Poland’s property investment market maintains positive momentum in early 2025

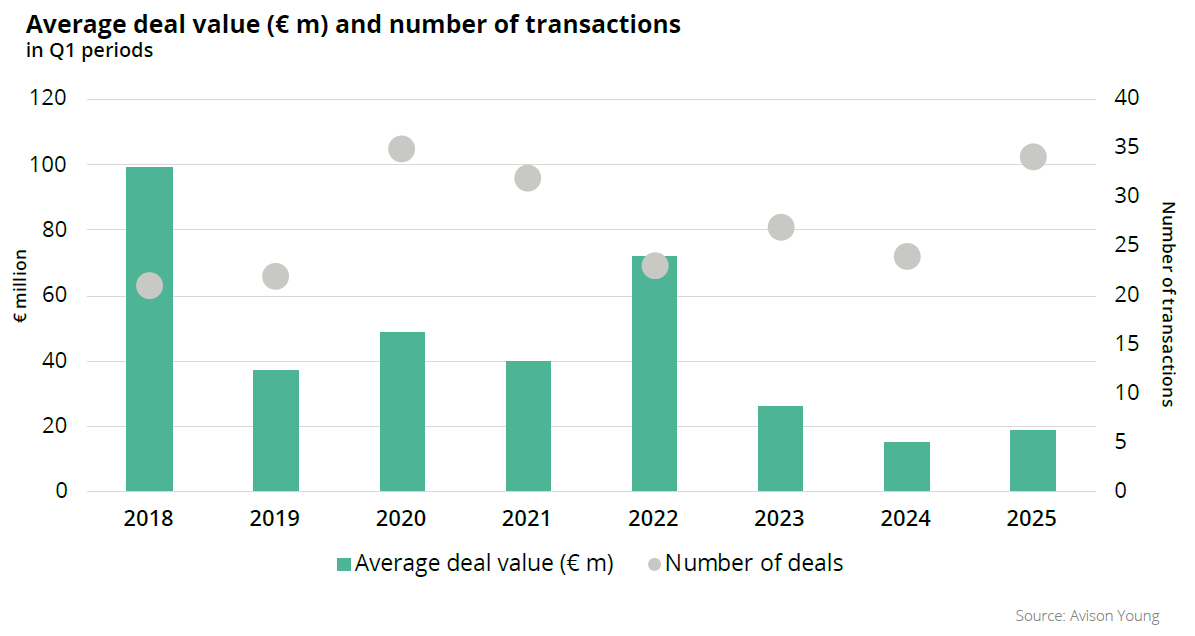

Poland’s property investment market started 2025 on stable footing, continuing the upward trend that began last year. According to the latest market report by Avison Young, total investment transaction volume in the first quarter of 2025 reached €686 million, a 64% increase compared to the same period in 2024. This marks a sustained recovery, following a doubling of total transactions in 2024 over the previous year, reflecting improving investor sentiment across real estate sectors.

