Poland’s Private Rented Sector (PRS) Market: Current Trends and Developments

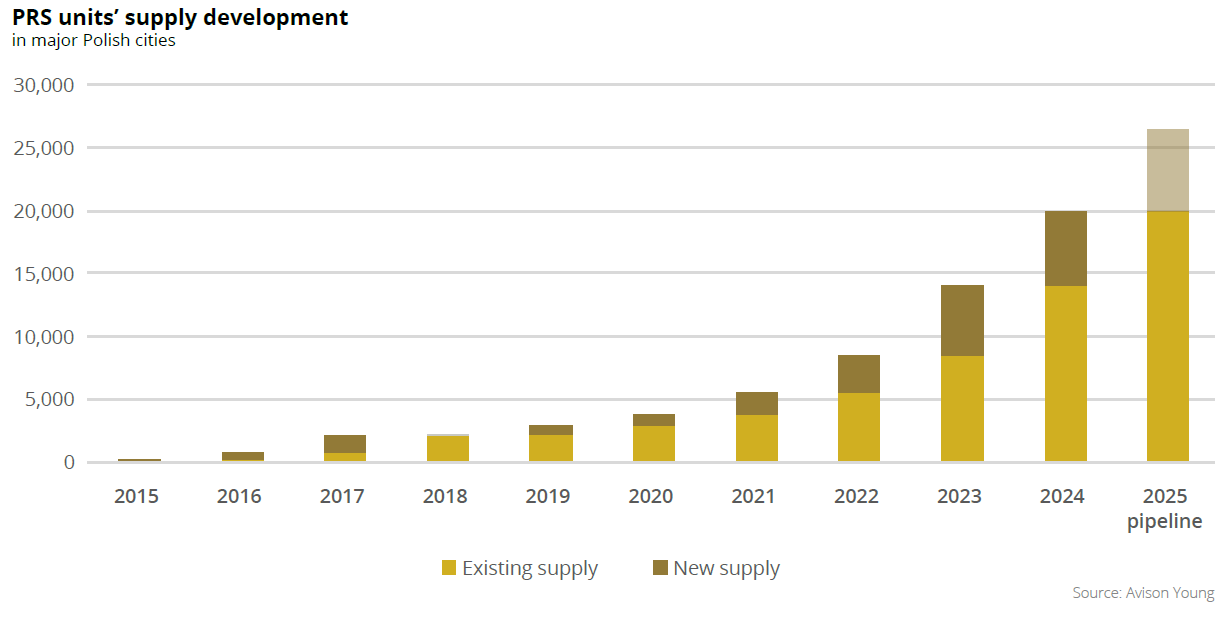

The Private Rented Sector (PRS) in Poland has seen significant growth over the past decade, though institutional rental remains relatively new, with the first transaction recorded in 2014. The state-owned Fundusz Mieszkań na Wynajem was the first to enter the market, acquiring a residential building in Poznań and beginning operations in 2015. Since then, more investors have entered the sector, with a notable increase in activity after 2019 as private companies started launching PRS projects.

By the end of 2024, institutional investors controlled approximately 20,000 rental units, with an additional 9,500 apartments under construction. This represents a fivefold increase in the market over the past five years, with forecasts suggesting continued stable growth.

