Prague Office Market: IT in Karlín, finance in city centre, manufacturing in Vysočany

The Prague office market has evolved into twelve established business districts, each shaped by the industries they attract and the pace of their development, according to the latest Prague Office Hubs 2025 report by Savills. The analysis outlines how distinct business sectors have contributed to the character and function of each location, highlighting the impact of corporate tenancy on the urban environment.

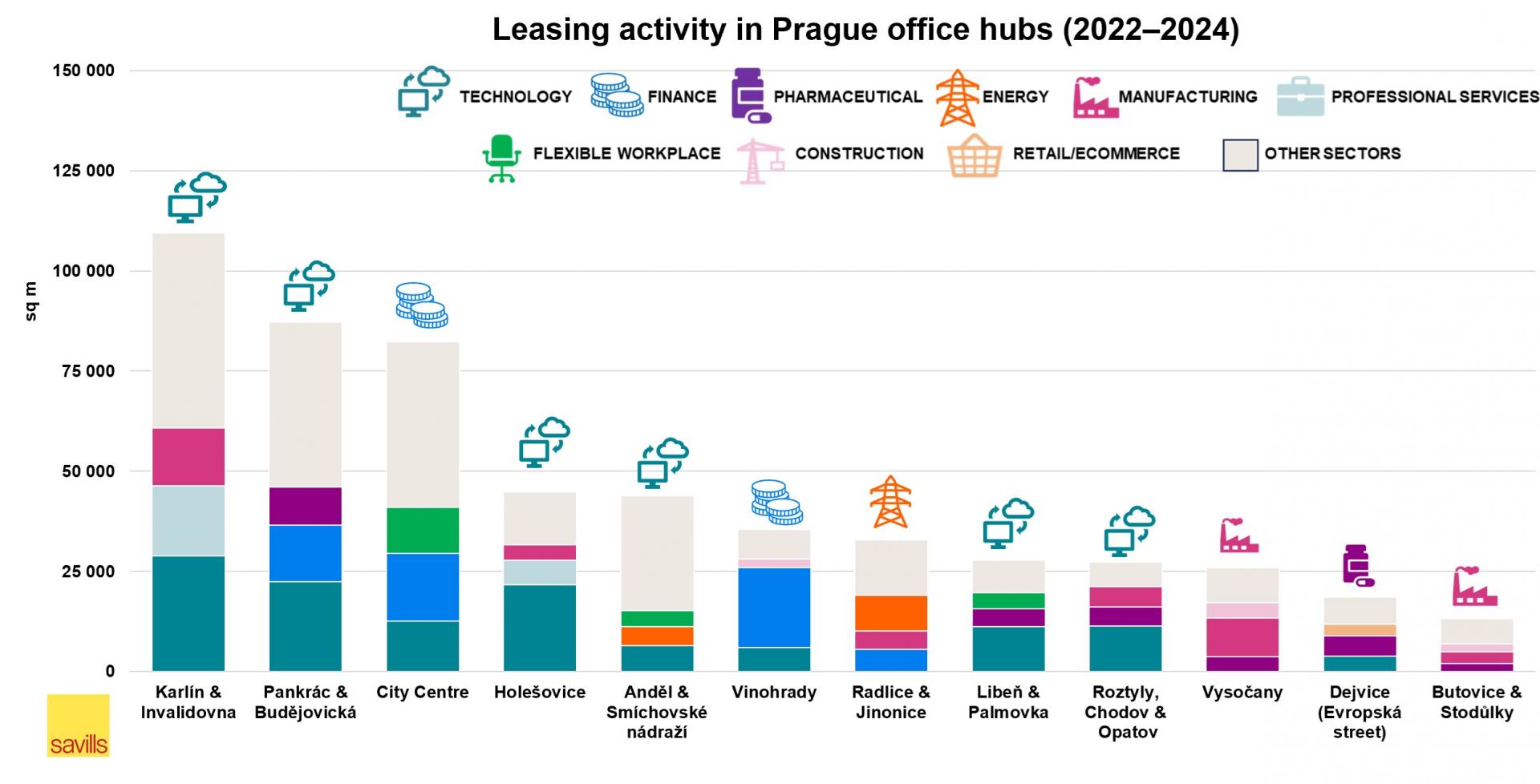

Three districts — Karlín & Invalidovna, Pankrác & Budějovická, and the City Centre — stand out for their volume of high-quality (Grade A) office space. These areas also led the city in new leasing activity between 2022 and 2024, recording the highest number of lease transactions.

From 2022 to 2024, the Technology and IT sector accounted for 23% of all net office take-up in Prague, with significant leasing activity in Karlín, Pankrác, and Holešovice. Financial companies ranked second, showing a preference for locations in the City Centre and Vinohrady. Manufacturing firms tended to lease space in districts such as Vysočany, Butovice, and Stodůlky, drawn by available floor space and logistical access.

In Radlice and Jinonice, most new leases were signed by companies in the energy and extractive sectors, while Dejvice saw a concentration of pharmaceutical and medical tenants.

Pavel Novák, Head of Office Agency at Savills, notes that location choices increasingly reflect the operational and employee needs of tenants. “Companies are no longer only looking for office space — they’re selecting environments that align with their brand and staff expectations,” he said. Factors such as district reputation, transport access, and amenities are shaping leasing decisions.

Novák also points out that the type of business in a district influences its development. “In tech-focused districts like Karlín or Holešovice, there’s been a rise in cafés and bistros catering to younger workforces. In areas with manufacturing or logistics firms, such as Vysočany or Butovice, facilities tend to prioritise parking and traditional dining options,” he added.

The report identifies Karlín & Invalidovna as the top location for new Grade A leases between 2022 and 2024, accounting for 19% of total volume, followed by Pankrác & Budějovická at 15%, and the City Centre at 14%. These areas combine strong transport links, modern buildings, and comprehensive services.

Looking ahead, new developments are likely to extend the city’s technology business zones beyond the established hubs. Areas such as Roztyly, Chodov & Opatov, Libeň & Palmovka, and Anděl & Smíchovské nádraží are emerging as potential new locations for fast-growing firms, supported by ongoing infrastructure investment and office construction.

The report concludes that Prague’s office market continues to reflect broader economic trends, with district specialisation shaping the city’s business landscape and creating diverse environments suited to a range of industries.