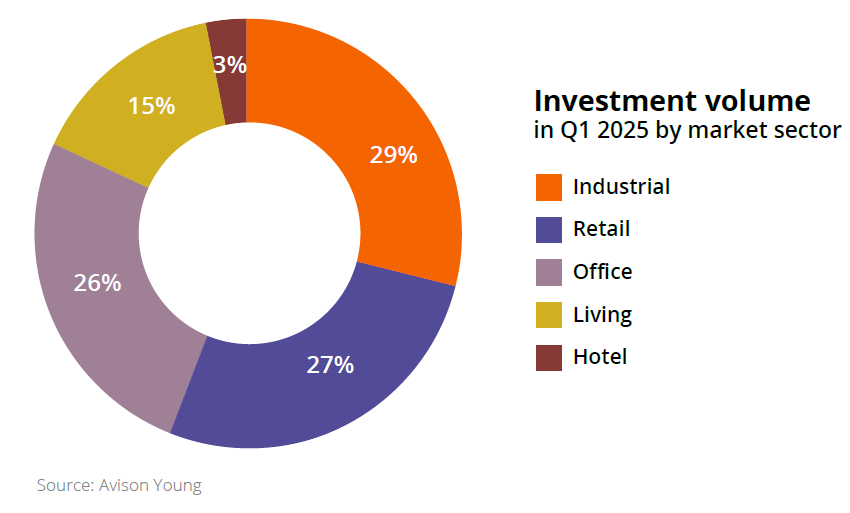

The first quarter’s transaction structure was shaped by strong activity in the retail sector—particularly retail parks—and non-core office assets. Although deal sizes remained moderate, with just four transactions valued between €50 million and €75 million, the pace of activity points to ongoing investor confidence. Domestic investors contributed 17% of the total disclosed investment volume, demonstrating the growing role of Polish capital in the market.

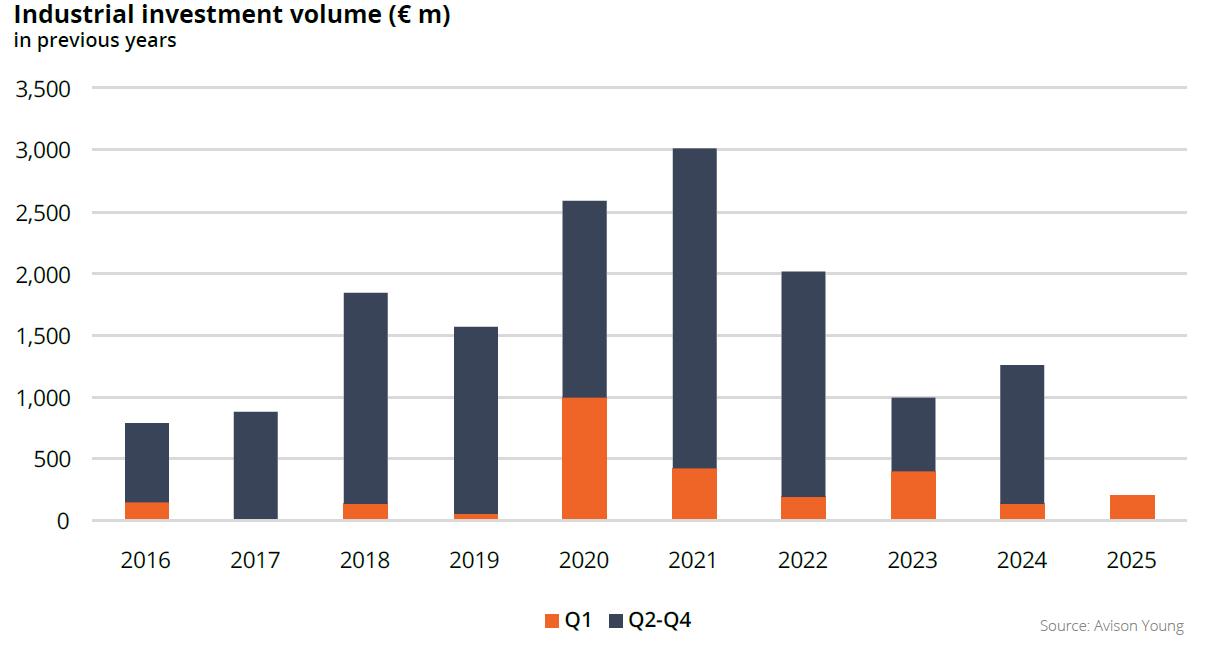

Industrial real estate continued to perform strongly, representing 29% of total investment volume. The sector recorded five transactions worth €202 million, including deals for large-scale logistics assets in Warsaw and the Tricity region, as well as a modern cold storage facility in Warsaw’s core zone. A notable milestone was the sale of GLP’s Polish portfolio to Ares Management, part of a broader international M&A deal, underscoring sustained institutional interest in logistics and warehousing.