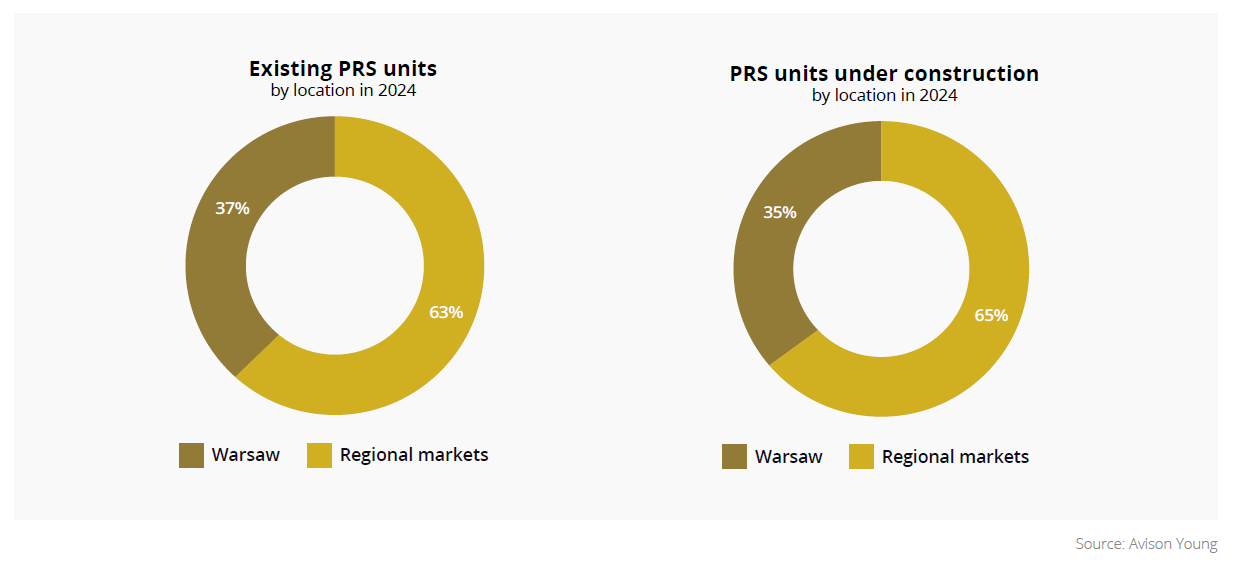

Nearly 37% of all PRS units in Poland are located in Warsaw, but the trend is expanding to other major cities. Regional markets now account for 65% of newly constructed PRS units. Smaller cities such as Lublin and Elbląg have also emerged in the sector, with Fundusz Mieszkań na Wynajem leading developments in these locations.

Among major cities, Wrocław has the highest proportion of PRS units in relation to the total housing stock, at 1.0%, followed by Warsaw and Poznań, both at 0.7%. However, these figures remain significantly lower than in cities like Berlin, where PRS housing comprises over 30% of the market.

In 2024, 28 PRS projects were completed, adding over 5,900 units, with most located in regional cities. The majority of these projects were developed by established PRS operators, with AP Słowackiego being the only new market entrant. The three largest players—Resi4Rent, Vantage Rent, and Fundusz Mieszkań na Wynajem—currently control more than half of the sector’s existing supply. In 2025, an additional 6,500 units are expected to be delivered, with 70% located outside Warsaw.

According to Tomasz Daniecki, Director and Head of Technical Advisory at Avison Young, demand for PRS apartments remains strong due to their modern construction, high-quality fittings, and flexible lease agreements. Recent upgrades, such as the installation of photovoltaic roof systems on 13 properties in Warsaw and Kraków, reflect a broader trend toward improving PRS offerings.

Initially, PRS units primarily catered to young professionals aged 25–35, including foreign workers relocating to Poland. However, rising mortgage rates and inflation have expanded the target demographic, including those unable to access financing or those preferring to rent rather than buy. While homeownership remains high in Poland, with only 13% of residents renting compared to 30% in the broader European market (Eurostat), this trend is shifting due to economic pressures and migration patterns. The average lease length in Poland remains short, at around one year, compared to more than ten years in Western Europe.

Demand and Rental Prices

The increasing number of institutional rental properties is a response to growing demand, driven by rising interest rates, limited mortgage accessibility, and the influx of Ukrainian refugees. Additionally, the “Bezpieczny Kredyt 2%” government program, which ended in January 2024, contributed to rising property prices, further increasing rental demand.

