Poland's trade trends in Q1 2025 reflect ongoing stagnation

Poland’s foreign trade in the first quarter of 2025 continued to mirror patterns established over the past two years, marked by limited growth in exports and rising imports. The overall picture points to sustained stagnation in trade activity, with key dynamics driven by subdued external demand—particularly from the European Union.

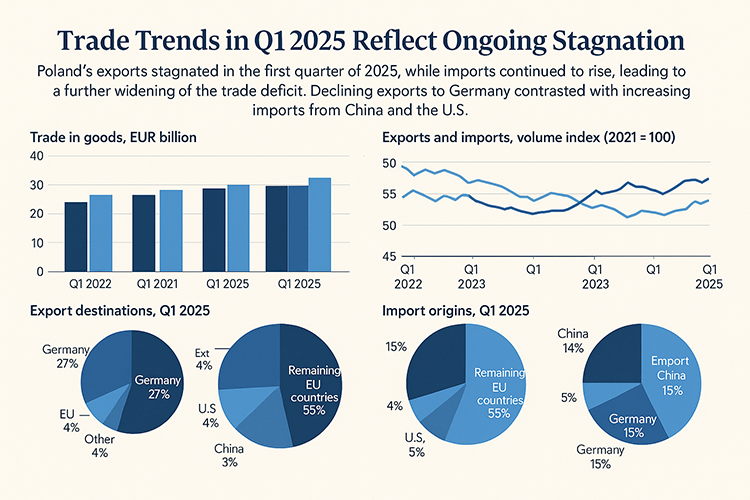

One of the most significant influences remains the ongoing economic slowdown in Germany, which continues to weigh on Polish exports. Since 2022, Germany’s share in Polish exports has declined by two percentage points, although the absolute export value has held steady. Meanwhile, the impact of recent U.S. tariffs is not yet evident in official trade figures, though an uptick in exports to the U.S. may suggest anticipatory shipping ahead of new trade barriers. Imports from China have maintained a steady upward trajectory.

According to data from the Central Statistical Office, Polish exports reached €88 billion in Q1 2025, nearly identical to the same period in 2024 in euro terms. However, imports rose by 6% year-on-year. The result was a continuing trade deficit, which has now persisted for five consecutive months. In zloty terms, exports fell by 3% while imports rose by 3%, reflecting the recent appreciation of the Polish currency.

Trade volume data for January shows modest signs of recovery. Export volume grew by 2.4%, although fluctuations in recent months indicate ongoing volatility. Trade with EU member states remains weak, reflecting broader sluggish growth across the region. Conversely, trade with non-EU countries has proven comparatively resilient, with import and export volumes more stable. One notable trend is the year-on-year decline in imports from non-EU countries since early 2023, influenced by a high baseline comparison from the 2022 period, which was marked by geopolitical disruption.

Poland’s export structure continues to be dominated by vehicle parts, although this category saw a 6% decline in value compared to Q1 2024. In contrast, exports of computer equipment and food products such as chocolate and poultry registered strong year-on-year growth. The steepest declines were observed in exports of trucks, passenger cars, monitors, and tobacco products. Battery exports, which fell sharply in 2024, continued to decline by a further 8% in the first quarter of this year.

Germany remains Poland’s top export destination, but its share has dropped from 29% in early 2023 to 27% in early 2025, underscoring the persistent effects of Germany’s economic stagnation. Meanwhile, imports from China are rising sharply, with the country now accounting for 14% of total Polish imports. Chinese goods worth over €13 billion entered Poland in Q1 2025, a 19% increase over the same period in 2024. These imports are heavily concentrated in advanced technologies and automotive components, although smartphone imports have declined. Growth is seen in categories such as TV parts, computer hardware, automotive systems, and data storage devices.

Trade with the United States has also grown. Polish exports to the U.S. rose by 12% year-on-year in Q1 2025, with a record €1.14 billion recorded in March. This increase may reflect frontloading ahead of expected tariff changes. Imports from the U.S. rose even more sharply, up 20.5% year-on-year, peaking at €1.81 billion in January.

Exports to Germany, in contrast, dropped by 2.2% year-on-year in the first quarter, a direct outcome of the continued economic stagnation in Germany. Imports from Germany remained largely unchanged during the same period.

Overall, the trade data for Q1 2025 underscores a continuation of recent trends: weak demand from key EU markets, a growing reliance on Chinese imports, modest export gains to the U.S., and a widening trade deficit.

Source: PIE