Poland’s retail parks see record high growth in new projects

The retail park market in Poland is experiencing unprecedented growth, with new projects reaching record highs, according to a recent report titled Retail Parks and Convenience Developments, prepared by Avison Young in collaboration with the Polish Council of Shopping Centres (PRCH). Contributions from legal and financial experts at Squire Patton Boggs and the Polish Sustainable Development Forum (POLSIF) also highlight the expansion.

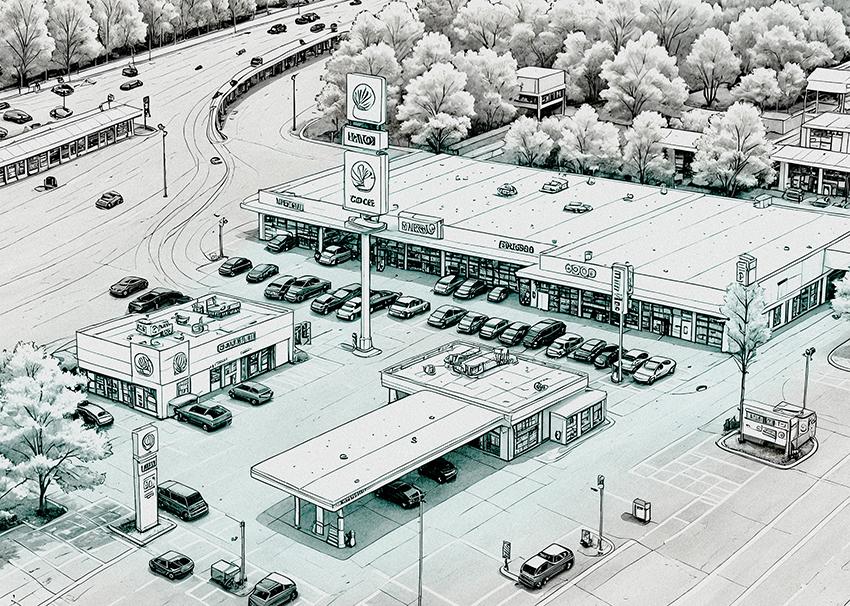

Retail parks in Poland trace their origins back to the political changes of the 1990s, with the first developments appearing at the end of that decade. These early retail parks were strategically located on the outskirts of major cities, forming the foundations of Poland’s modern retail landscape. By 2019, the sector had grown to encompass 1.5 million square meters of gross leasable area (GLA) in parks over 5,000 sq m.

The COVID-19 pandemic marked a turning point for retail parks, as their design—featuring units with direct parking access and no shared common spaces—allowed them to remain operational under strict health measures. This shift in consumer preferences and investor perceptions catalyzed rapid sector growth, with supply increasing by 1.1 million sq m between 2020 and 2023, and an additional 180,000 sq m completed in the first half of 2024. Another 300,000 sq m is expected by the end of 2024, with a record 500,000 sq m projected for completion in 2025.

Since 2020, the development of retail parks has accelerated, with over 70% of new projects falling between 5,000 and 10,000 sq m. Investors have primarily focused on smaller towns with populations under 50,000, where modern retail offerings remain scarce. Out of more than 100 new parks, 68 have been developed in these smaller municipalities. Larger parks, ranging from 10,000 to 20,000 sq m, accounted for 32% of new supply, while 15% of the space was contributed by eight projects ranging from 20,000 to 40,000 sq m.

Currently, there are 260 large retail parks in Poland, collectively offering 2.9 million sq m of GLA. This format now represents 18% of modern retail space in Poland, up from 9% in 2010. Over 80% of ongoing construction in the retail sector is dedicated to retail parks, underscoring their growing importance.

In 2024, larger retail parks are gaining momentum, with 35 parks above 5,000 sq m under development, 13 of which exceed 10,000 sq m. The largest project under construction is PH Osada in Żyrardów, covering 33,000 sq m. These larger parks now account for 57% of the retail space under construction, reflecting a trend toward building larger, more comprehensive retail destinations.

Retail parks have emerged as an appealing alternative to traditional shopping centres, offering tenants lower operating costs and access to previously untapped markets. The sector has attracted a wide range of tenants, from budget fashion brands to service providers like gyms, playgrounds, and childcare facilities, further diversifying the tenant mix.

Smaller retail parks and convenience centres, ranging from 2,000 to 5,000 sq m, are also expanding rapidly. With 1.1 million sq m of GLA in Poland, these formats are becoming increasingly popular, particularly in towns with populations between 10,000 and 50,000. The convenience model is gaining traction in larger cities as well, aligning with the “15-minute city” concept, which prioritizes access to basic services within a short distance.

Investor interest in retail parks and convenience centres remains high, with many viewing them as stable, long-term investments with attractive WAULT (Weighted Average Unexpired Lease Term) periods. The dynamic growth in both large and small retail parks reflects their strong performance and increasing role in Poland’s modern retail landscape.

Photo: Paulina Brzeszkiewicz-Kuczyńska, Research and Data Manager at Avison Young