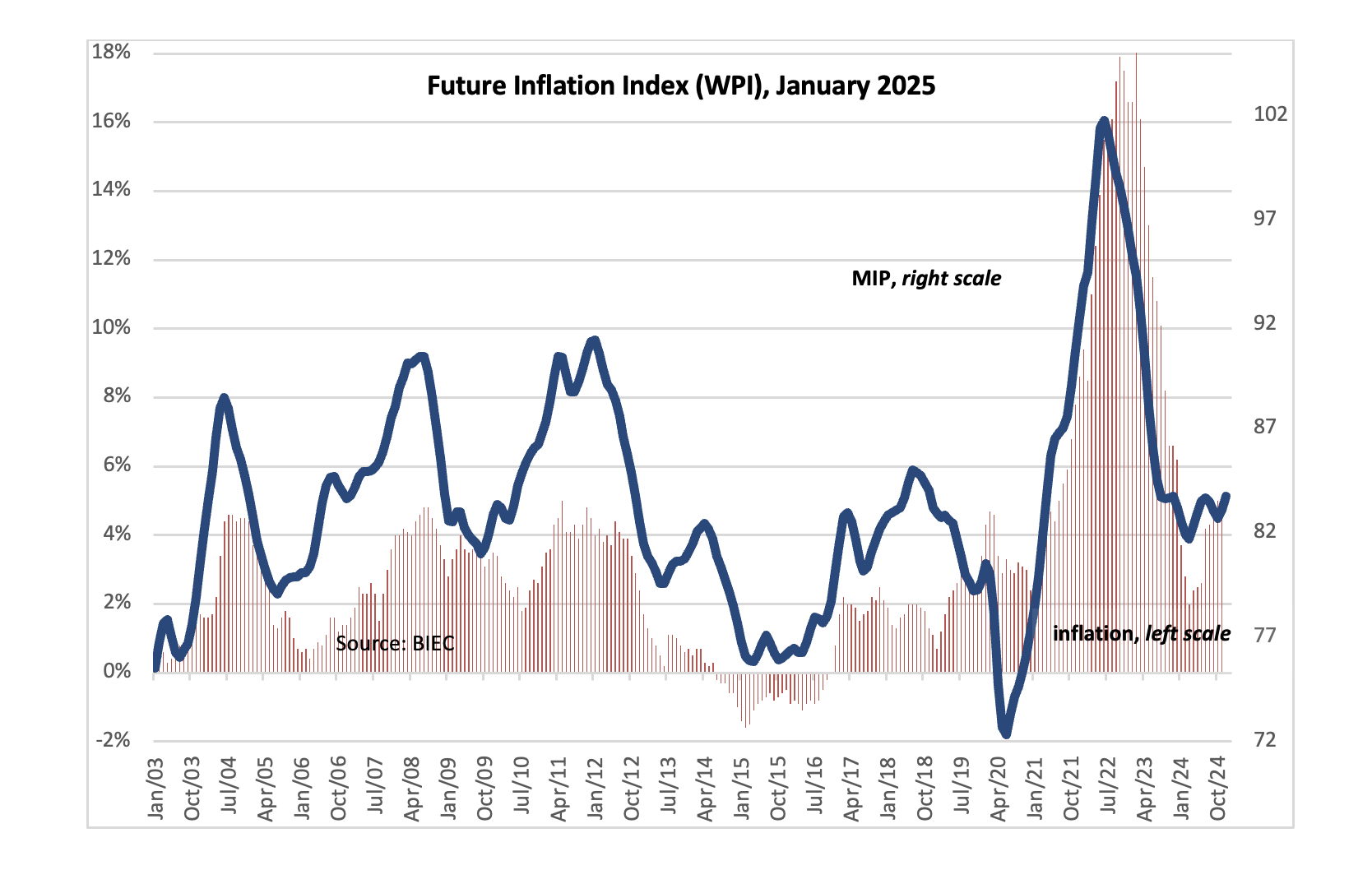

Polish future inflation index signals persistent pro-inflationary pressures

The Future Inflation Index (WPI), which predicts price trends for consumer goods and services several months in advance, rose by 0.7 points in January 2025 compared to the previous month. This marks the second consecutive monthly increase, suggesting that pro-inflationary pressures remain strong. While inflation may dip below 5% periodically, a sustained decline to align with the NBP’s inflation target is unlikely this year.

Manufacturing companies are increasingly indicating plans to raise prices, particularly in sectors producing durable and non-durable consumer goods. Industries such as food, clothing, household appliances, and electronics are leading this trend, with a net balance of around 16 percentage points more firms planning price hikes than reductions. In the vehicle manufacturing sector (excluding cars), this net balance rises to approximately 23 percentage points.

Consumer inflation expectations have remained consistent, with 84% of respondents in December anticipating price increases. However, there has been a shift in the structure of these responses: more consumers now expect prices to rise at the current pace, while fewer predict slower-than-expected increases.

Producers’ expectations, however, carry greater weight in forecasting inflation trends. Unlike consumers, who base their expectations on recent price movements, producers reflect their operational plans, which depend on market demand and their competitive position. These plans are likely to materialize if conditions allow.

Global raw material prices have shown stability in recent months, with the IMF’s commodity price index remaining relatively steady over the past quarter. However, oil prices have been rising in recent weeks due to seasonal factors, a colder-than-usual winter in the U.S. and Europe, and geopolitical disruptions affecting supply. Meanwhile, food prices have declined since November, when the FAO Food Price Index hit a recent peak.

These dynamics underline a complex inflationary landscape, where stabilizing factors such as raw material prices are offset by persistent pressures from manufacturing sectors and rising energy costs.

Source: BIEC