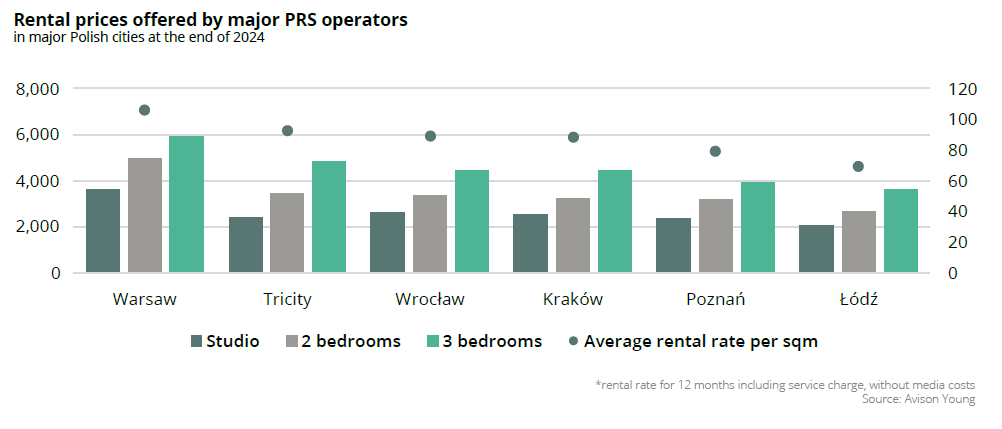

Occupancy rates in PRS developments remain high, with vacancy levels averaging around 2.0% among leading operators at the end of 2024. Rental rates vary based on apartment size, location, floor level, and amenities such as balconies or terraces. Warsaw recorded the highest rental rates, at approximately PLN 106 per square meter, followed by Tricity (PLN 93 per sqm), Wrocław (PLN 89 per sqm), and Kraków (PLN 88 per sqm). Łódź had the lowest rates, averaging PLN 69 per square meter. These figures include service charges but exclude utility costs.

Investment and Market Players

Investment funds play a key role in Poland’s PRS market, acquiring entire buildings and residential complexes for institutional rental. The built-to-rent model has become increasingly popular, allowing for standardized rental pricing and efficient management.

More than 50% of PRS units are controlled by the three largest operators: Resi4Rent, Vantage Rent, and Fundusz Mieszkań na Wynajem. Together, these companies manage over 10,850 rental units. Resi4Rent leads in both completed and planned developments, accounting for over one-third of new PRS projects, followed by Life Spot (19%) and Fundusz Mieszkań na Wynajem (18%).

According to Patryk Błach, Senior Consultant at Avison Young, there is growing investor interest in repurposing older office buildings for PRS or student housing. Many of these properties are located in prime city-center areas, and conversion can be more cost-effective than new construction. Recent assessments suggest that adapting office spaces for residential use is feasible under current technical regulations.

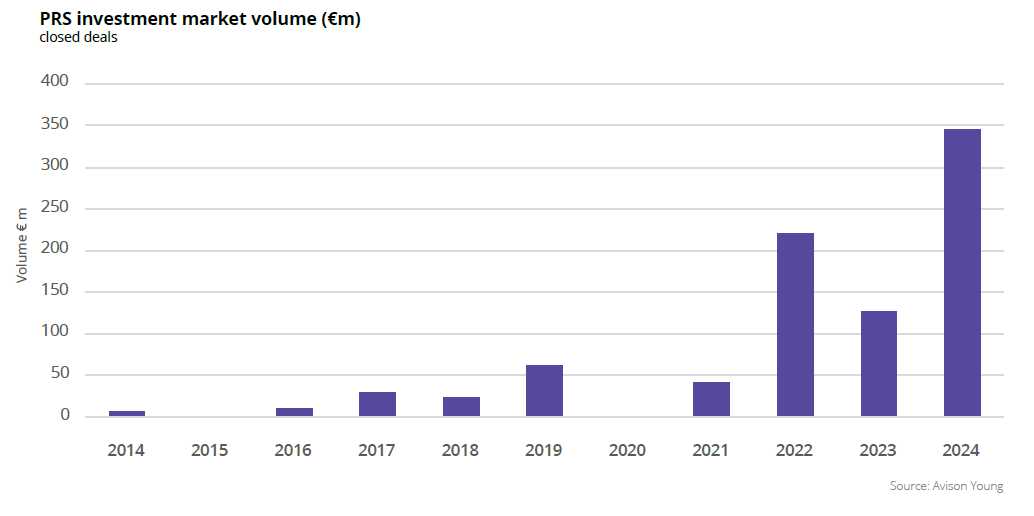

In 2024, Poland recorded 12 closed PRS transactions, with a total investment volume of EUR 344 million, marking a record year for the sector. Most acquisitions were made by established investors, with Lew Invest being the only new entrant, acquiring the Urban Home project from G City in Kraków. Sweden-based investors accounted for half of the total PRS investment volume, while Warsaw remained the most active market, with nine transactions completed. Notably, Avison Young brokered a portfolio sale of City Living apartments in Warsaw, Poznań, and Bydgoszcz.

