Prague hotel market nears pre-pandemic levels amid steady recovery

The hotel sector in Prague and across Central and Eastern Europe is recovering faster than initially projected, according to the latest analysis from CBRE. International overnight stays in Prague have reached 95% of 2019 figures, and hotel investment in the CEE region has risen by 12% year-on-year.

CBRE reports that tourism growth is supported by renewed domestic demand, the return of foreign visitors, and shifts in travel habits, including increased off-season travel. This trend is helping balance visitor numbers throughout the year, contributing to greater market stability. Prague remains the region’s most visited city, with expectations to surpass pre-pandemic performance by the end of 2025.

The return of tourists varies by origin, with visitors from Western Europe, the United States, and the Persian Gulf returning in strong numbers. Travellers from Germany, Austria, Italy, the UK, and France have largely recovered, while American tourists have increased by 18% compared to 2019. However, arrivals from Northeast Asia and the broader Asia-Pacific region remain significantly below pre-pandemic levels.

Hotel performance indicators across CEE capitals show growth, with average occupancy rates rising by six percentage points last year, now ranging between 76% in Warsaw and 82% in Prague. The average daily rate has increased by 25% compared to 2019, while revenue per available room has risen by 12%.

In terms of hotel categories, the region now offers more than 450,000 rooms, with four-star hotels representing up to half of the supply, and five-star properties accounting for around 10 to 15%, mainly in capital cities and resort areas. While standard rooms remain dominant, there is rising demand for suites, family rooms, and long-stay units. Investment is also shifting towards sustainable construction, renovations of historic buildings, and projects combining hospitality with other functions like retail and co-working spaces.

