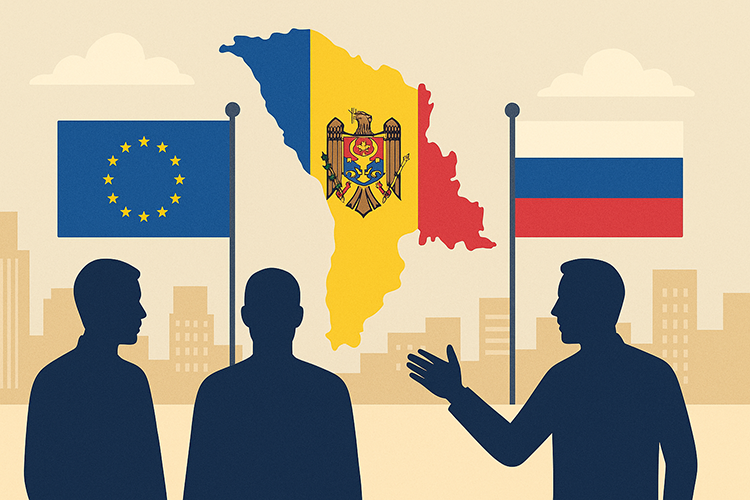

Moldova’s residential real estate sector is undergoing one of its sharpest upswings in years, with home prices in Chișinău climbing rapidly even as transaction volumes slow. Against this backdrop, the victory of the pro-European Party of Action and Solidarity (PAS) in Sunday’s parliamentary elections is expected to have a stabilizing effect on investor sentiment, potentially influencing the future direction of the market.

According to the National Bank of Moldova, the Residential Property Price Index for the capital rose by 18.4 percent in the first quarter of 2025 compared with the previous quarter, and by 35.4 percent year-on-year. Newly built apartments have led the surge, though resale prices are also climbing. By the second quarter of the year, however, sales activity had weakened even as prices continued to rise, creating a widening gap between demand and affordability.

Independent analysis echoes these findings. Data analysis shows that after a period of stagnation in 2022–2023, demand rebounded strongly. In the third quarter of 2024, the index increased by 18.5 percent year-on-year, underlining the intensity of the recovery. Analysts point to robust demand in Chișinău and tight supply as key drivers behind the spike in valuations.

Mortgage lending has played a critical role in sustaining momentum. The central bank reports that more than 70 percent of transactions in the second quarter of 2025 were financed by mortgages, reflecting the influence of government-backed programmes such as Prima Casă Plus, which have eased access to credit for first-time buyers. Yet rising reliance on debt is unfolding amid a sharp decline in the number of transactions. Economist Veaceslav Ionita, writing in the economic outlet Logos-Pres, described the situation as a paradox: while mortgage issuance is growing, completed transactions have dropped to their lowest level in over a decade. He attributes this to soaring prices, regulatory hurdles and a shortage of new housing stock.

The outcome of the parliamentary elections adds a new dimension to the market outlook. PAS’s victory is widely seen as a mandate for continued European integration, institutional reform and economic stabilization. For the property sector, this could translate into greater investor confidence, an acceleration of housing policy reforms and an increase in foreign interest. Developers expect that a more predictable legal and regulatory environment will help expand housing supply, while households could benefit from improved access to EU funding mechanisms that support affordable housing and urban renewal projects.

At the same time, PAS faces the challenge of reconciling rising housing costs with stagnant transaction volumes. Without policy intervention to expand supply and address affordability, the gap between prices and completed deals could widen further, fueling concerns of a market imbalance. Economists argue that PAS’s stronger position in parliament gives it the ability to enact structural reforms in construction permitting, land regulation and financing frameworks, which could ease constraints and improve affordability over time.

In the short term, Moldova’s housing market is likely to remain characterized by high prices and relatively low deal numbers. In the longer term, however, PAS’s strengthened mandate offers an opportunity to align housing policy with broader economic modernization, making real estate both a symbol and a beneficiary of Moldova’s pro-European trajectory.