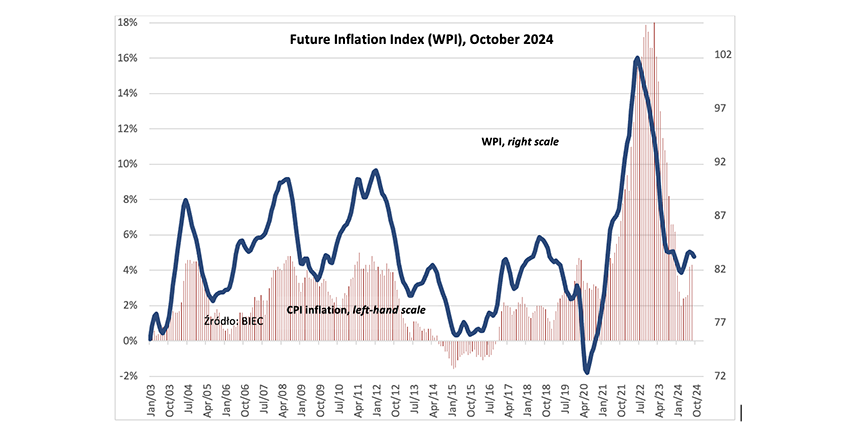

Poland: Future inflation index shows decline, but risks remain for rising prices

The Future Inflation Index (WPI), which projects changes in consumer goods and services prices several months in advance, decreased by 0.3 points in October 2024 compared to the previous month. The decline was attributed to lower commodity prices on global markets and reduced expectations of price hikes from both consumers and producers. However, beneath this positive headline, risks remain, especially related to inflation seasonality, growing producer price pressures, and rising food costs globally.

Consumer inflation expectations fell in September, with the percentage of people expecting prices to rise dropping from 88% in August to 83%. Notably, fewer consumers anticipate rapid price increases in the near future. Those expecting prices to rise at the same or slower rates remained stable. Typically, seasonal price declines, particularly in fruits and vegetables at the end of summer, contribute to more optimistic consumer views on future inflation.

In the manufacturing sector, inflation expectations also eased. The proportion of producers planning price increases dropped slightly from 6 percentage points in August to 5.7 percentage points in September. However, this varied significantly across industries. Companies producing consumer goods—both durable and non-durable—showed a strong inclination to raise prices. Food producers were among the most likely to plan price hikes, with a 14 percentage point lead over those planning reductions. Similarly, companies producing clothing, electronics, furniture, and white goods reported an 11 percentage point advantage in favor of price increases.

Producers are being squeezed by rising labor and energy costs, even as demand for durable and non-durable consumer goods holds steady. This has led many companies to consider price increases to offset these rising operational expenses.

Meanwhile, the market for industrial raw materials has stabilized in recent months, with a slight downward trend, particularly in energy commodities. Metals have seen less price relief. However, in contrast, food commodity prices are climbing. The FAO Food Price Index recorded a 3% month-on-month rise in September, driven by higher prices for key staples like sugar, vegetable oils, and cereals, alongside increases in coffee, tea, and cocoa.

Despite the decline in the Future Inflation Index, the outlook for future prices remains uncertain due to both international and domestic pressures. While commodity prices are fluctuating and inflation expectations have moderated, factors like food price increases and industry-specific cost pressures pose potential risks to future inflation trends.