Savills Report: Five positive trends driving Warsaw’s office market in Q3 2024

According to Savills’ latest Warsaw Office Market report for Q3 2024, the Polish capital continues to thrive, marked by stable rental prices, a growing demand for flexible office space, and increasing investments in green construction. These positive trends are positioning Warsaw as a regional leader in Central and Eastern Europe, providing a solid foundation for the sector’s future growth. Here are five key insights from the report that highlight Warsaw’s potential.

1. Revival of Pre-Letting and Strong Supply Growth

The Warsaw office market has seen a significant revival in pre-letting activity. In Q3 2024, around 38,600 sq. m. of office space was pre-leased, primarily in central Warsaw locations in projects still under construction. This uptick brought the share of pre-leases to 9% of total office take-up from the start of the year to September.

“Tenants are becoming more optimistic about the business landscape and are more confident in signing pre-leases for modern office space,” said Jarosław Pilch, Director and Head of Tenant Representation at Savills Poland. New buildings are filling the gap left by delayed projects in previous quarters. However, the limited availability of prime office space is creating competition for top-class locations.

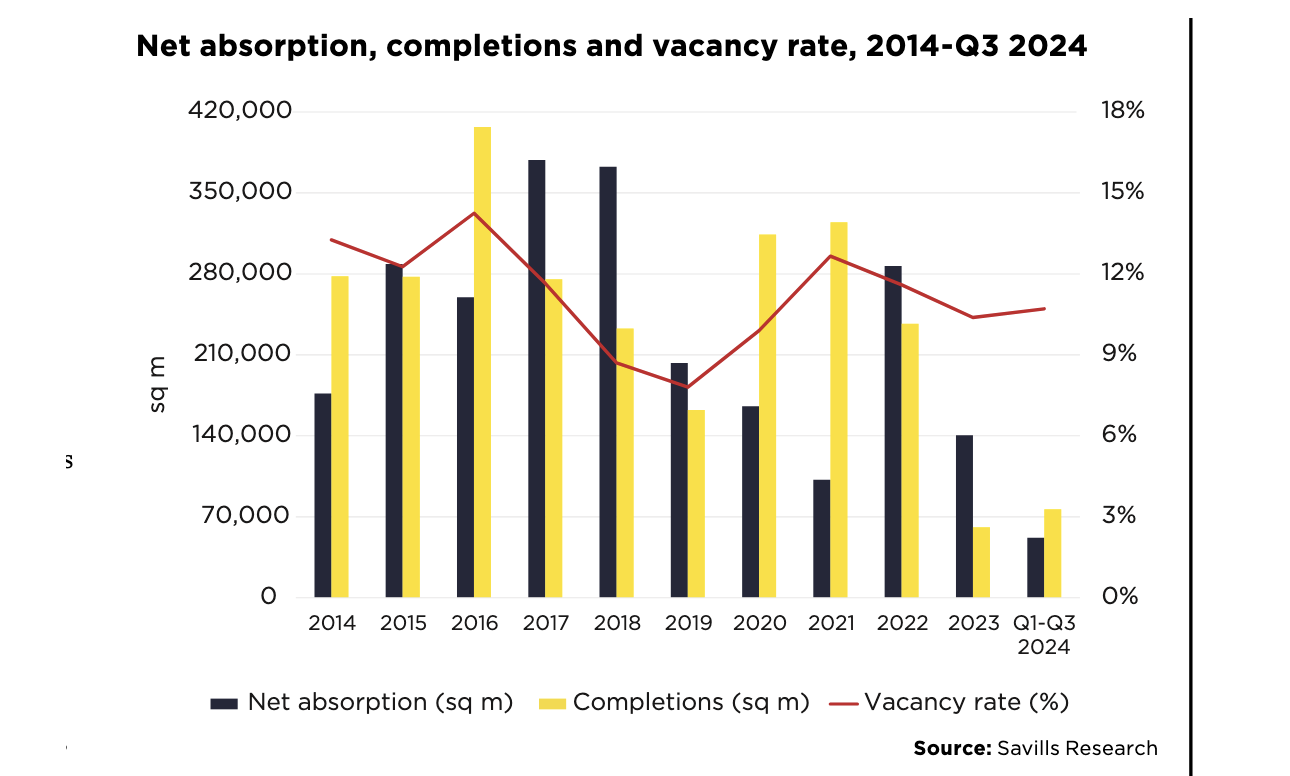

By the end of Q3, the market saw 75,000 sq. m. of new office space, surpassing 2023’s total of 61,000 sq. m. Major projects completed this year include the third phase of Lixa (26,300 sq. m.), Saski Crescent (15,500 sq. m.), and Vibe A (15,000 sq. m.), with over 70% of new supply concentrated in central Warsaw.

2. Stable Rents in Prime Locations

Rental rates in Warsaw’s key office districts have remained stable, particularly in the Central Business District (CBD), where prime office space costs between EUR 22.50-26.00 per sq. m. per month. This stability is attracting both domestic and international companies seeking high-quality office space in prestigious locations.

Despite ongoing development and new space coming onto the market, the increasing demand for larger offices in prime areas may push rents higher over the next two years. In non-central areas, however, competition is likely to keep rents steady as tenants seek more affordable alternatives.

3. Growing Demand for Flexible Office Space

Demand for flexible office solutions, including coworking spaces, has surged in 2024, with 22,400 sq. m. leased by operators this year. This trend reflects companies’ shift to hybrid working models and the need for adaptable office space.

While flexible office operators are mainly focused on central locations, building owners in other parts of the city are creating their own coworking spaces to reduce vacancies and offer tenants quick access to additional space if needed.

4. Sustainability Takes Centre Stage for Investors

Sustainability has become a key priority in Warsaw’s office market. Increasingly, new projects are incorporating environmental certifications like BREEAM and LEED, making these buildings more attractive to tenants. Owners of older office buildings are also modernizing to meet new standards, improving energy efficiency and implementing green solutions.

“As long as owners invest in modern, energy-efficient solutions, they can remain competitive in leasing their space,” said Daniel Czarnecki, Director and Head of Landlord Representation at Savills Poland.

5. Continued Demand and Stable Vacancy Rates

Despite challenges, demand for Warsaw office space remains robust. From January to September 2024, 492,200 sq. m. of office space was leased, with high demand coming from the financial, IT, business services, and manufacturing sectors. As one of the key business hubs in Central and Eastern Europe, Warsaw continues to attract tenants with its high-quality office spaces and competitive pricing.

By the end of Q3, the vacancy rate stood at 10.7%, with central areas faring better at 8.9%. Although vacancy rates increased slightly in non-central areas, developers are reactivating previously delayed projects to meet ongoing demand.

Warsaw still the leader

Warsaw’s office market in 2024 is a picture of stability and growth potential. Strong pre-letting activity, stable rents, increased interest in flexible workspaces, and a focus on sustainability are all positive signs for the market’s future. As one of the leading office markets in Central and Eastern Europe, Warsaw continues to attract investors and tenants, positioning itself for continued success.