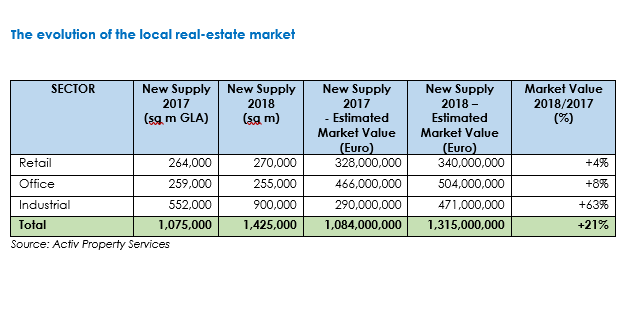

Real estate properties of over 1.3 billion euro were completed last year in Romania

„The positive evolution of the local real-estate market brought over 1,425,000 sq m GLA of new retail, office and industrial completions last year in Romania. The market value of these properties is estimated at over 1.3 billion Euro, marking a 21% annual jump.” says Cristian Negrea, Head of Valuation Department at Activ Property Services.

The main source of growth came especially from the industrial sector where completions were 63% higher than in the previous year, but there was also registered a hardening yields’ evolution in prime properties.

Approximately 38% of the total value of 1.3 billion Euro is represented by new office buildings, followed by industrial new stock that represents 36% of total value and retail deliveries (shopping centres, retail parks, big-box units) totalling 26% of total.

There were included in the analysis all the major new retail, office and industrial buildings of 3,000-5,000 sq m GLA completed in 2018 at national level, both speculative and owner-occupied.

Office Market

New offices of over 255,000 sq m GLA were delivered last year at national level, with top locations being Bucharest (150,000 sq m GLA) and Timisoara (53,000 sq m GLA). Major deliveries included Orhideea Towers, Globalworth Campus (building 2) and the first phase of Campus 6 in Bucharest, respectively new buildings as part of Coresi Brasov, Bega Business Park Timisoara, Isho Timisoara and United Business Center Riviera in Cluj-Napoca.

The total value of office deliveries is estimated at 504 million Euro, with an average rent that varies in between 11-15 Euro/sq m/month and an average yield of 7.5-8.5%.

Industrial Market

The industrial sector recorded its best ever evolution in 2018, with over 900,000 sq m GLA delivered at national level, marking a 63% annual jump. Bucharest was the most effervescent market with 360,000 sq m completed, followed by Timisoara (103,000 sq m), Pitesti (68,000 sq m) and Cluj-Napoca (61,400 sq m).

The market value of these new industrial buildings is estimated at over 471 million Euro, out of which 43% is represented by the completions in Bucharest area. New A-class buildings have average rents of 3.5-4.0 Euro/sq m/month and average yields of 8.5-9.0%.

Retail Market

Retail openings totalized 270,000 sq m GLA last year, including new shopping centres of 43,600 sq m GLA, new retail parks of 107,500 sq m GLA and big-box retail warehousing of 119,000 sq m GLA. Last year’s main change was the significant jump in retail parks development pace, the new stock being more than triple as compared with 2017.

Retail properties’ value is estimated at 340 million Euro, representing a 4% increase as compared to 2017.

Market Value of New Properties by Areas

„Bucharest remains the most active real-estate market in Romania, with over half a million (555,000 sq m GLA) of new retail, office and industrial properties being completed in 2018. The total market value of these new buildings is estimated at 592 million Euro, representing 45% of last year’s new stock value in Romania.” says Cristian Negrea.

Timisoara was the most active market outside Bucharest, with new buildings delivered having an estimated value of 149 million Euro, a 42% annual growth. Offices and industrial were the main contributors.

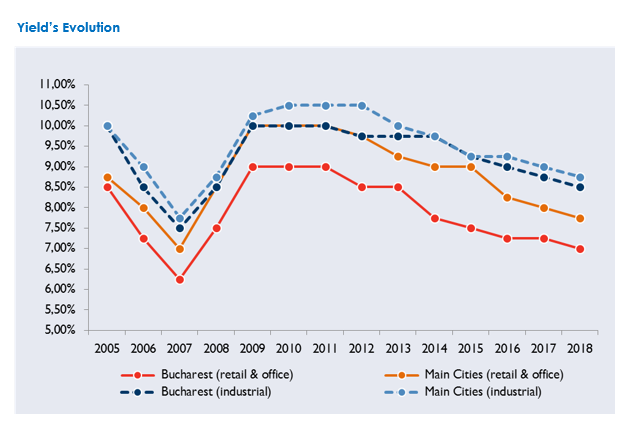

Yield’s Evolution

Yields have registered a slight hardening tendency in 2018, with positive effects on the market value of properties included in the analysis. Prime yields decreased by an average of 25 bps, reaching levels of 6.75-7.25% in Bucharest and 7.75-8.25% across the main cities for retail / office sectors. Prime industrial yields have average levels of 8.5-9.0%.