Prague office market experienced the highest-ever leasing activity in 2022

A 44% higher demand for offices in Prague was recorded year-on-year in Q4 2022. Renegotiations accounted for 58%, the remaining transactions included new leases, expansions, and subleases. By 2025, an additional 400,000 sqm of new office space, currently in different stages of preparation, is due to come online in Prague.

A resurgence is also evident in the flexible office market. Due to increasing demand in Prague, eight (8) new centres offering flexible office spaces (coworking centres or serviced offices) opened last year.

The renegotiations of O2 in the building Gamma, Brumlovka (29,000 sqm) in Prague 4 and Expedia in the Corso Court building (7,300 sqm) in Prague 8 represented the most significant deals concluded in Q4 2022. Generali concluded a new lease of 5,500 sqm in the Beta, Brumlovka building in Prague 4.

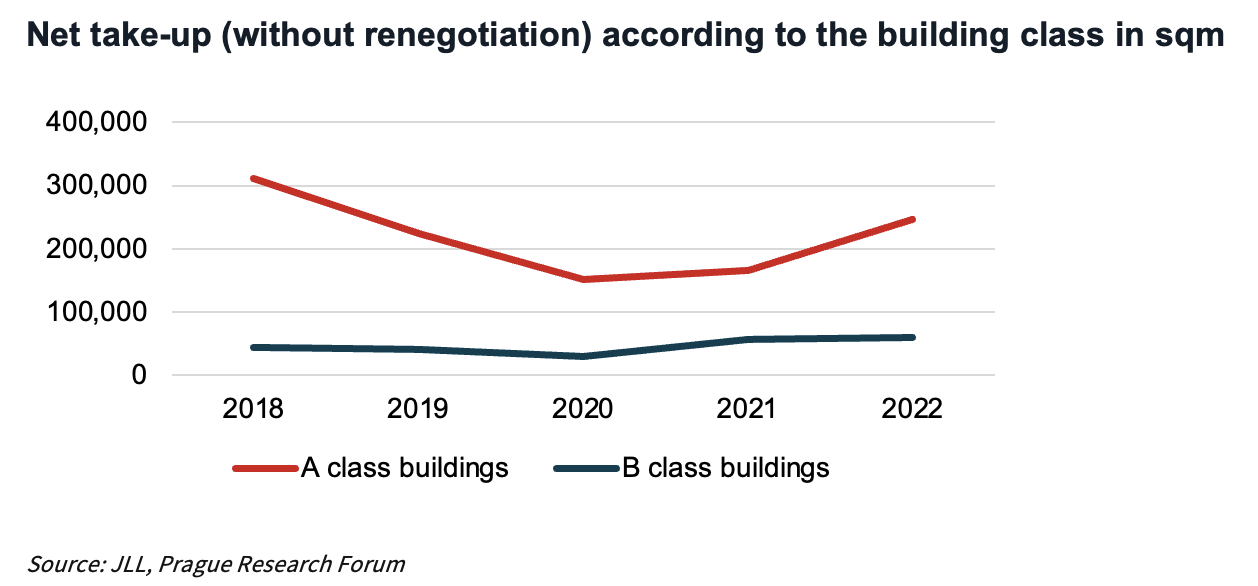

During the entire year of 2022, over 547,000 sqm of office space was leased, which was the largest volume of leased office space since the beginning of modern office market monitoring in Prague. “The increase in demand is not accidental. Last year several factors occurred at the same time in the office rental market – the end of leases which were concluded in the strong years 2017 and 2018, as well as pent-up demand resulting from the COVID-19 pandemic and the subsequent recovery. All these circumstances led to a higher net demand in 2022, particularly in the first half of the year, with more renegotiations taking hold in the second half,” comments Blanka Vačkova, Head of Research in JLL. Renegotiations of existing lease agreements accounted for the majority of the leasing demand, as evidenced by our statistics, where four of the five largest transactions in 2022 were renegotiations.

According to recent data, during the second half of the year, no new office buildings commenced construction. This trend is expected to continue, as developers are opting to delay construction or postpone projects indefinitely.

During Q4 2022, only one office building Smíchov City Na Knížecí in Prague 5 was completed, consisting of 8,300 sqm of office space. For the entire year 2022, only 75,400 square meters of office space were completed. This is the third lowest result in the last ten years.

Regarding the larger redevelopment projects across the city, construction work continues on Masaryčka, Nová Waltrovka, Port 7 and Hagibor. The expected addition of around 400,000 sqm of new offices will be further expanded by 2025 in further phases in Hagibor and Rohan in Karlín.

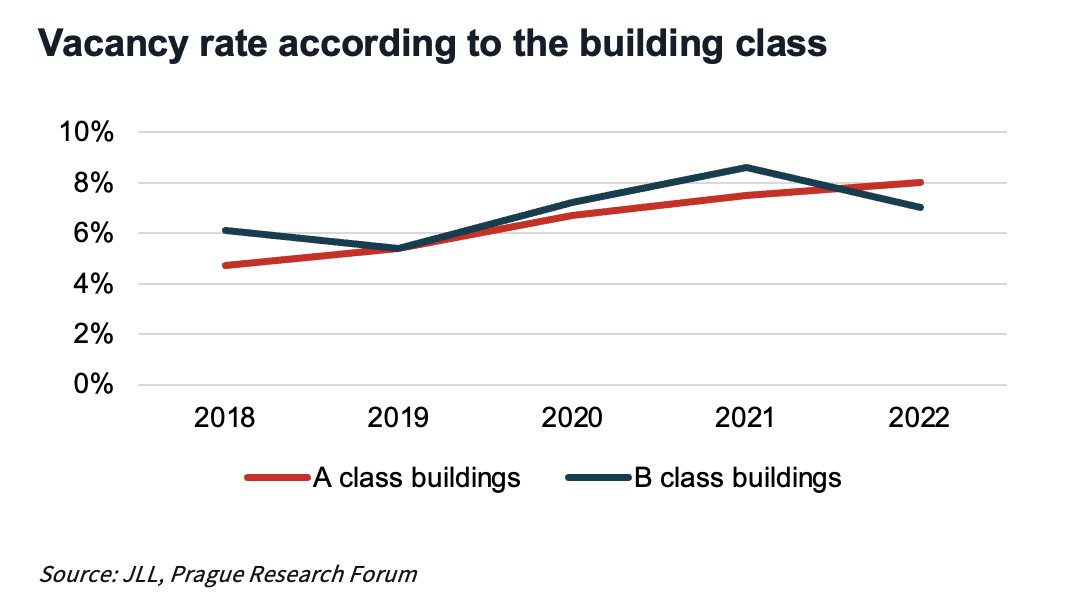

Two of the main indicators of the office space market remained without major changes in the fourth quarter – vacancy rate and rents. The vacancy rate dropped slightly to 7.7%, which is still assessed as a low vacancy rate.

Whilst historically B-Class buildings showed higher vacancy rates, the situation has reversed in the past year, and it is A-class buildings that are registering higher vacancy rates. The reason is the addition of newly completed office space, which was not fully occupied at the time of completion and is still awaiting its committed future tenants. "One of the reasons for their slower occupancy is certainly the growth in rents corresponding to higher construction costs," adds Josefína Rybářová, Tenant Representation Consultant in the Office Leasing Department at JLL Czech Republic.

Prime rents also remained stable, with rates per sq per month in the city centre ranging between €26.50 - €27.0, for the inner city €17.50 - €18.0 and for the outer city €15.0 – €16.0.

Source: JLL Czech Republic