Slovak Industrial Production Declines Further in July as Energy and Metal Output Weakens

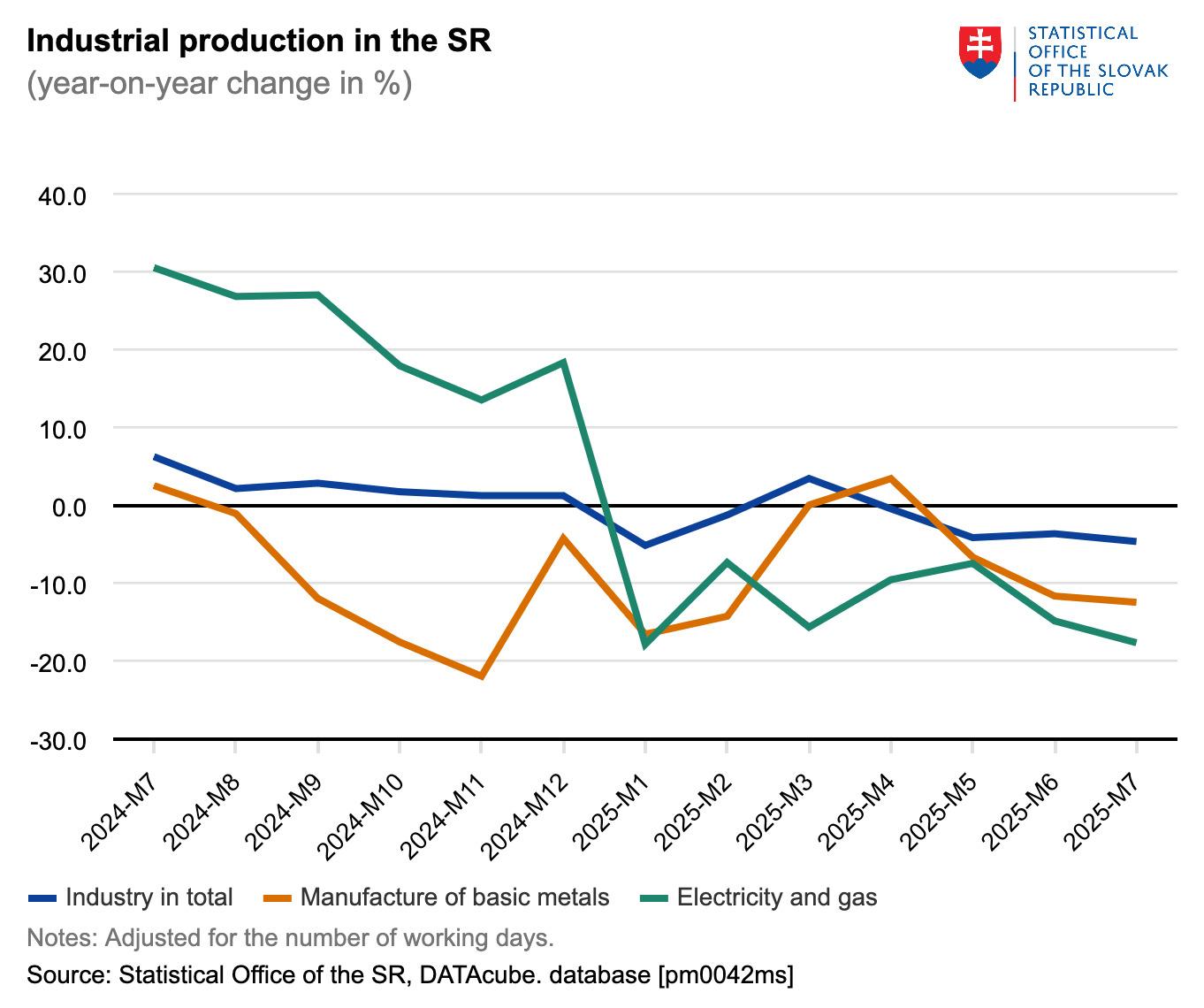

Slovakia’s industrial sector recorded a sharper contraction in July, with production falling by 4.6 percent year-on-year compared to a 3.6 percent decline in June. According to the Statistical Office of the Slovak Republic, this was the fourth consecutive monthly decline and the sixth drop since the beginning of the year. The downturn was driven mainly by weaker performance in energy supply and metal production, alongside declines in machinery and transport equipment manufacturing.

