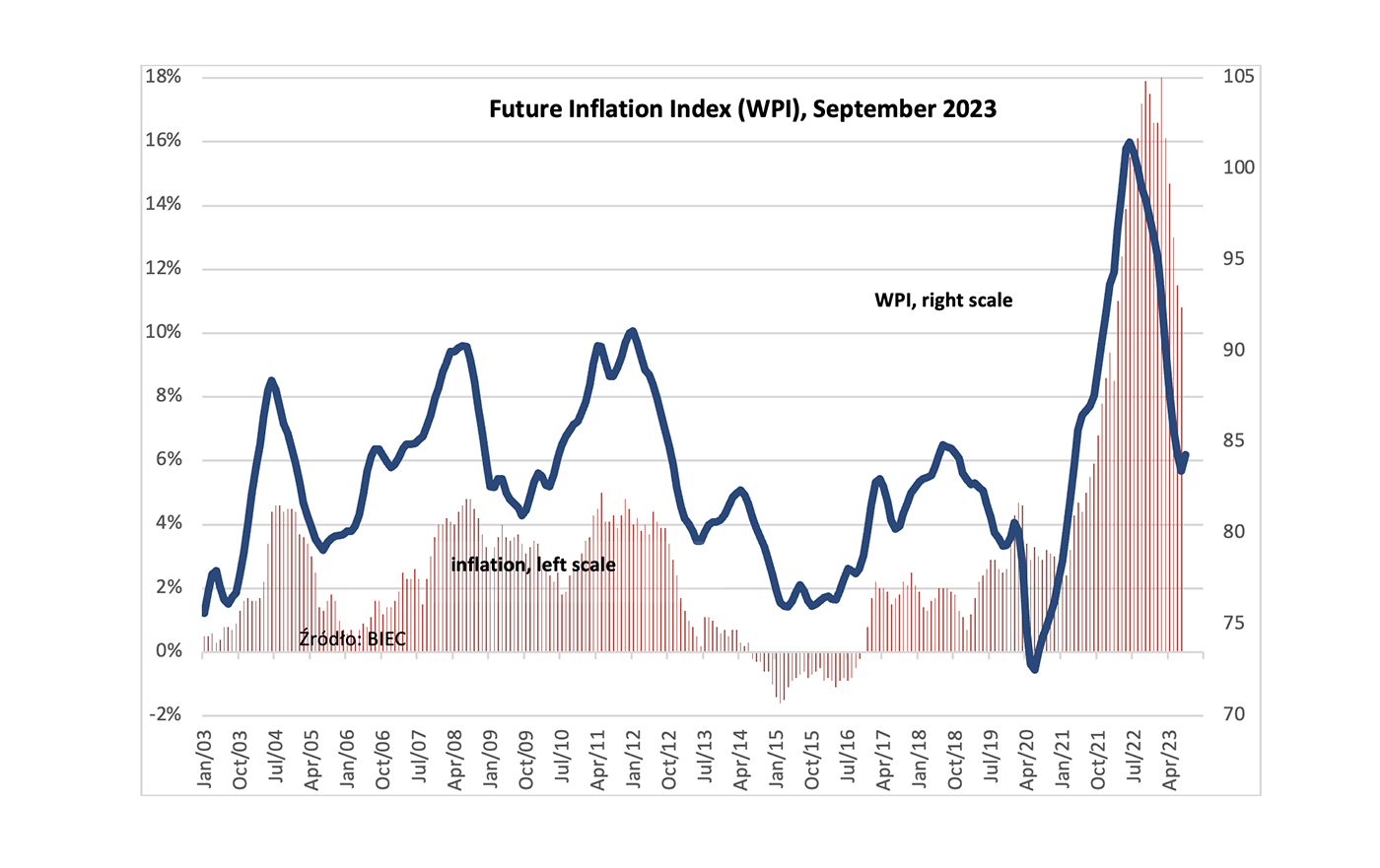

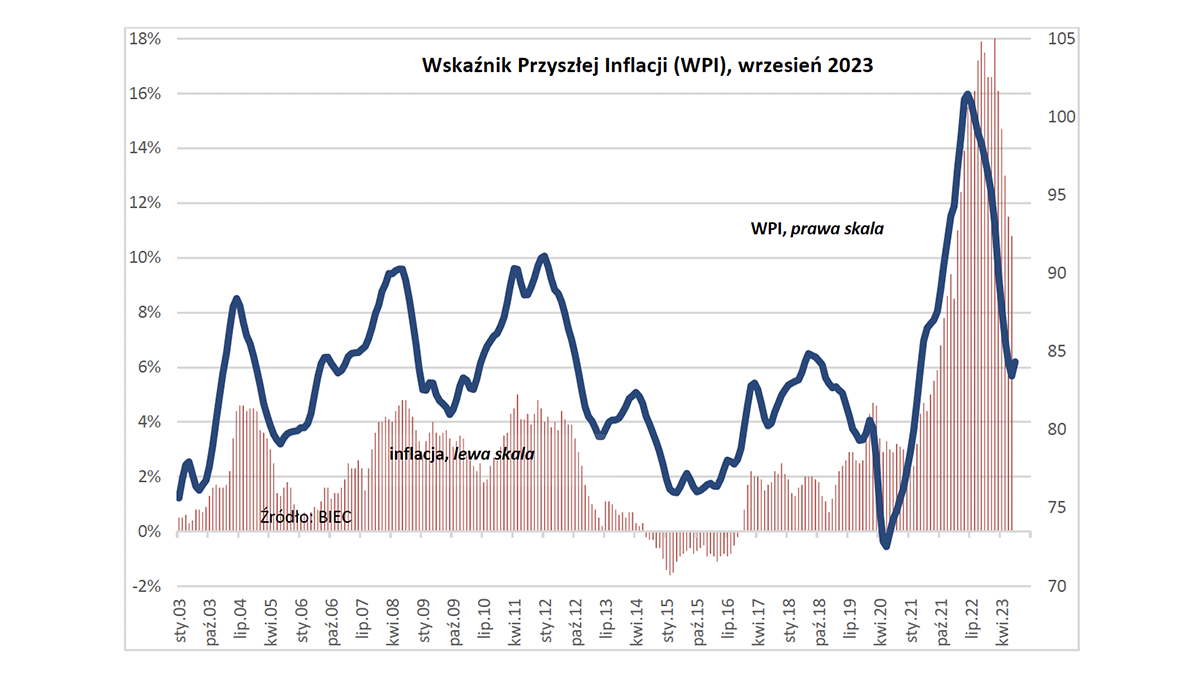

Poland: A rebound in inflation is certain

The Future Inflation Index (WPI), which forecasts several months in advance the direction of consumer prices in September 2023, rose by 0.9 points for the first time in 15 months. Since April this year, declines in the index have been slower and slower, already indicating the exhaustion of factors working towards disinflation. It is worth noting that the vast majority of the index's components do not yet take into account the MPC's recent decision to cut key interest rates. Certainly, the effects of this decision, will be reflected in the next statistics and will act in the perspective of the next few months towards a renewed acceleration of price growth. Lower instalments on loans taken out, higher creditworthiness and lower interest rates on deposits will increase consumer demand and at the same time upward pressure on prices. A weakening zloty, together with more expensive raw materials, will raise import prices and, for domestic producers, create an incentive to raise prices for substitute goods. An exceptionally strong accumulation of pro-inflationary factors will occur with the beginning of 2024, when electricity prices are likely to be unfrozen and the 5% VAT rate on food will return. It will be very difficult to guard against the return of higher inflation, while its perpetuation, which is already occurring, condemns Polish society to living with persistently high inflation for at least the next few years.

Of the eight components of the index, four acted to increase inflation and four to decrease it.

The inflation expectations indices of consumers and managers of manufacturing companies are still declining, although the rate of decline has moderated in recent months. This is particularly evident in the case of producers' intentions to price their manufactured goods. The weakening tendency to reduce prices, means that they have approached the minimum set by costs and margins. Producer expectations are being followed by so-called producer inflation, as expressed by the PPI. This index declined at the fastest rate in the first quarter of this year, while in the following months of this year the rate of decline slowed noticeably.

Similar trends are observed among consumers. The percentage of those expecting prices to rise at the current or faster rate is steadily declining. What is characteristic of the most recent surveys is the highest percentage of those expecting prices to fall (5% of respondents). This means that it is most likely that those choosing this response option equate falling inflation with falling prices.

The commodity price index published by the IMF increased in July and August. This broke a nearly year-long trend when prices of basic raw materials had been falling. In the last month, energy commodities (oil, gas and coal) rose the most, and among food commodities, rice rose the fastest. With the weakening zloty, this means higher import prices and, consequently, higher retail prices and a greater tendency to raise prices among domestic producers.

Author: BIEC Biuro Inwestycji i Cykli Ekonomicznych