Slovenia’s real estate market in 2024: Performance and 2025 outlook

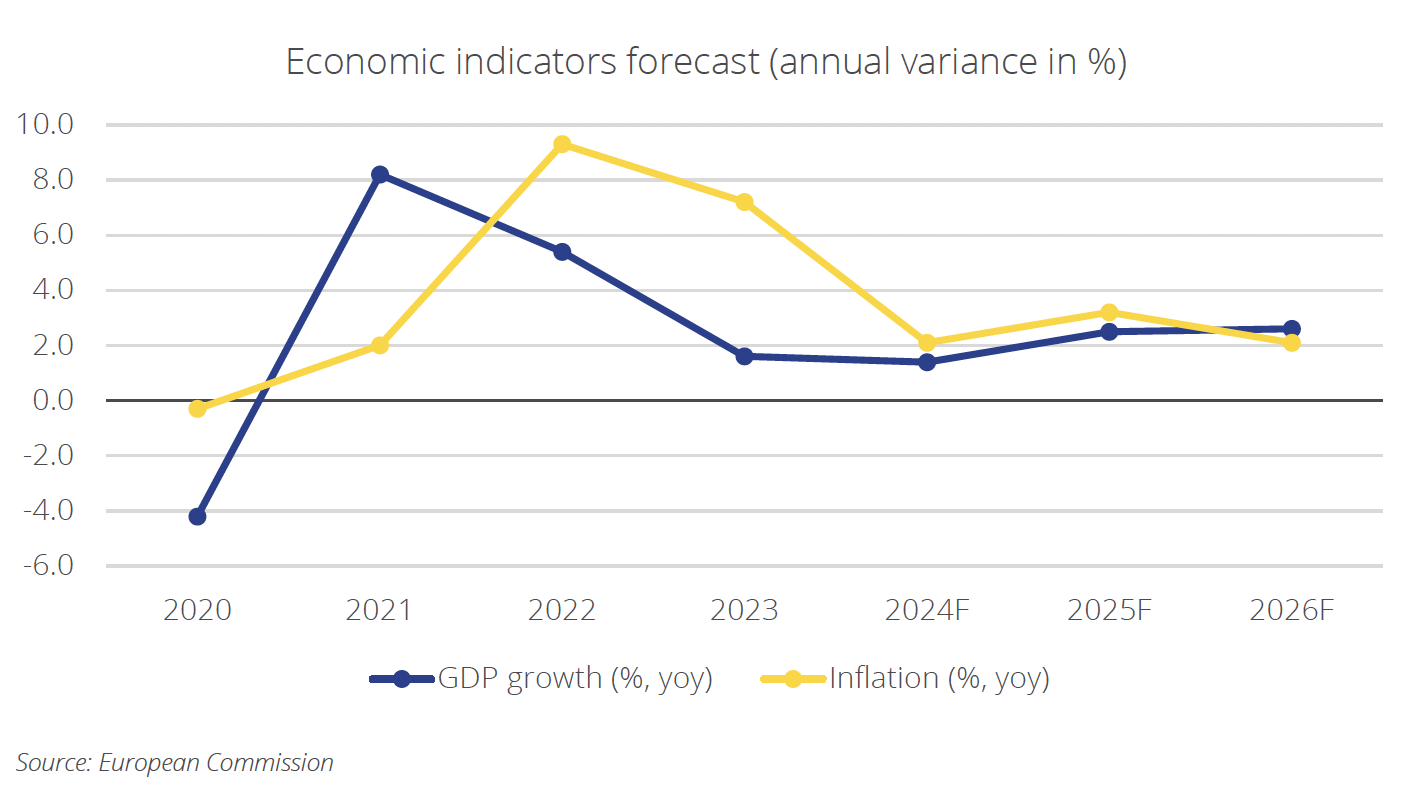

Slovenia’s real estate market has shown a mixed performance in 2024, with economic slowdown impacting investment activity, while certain sectors such as logistics and hospitality have demonstrated resilience. According to the latest market overview by Colliers, the country’s GDP growth slowed to 1.6% in 2024, with foreign trade and reduced gross investments contributing to the deceleration. However, economic forecasts indicate an increase to 2.5% growth in 2025.