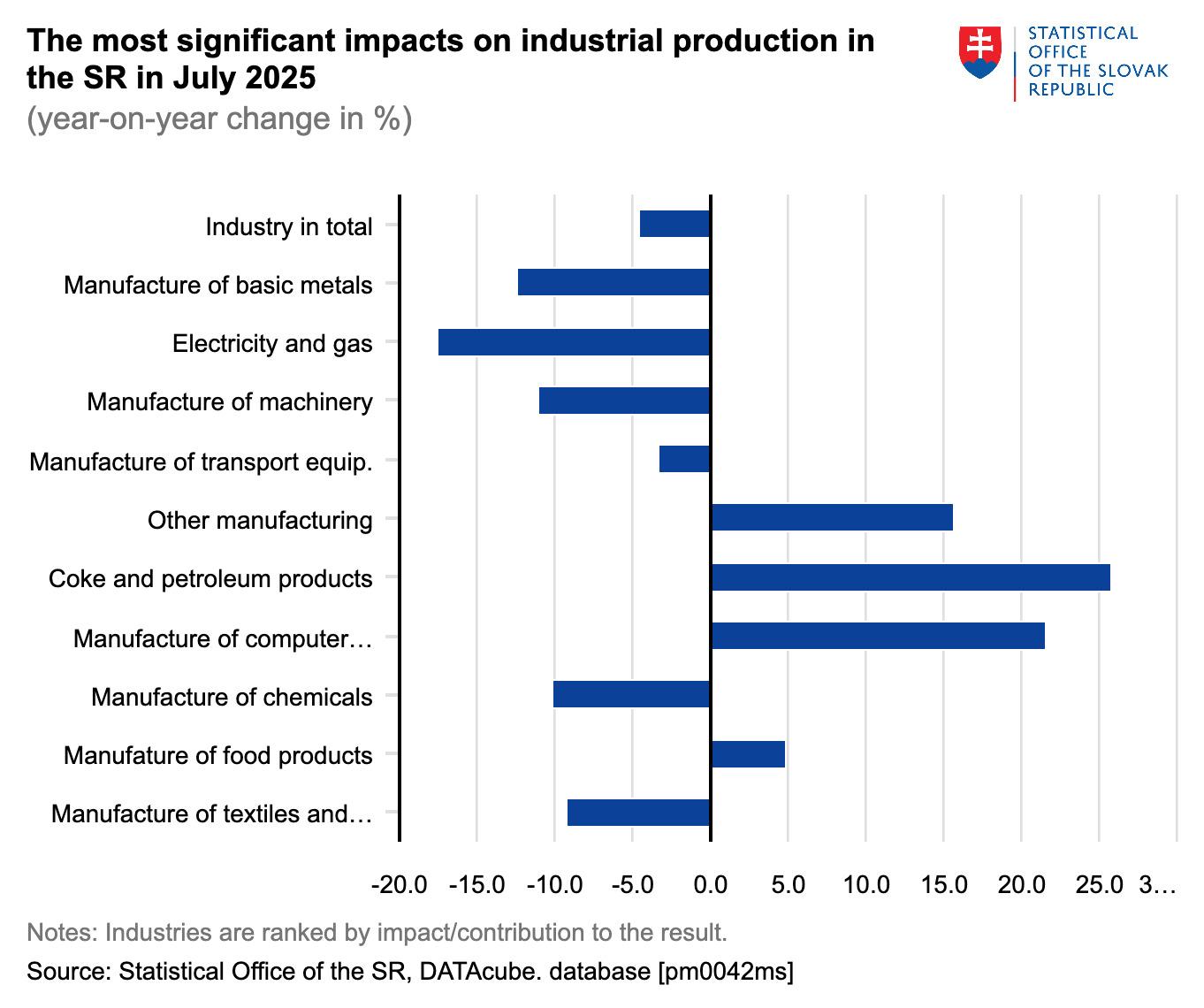

The metal industry, which has been struggling for several months, reported a year-on-year drop of more than 12 percent in July, marking the third month of contraction. Electricity and gas supply also fell sharply, down nearly 18 percent. Machinery and equipment manufacturing contracted by more than 11 percent, while transport equipment output decreased by just over 3 percent, only the second monthly decline in car production this year.

Positive contributions from other sectors were not enough to offset the downturn. Growth in smaller categories such as other manufacturing, coke and petroleum products, and computer products provided some relief, with increases ranging from 16 to more than 20 percent. On a seasonally adjusted basis, overall industrial production rose by 0.9 percent compared to June, but the year-on-year results remained negative.

From January to July 2025, industrial production in Slovakia declined by 2.2 percent compared to the same period in 2024. Over this seven-month period, eight out of fifteen monitored sectors recorded lower performance. The cumulative results were supported by a more than 6 percent rise in transport equipment production, which provided the largest positive contribution. However, this was outweighed by significant declines in energy supply, metal production, machinery, and electrical equipment manufacturing, all of which dragged the sector into negative territory.

The Statistical Office noted that the impact of company-wide holidays in July was minimal, as shutdowns occurred at similar times as in the previous year, meaning the declines were primarily the result of weaker sector performance rather than seasonal effects.