Over the past decade, PRS transactions in Poland have totaled more than EUR 860 million. The secondary market for operational assets emerged in 2022, following Catella’s withdrawal from Poland, leading to a sharp increase in investment activity.

Master Plans and Development Trends

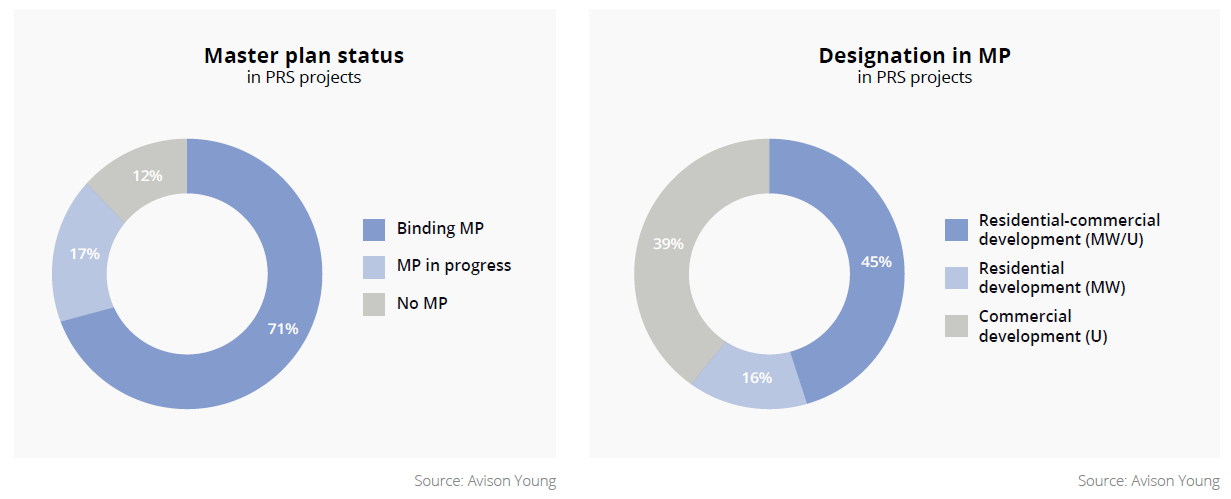

As available residential land in major cities becomes scarce, investors are increasingly developing PRS projects on commercially zoned plots. By the end of 2024, Poland had 140 PRS investments, 80% of which were completed and 20% under construction. Nearly 75% of these projects are located in areas covered by local master plans (MP).

Most PRS developments are situated in areas designated for mixed-use (MW/U) rather than exclusively residential use (MW), which accounts for less than 20% of projects. Around 40% of PRS investments are in areas zoned for commercial development (U), reflecting a shift toward utilizing commercial land for residential projects.

Regional variations exist in PRS development trends. In Wrocław and Poznań, around 20% of PRS projects are built on residential-designated plots, while in Tricity, 45% of developments are located on commercially zoned land. In Warsaw, Łódź, and Kraków, approximately 25% of PRS projects are in areas where local master plans are still in progress. In Poznań, 35% of PRS projects are in locations without master plans, reflecting the lack of zoning regulations in central parts of the city.

Due to high land costs, commercial plots have become an attractive alternative for PRS investors, as they are often cheaper than residentially zoned land and do not require competing with traditional residential developers. However, developing PRS on commercial land involves VAT on rental income, impacting initial yields.

As the PRS sector in Poland continues to mature, institutional investors are adapting to regulatory and market conditions, ensuring steady growth in supply and investment.

Source: Avison Young