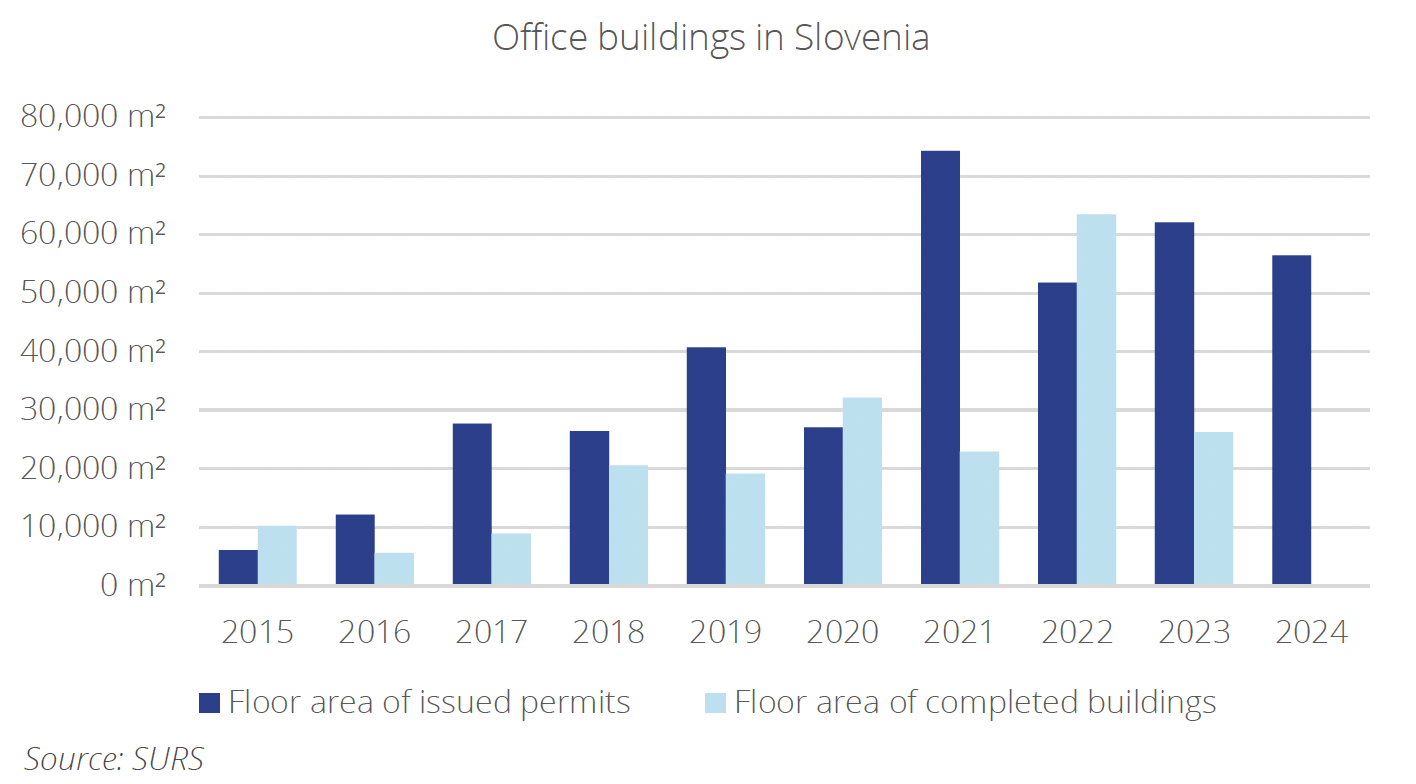

Office Market: Rising Demand Amid Limited Supply

The Ljubljana office market remains characterized by a limited supply of high-quality Class A office spaces, driving rental prices higher. In 2024, the prime headline rent reached €20.50/m², reflecting the strong demand for premium office locations. The most significant office completion of the year was DCB Montana, delivering 11,435 m² of new space.

