Oil Prices Recover Partially as OPEC+ Output Rises and Geopolitical Tensions Escalate

Oil markets in September 2025 showed volatility as crude prices attempted to recover from early-month losses but remained below the USD 70 per barrel threshold. The partial rebound was supported by a smaller-than-expected production hike announced by OPEC+, a strike in Qatar, and renewed discussions on sanctions against countries buying Russian crude. However, downward pressure persisted due to oversupply, higher U.S. output, and concerns over sluggish demand in major economies.

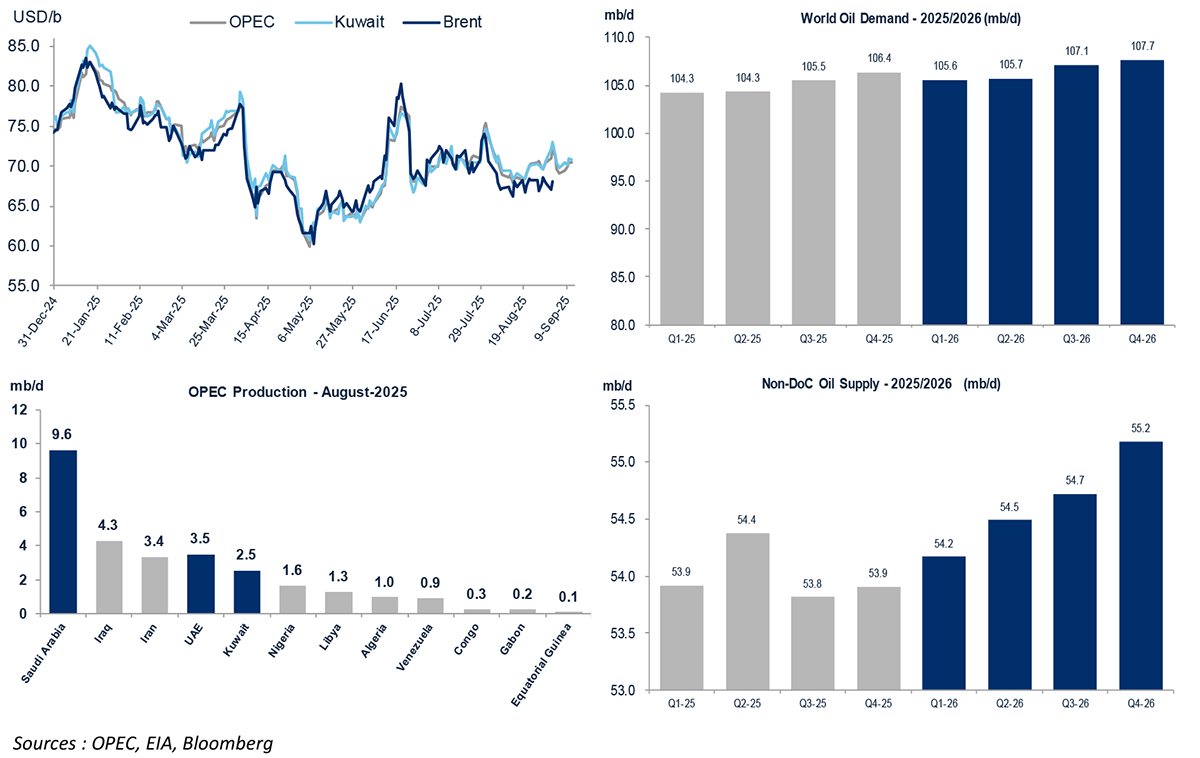

Average crude prices declined in August, with Brent down 3.8% to USD 68.2/b, OPEC’s reference basket down 1.7% to USD 69.7/b, and Kuwait Export crude down 1.0% to USD 70.7/b. Forecasts from major institutions point to further softening, with median expectations for Brent at USD 64/b in Q4 2025 and USD 62/b in Q1 2026.

Demand forecasts diverged slightly between agencies. OPEC held its 2025 growth outlook steady at 1.3 million barrels per day (mb/d), bringing total demand to 105.1 mb/d. The International Energy Agency (IEA), meanwhile, raised its projection to a 740,000 b/d increase, citing stronger-than-expected consumption in advanced economies, though warning of weaker second-half demand. Refinery runs reached record highs of 85.1 mb/d in August.

On the supply side, world output hit a record 106.9 mb/d in August, up from 105.6 mb/d in July, as OPEC+ and non-OPEC producers unwound earlier cuts. U.S. production climbed to 13.5 mb/d in early September, while OPEC production rose for a sixth consecutive month to 27.9 mb/d, its highest level in over two years. Spare capacity among OPEC members was estimated at 5.15 mb/d.

Geopolitical risks added further uncertainty. The strike on Qatar raised concerns about Middle East stability, while renewed hostilities between Russia and Ukraine led to fresh discussions in Washington and Brussels about tightening restrictions on Russian crude exports. Moves by Iraq and Saudi Arabia to cut supplies to Russian-linked refineries in India highlighted the complex interplay between sanctions policy and trade flows.

Looking ahead, consensus forecasts suggest oil prices will remain under pressure from oversupply through 2026, with world production expected to rise further to 107.9 mb/d. While geopolitical risks continue to lend short-term support, the broader trend reflects a market facing persistent surplus and demand uncertainty.

Source: Kamco Invest