Polish retailers face rising debts amid changing consumer trends

Retail remains a key sector in the Polish economy, directly influencing GDP and financial stability. However, recent data from the BIG InfoMonitor and BIK Debtors Register indicate that the industry is facing financial difficulties. In January 2025, total arrears in the retail and wholesale trade sector exceeded PLN 9 billion, reflecting growing financial strain. With World Consumer Day on March 15, it is important to assess the reasons behind this situation and the impact of evolving consumer behavior on the sector.

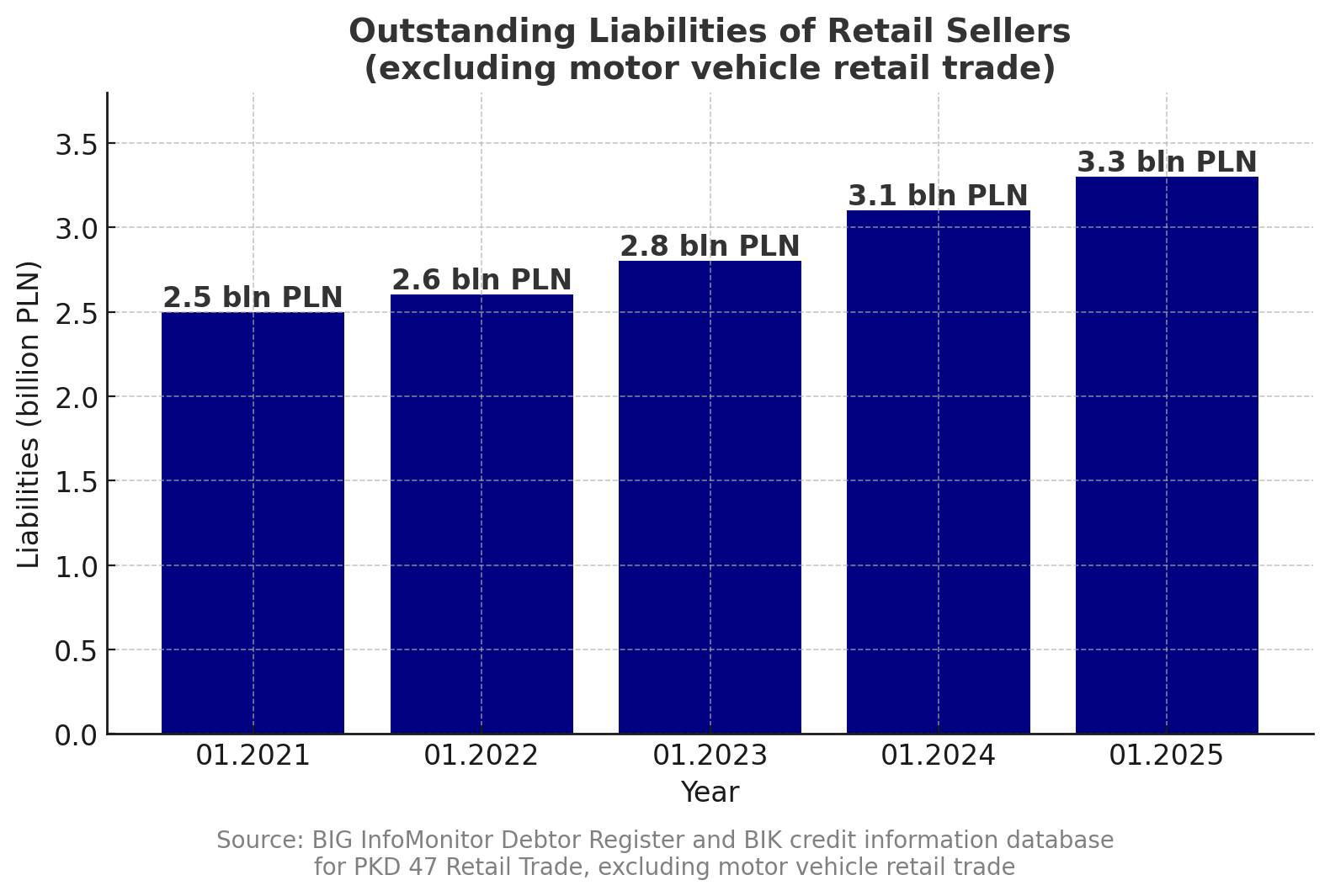

The longstanding trend of accumulating material goods, which has supported economic growth in Poland for years, appears to be shifting. Generation Z is emerging as a key consumer group, prioritizing experiences over possessions. This demographic is less attached to physical goods, showing a preference for sustainable consumption and second-hand products. As a result, spending has shifted from material goods to experiences, influencing the retail sector. According to BIG InfoMonitor, retailer arrears increased by PLN 207.4 million (6.6%) over the past year, reaching PLN 3.33 billion by the end of January 2025. Over the past five years, overdue debt in the retail sector has grown by more than 25%.