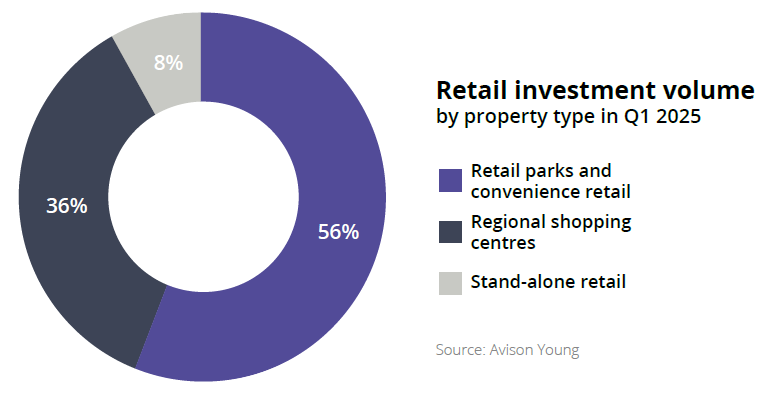

The retail market saw 14 transactions in the first quarter, amounting to €189 million in total investment volume. Retail parks dominated investor attention, accounting for 56% of the sector’s activity. Key transactions included BIG Shopping Centres’ acquisition of Power Park Olsztyn, Newgate Investment’s purchase of Comfy Park Bielik in Bielsko-Biała, and a retail park portfolio acquired by Terg. Convenience-oriented shopping centres outside major cities accounted for more than a third of retail investment volume, with Focus Estate Fund’s purchase of three Plaza Centres in Silesia being the largest transaction in this segment.

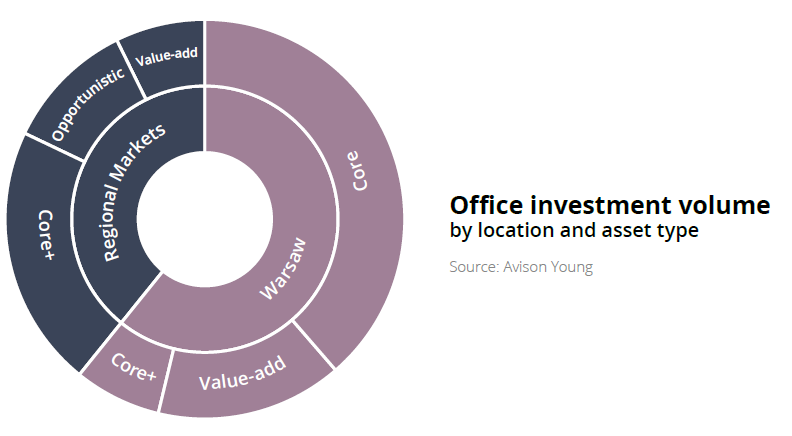

Office investments totalled €176 million in the first quarter, with activity driven largely by value-add and opportunistic strategies. While eight out of twelve transactions took place in regional cities, these accounted for slightly over 40% of total volume. The largest office deal was Uniqa Real Estate’s acquisition of Wronia 31 in Warsaw—the quarter’s sole core transaction. Investors focused on repositioning opportunities, with core capital remaining cautious in light of ongoing geopolitical and economic uncertainties.

In the living sector, three deals were finalised in the first quarter, amounting to more than €100 million. The largest was AFI Europe’s forward funding of PRS Metro Szwedzka. Other notable transactions included NREP’s acquisition of co-living project Nad Stawem and Xior Student Housing’s purchase of a PRS asset from Syrena Real Estate. The sector also attracted new entrants such as Polski Holding Nieruchomości, which announced plans to repurpose vacant properties into PRS units, aiming to deliver 800 units by 2030.

A growing trend involves investors targeting older office buildings for conversion into residential or student housing. Avison Young reports increased demand for technical due diligence on such assets, noting that conversions are technically feasible under current regulations and, in many cases, more straightforward than converting residential properties into office use.

Looking ahead, Poland’s property market is expected to remain one of Central Europe’s most attractive investment destinations, supported by solid fundamentals and investor interest in high-quality assets meeting ESG standards. A gradual narrowing of the pricing gap between buyers and sellers is anticipated, helped by projected interest rate cuts. Meanwhile, environmental and sustainability considerations are becoming more prominent, with both investors and lenders placing greater emphasis on net-zero and green financing requirements.

Despite selective investor behaviour, Poland’s market outlook for 2025 remains optimistic, as opportunities emerge across industrial, retail, office, and residential segments, attracting both domestic and international capital.

Source: Avison Young