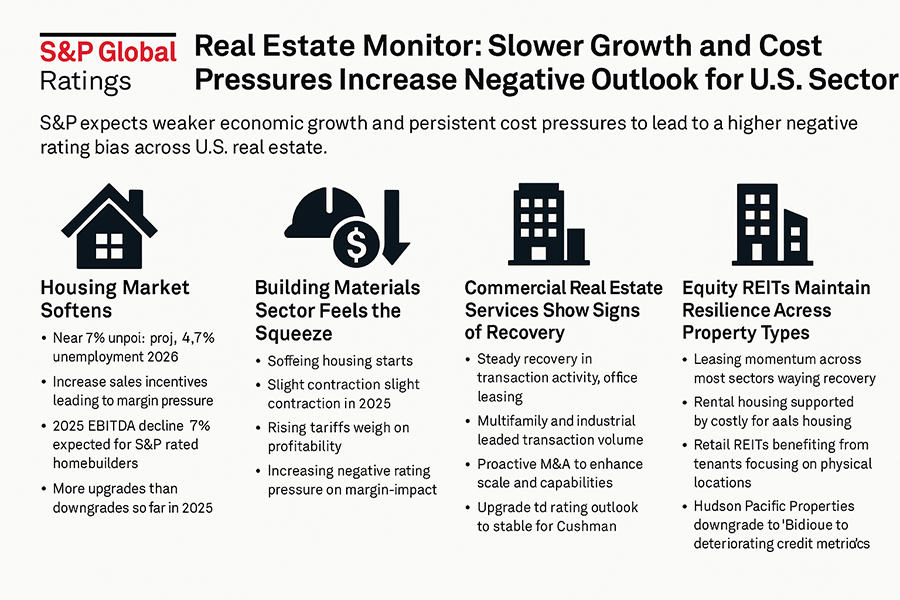

Real Estate Monitor: Slower growth and cost pressures increase negative outlook for U.S. Sector

S&P Global Ratings has warned that persistent cost pressures and weaker economic growth could result in a higher negative rating bias across the U.S. real estate sector. The agency recently lowered its baseline forecast for U.S. GDP growth to 1.5% in 2025 and 1.7% in 2026, citing elevated tariffs, policy uncertainty, and continued high interest rates that are reducing consumer demand and investor confidence.

Housing Market Softens, Margins Under Pressure

The U.S. housing market continues to cool, particularly for first-time buyers, as affordability remains strained. The 30-year mortgage rate hovers near 7%, and with unemployment projected to peak at 4.7% by mid-2026, consumer sentiment is likely to remain cautious. In markets like Florida and Texas, a growing supply of resale homes is outpacing demand, leading to increased use of sales incentives by homebuilders and putting further pressure on margins.

Builders have slowed the pace of new starts and are focusing on reducing inventory, often prioritizing sales volume over pricing. As a result, while overall revenue and deliveries may see modest year-over-year growth in 2025, S&P anticipates a 2% decline in EBITDA across its rated homebuilder portfolio due to shrinking gross margins.

Despite this, positive rating actions among homebuilders have outnumbered downgrades in 2025, with several companies—including Toll Brothers, Five Point Holdings, and Brookfield Residential—receiving upgrades. Conversely, Adams Homes and LGI Homes have seen their ratings lowered due to weaker financial results.

Building Materials Sector Feels the Squeeze

High interest rates, softening housing starts, and persistent cost pressures are also weighing on the building materials sector. S&P forecasts a modest decline in housing starts to 1.35 million units in 2025, with both residential and nonresidential construction activity expected to contract slightly.

While companies are attempting to offset tariff-related costs through price adjustments and operational efficiencies, the outlook remains cautious. The agency expects negative rating pressure to increase, especially for companies that undertook debt-financed acquisitions in 2024. Currently, 17% of issuers in this segment carry negative outlooks.

Recent rating actions reflect this trend, including a downgrade for Oscar AcquisitionCo and a negative outlook revision for BlueLinx Holdings. QXO Inc. received a ‘BB-’ rating after its acquisition of Beacon Roofing Supply.

Commercial Real Estate Services Show Signs of Recovery

CRE services companies benefited from a steady rebound in transaction activity during the first quarter of 2025, supported by improved financing conditions. Leasing activity, particularly in the office segment, has seen notable growth as companies continue to return to the office. The industrial and multifamily sectors led transaction volumes, and new mandates in property and project management contributed to stable revenue.

While S&P upgraded Cushman & Wakefield’s outlook to stable due to improved credit metrics, it maintained a negative outlook on Avison Young, reflecting ongoing liquidity concerns. Merger and acquisition activity may accelerate as companies take advantage of improved balance sheets to expand capabilities.

CRE Finance Firms Stabilize, But Caution Remains

Commercial mortgage REITs showed stable performance in early 2025, supported by a recovery in CRE markets and increased loan originations. Although high interest rates continue to impact legacy loans, loan losses were contained within the 2%–6% range across rated lenders.

S&P does not expect widespread deterioration in CRE portfolios, but warns that lenders will remain selective with new originations while focusing on asset resolution and liquidity preservation.

Equity REITs Maintain Resilience Across Property Types

Operating performance for equity REITs generally met expectations in the first quarter. Leasing activity picked up across most sectors, with the exception of West Coast office markets, which remain under pressure. East Coast and Sun Belt office markets are showing stronger signs of recovery, and net effective rents are rising despite continued incentives.

Multifamily REITs remain supported by favorable rental dynamics, as high mortgage rates continue to make renting more affordable than buying. Retail REITs are showing resilience, with tenants increasingly focused on physical store expansion. Meanwhile, industrial REITs may face some near-term softness due to tariff uncertainty and economic slowdown, but stable credit metrics are expected to hold, supported by tenant retention and rent growth potential.

Among recent rating actions, Sun Communities was upgraded to ‘BBB+’ following a divestment and debt reduction. Hudson Pacific Properties was downgraded due to continued deterioration in credit metrics and refinancing challenges. The outlooks for Invitation Homes and American Homes 4 Rent were revised to positive, reflecting the favorable prospects for the single-family rental market.

Outlook

Across the U.S. real estate landscape, high financing costs, persistent inflationary pressures, and cautious consumer sentiment are creating mixed conditions. While homebuilders and materials companies face mounting margin pressure, commercial real estate and REITs are proving more resilient. Nevertheless, S&P warns that elevated refinancing risk and weaker macroeconomic indicators could lead to a broader increase in negative rating actions throughout 2025.