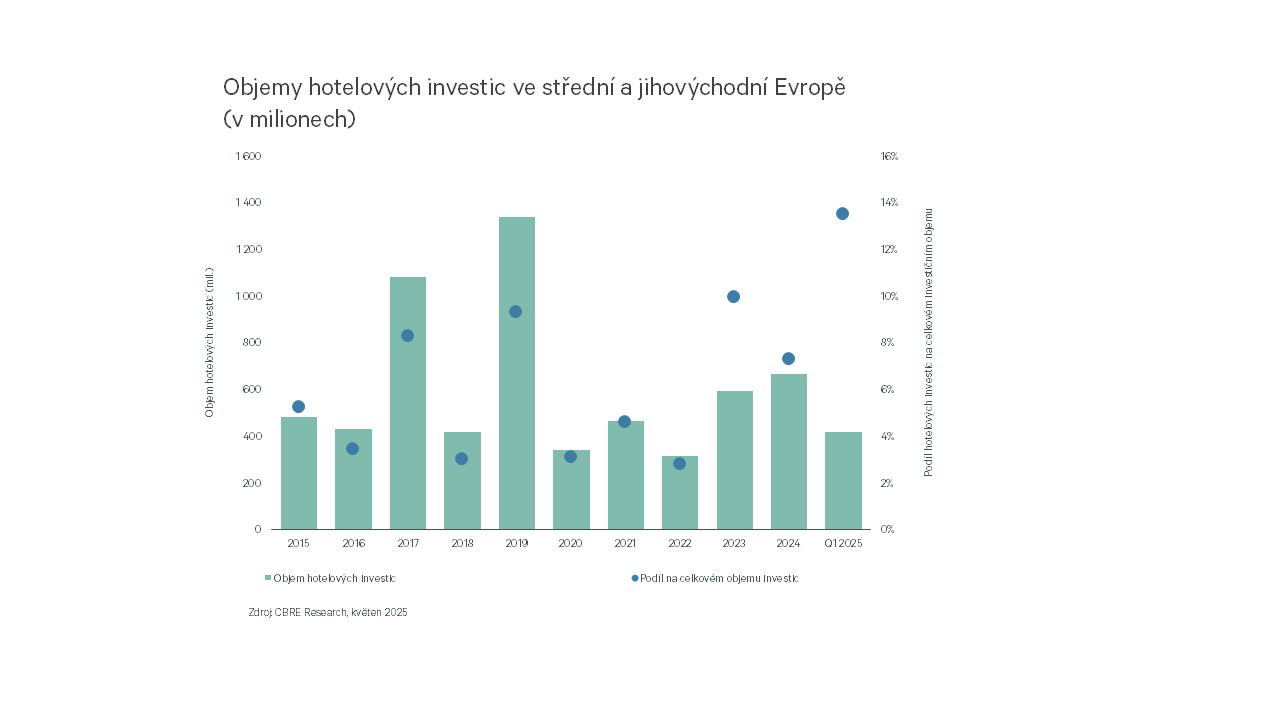

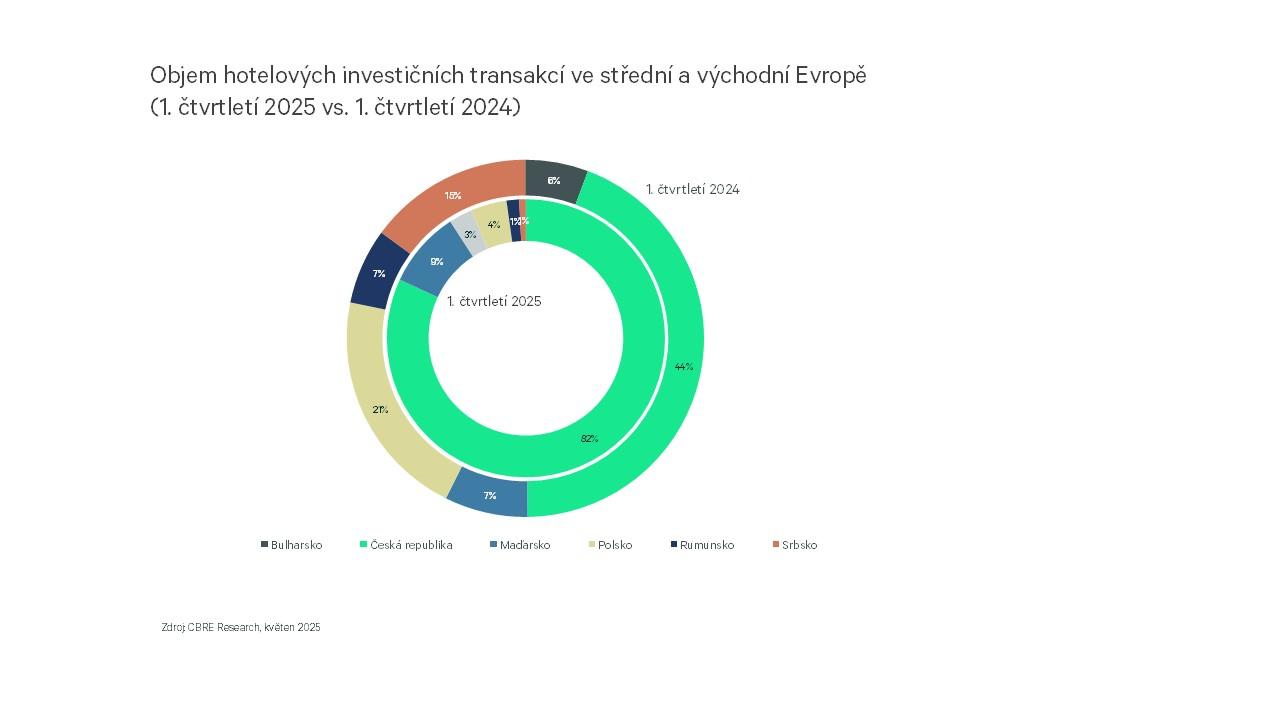

Investment activity in the hotel sector has been increasing since 2023. In the first quarter of 2025 alone, hotel transactions in the CEE region reached EUR 417 million, already representing 63% of last year’s total volume. The Czech Republic led the region in hotel investment, followed by Poland and Hungary. The sale of the Hilton Prague Hotel was highlighted as the largest transaction in the region so far.

Despite challenges such as inflation, labor shortages, and geopolitical risks, CBRE remains optimistic about the hotel sector’s outlook in Prague and the wider CEE and SEE regions, citing continued investments in digitalization, sustainability, and expanding tourism services.