Mortgage fixed interest rates decreased by 13.7% in 2024

Mortgage fixed interest rates decreased by 13.7% in 2024, this type of credit representing over 95% of the mortgage loans granted in 2024, while variable interest rates increased by 2%, due to IRCC fluctuations, according to a market report released by online broker Ipotecare.ro and financial consulting and mortgage lending company SVN Credit Romania.

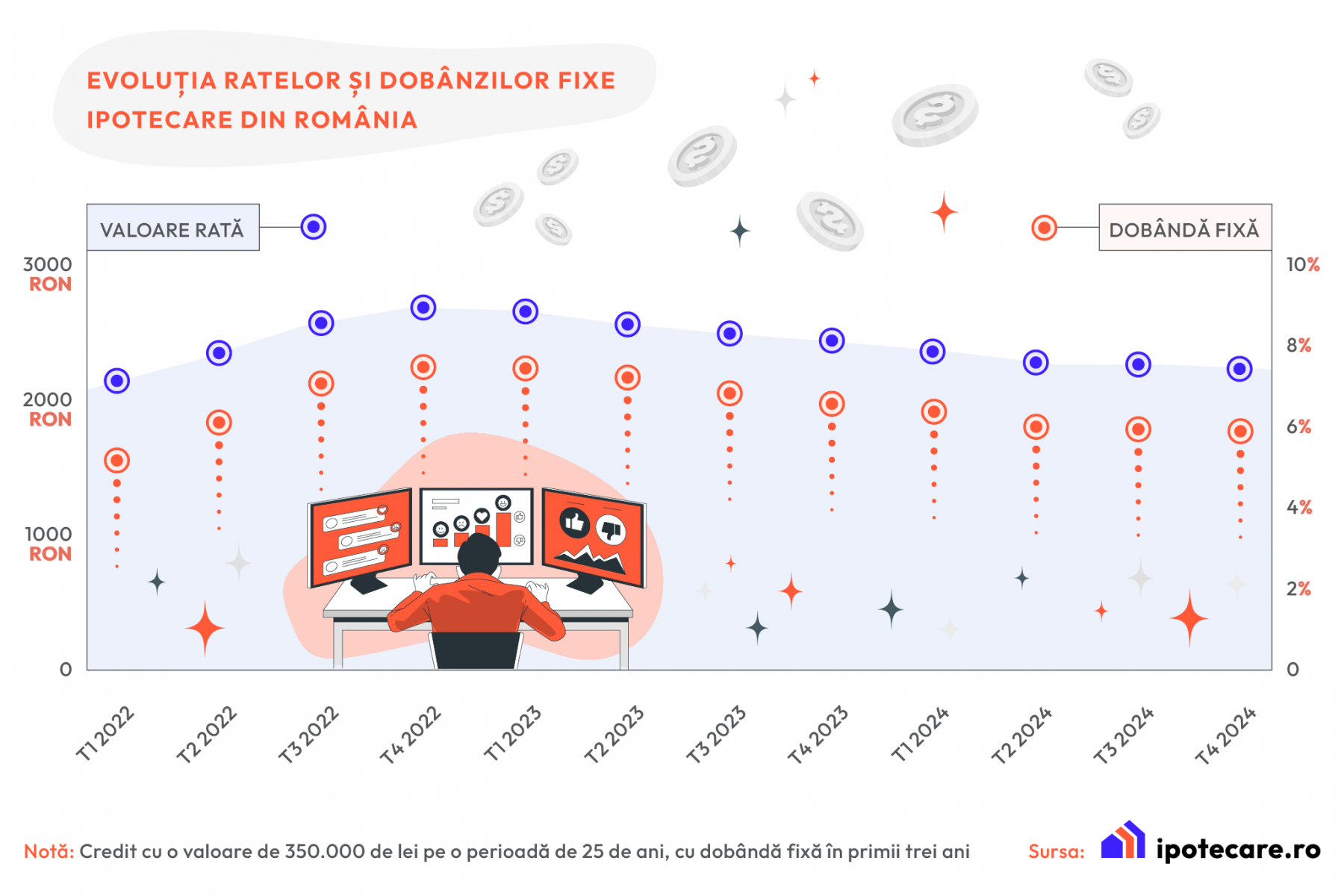

Thus, 2024 started with an average fixed interest rate of 6.71% for mortgage loans granted in Bucharest, the average fixed interest rate for loans granted in the fourth quarter of this year being of 5.79%. This decrease of almost one percent registered on the fixed interest rate segment translated in a RON 200 smaller instalment for the same mortgage loan worth EUR 70,000 granted for a 25-year period, contracted at the end of 2023 and today.

Variable interest rates, which are calculated based on the quotations of the reference interest rate for consumer loans (IRCC), experienced several fluctuations throughout 2024. Today, the average variable interest rate for a mortgage loan is about 2% higher compared to the level registered a year ago, according to SVN’s calculation based on data from the banking sector.

Thus, the average variable interest rate was of 8.21% at the end of 2023. It increased to 8.47% in the first quarter of this year, and then it recorded a decrease, currently being of 8.39%. The instalments of mortgage loans with variable interest rates will further decrease from 1st January, when IRCC will decrease to 5.66%, from 5.99% today. This will translate into a new average variable interest rate of approximately 8.11%, meaning a RON 70 smaller instalment for a EUR 70,000 mortgage loans.

”2024 was the comeback year for the Romanian mortgage market. The downward trend of mortgage interest rates will continue throughout 2025, with room for further interest rates cuts. The offer is extremely varied, with over 250 existing mortgage products and with interest rates starting from 4.8% in the first three years for a 25-year mortgage loan and reaching 10.2% fixed interest rate for a 10-year mortgage, the fixed interest rate being for the entire period. Homebuyers should use a performant online calculator to see what instalment reductions can obtain through refinancing and the amounts they are eligible for”, said Alexandru Radulescu, managing partner SVN Romania | Credit & Financial Solutions.

Mortgage loans worth EUR 7.3 billion were granted in total at a national level in the first ten months of 2024, up 43% compared to the first 10 months of 2023 – please note that this volume also includes refinancings, conversions, transfer and restructurings.

The overall mortgage balance reached EUR 21.7 billion at the end of the third quarter, up 2% compared with the balance registered at the and of 2023, according to the data of the Central Bank (NBR). Mortgage loans represent 58% of all loans in payment, while about 42% are consumer loans.