The rising debt burden reflects the growing financial challenges for retail businesses. Data from BIG InfoMonitor and BIK indicate that the proportion of unreliable debtors among retail companies is just under 4%, meaning that more than 36,000 businesses are struggling to meet their payment obligations. The average outstanding debt per company exceeds PLN 92,000. In the first half of 2024 alone, 697 commercial companies, including 340 retailers, declared insolvency—an increase of 26% year-on-year. Several factors contribute to this trend, including rising operational costs, the expansion of e-commerce, and changing consumer behavior. To remain competitive, businesses must adapt their value propositions and customer engagement strategies. One emerging model is direct-to-consumer (D2C) e-commerce, which allows brands to sell directly to customers without intermediaries, according to Waldemar Rogowski, PhD, chief analyst at BIG InfoMonitor.

Impact on Other Sectors

The downturn in retail has affected other industries, particularly interior design and consumer electronics. Data from BIG InfoMonitor and BIK show that arrears among household appliance retailers surged by 177.3% year-on-year, exceeding PLN 120 million by the end of January 2025. Meanwhile, debt among furniture, lighting, and household goods retailers rose by 82.7% to PLN 149 million. These figures suggest that consumers have been limiting their spending on durable goods due to economic uncertainty, rising loan repayments, and the high cost of living.

Despite the overall increase in arrears, the share of companies facing payment difficulties has remained relatively stable. For example, in the audio and video equipment sector, the proportion of businesses with overdue payments increased only slightly, from 4.8% to 4.9%. According to Paweł Szarkowski, president of BIG InfoMonitor, this suggests that financial distress is primarily affecting companies that were already struggling with debt. A significant challenge remains for small and medium-sized enterprises (SMEs) in the retail sector, as 86% report receiving late payments for invoices, which affects their cash flow. Surveys also indicate that retailers’ main concerns include declining sales (21%), high business costs (20%), and finding new markets (17%), all of which could further impact liquidity.

Wholesale Sector Also Under Pressure

Retailers’ financial difficulties are also affecting the wholesale trade sector. Data from BIG InfoMonitor show that arrears in wholesale increased by nearly PLN 259 million (6.2%), reaching over PLN 4.4 billion by the end of January 2025. More than 24,500 wholesalers are struggling to pay outstanding invoices, loans, and supplier bills, with the number of businesses in arrears rising by 1,404 over the past year. The proportion of wholesalers with payment difficulties now stands at 7%.

According to Paweł Szarkowski, verifying the financial stability of business partners before entering into agreements is crucial to mitigating financial risk. He advises businesses to use resources such as the BIG InfoMonitor Debtor Register and BIK database to assess potential risks and avoid liquidity issues.

Outlook for 2025

The challenges facing the retail sector are linked to broader economic factors. Polish consumers have been cautious in recent years, influenced by concerns over inflation, the lingering impact of the COVID-19 pandemic, and geopolitical instability, particularly the war in Ukraine. These factors have encouraged saving over spending. In 2024, sales revenues in the trade and repair sector remained largely unchanged compared to the previous year, while net profits fell by 40%, largely due to rising costs, particularly wages.

However, the outlook for 2025 is more optimistic. Consumer demand is expected to play a larger role in supporting the retail sector. A decline in inflation and potential stabilization in Ukraine could boost consumer confidence, leading to increased spending. If interest rates are reduced in 2025, retail and wholesale businesses may benefit from improved sales conditions.

Recent data from the Central Statistical Office support this outlook, showing that retail sales at constant prices in January 2025 were 4.8% higher than a year ago. This continues a positive trend, following a 3.0% increase in January 2024 and a marginal 0.1% rise in January 2023. Notably, sales in the “furniture, electronics, and household appliances” category rose by more than 13%, suggesting a potential recovery in durable goods purchases.

While Polish consumers may become more confident in their spending, the future of the retail sector will depend on how businesses adapt to changing consumer habits. Companies that can effectively respond to these shifts—by adjusting their product offerings, sales channels, and payment options—stand a better chance of maintaining competitiveness and long-term viability in the evolving market, concludes Waldemar Rogowski.