Over 100,000 m² of office space is currently under development, with major projects including WestLink Campus (12,500 m²), Vilharia (36,000 m²), Emonika (35,000 m²), and L33 (10,000 m²). Despite the increased supply, vacancy rates remain below 3%, signaling continued demand for modern office spaces that comply with Environmental, Social, and Governance (ESG) requirements.

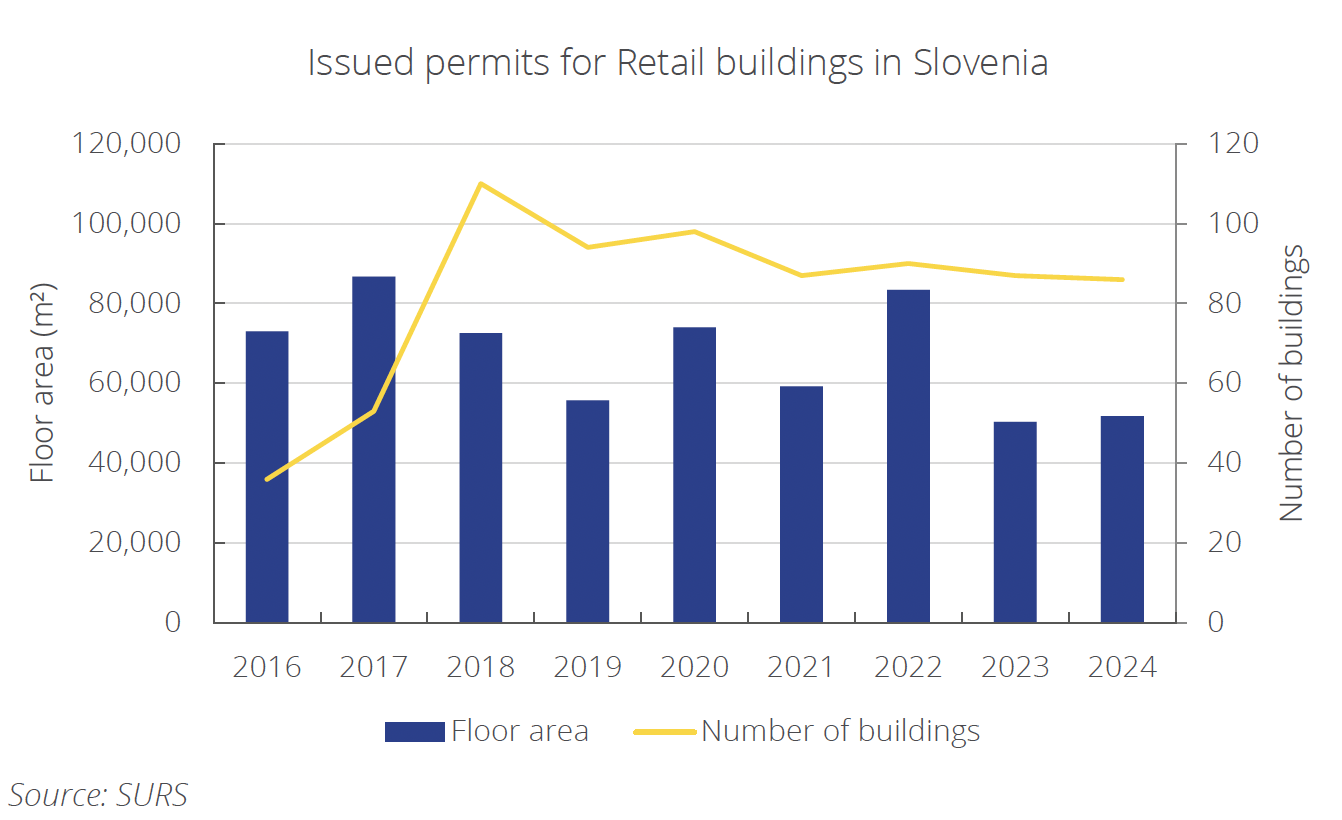

Retail Sector: Stable Growth with Key Transactions

The retail sector in Ljubljana has remained relatively stable, with prime shopping center rents ranging from €19.0/m² to €24.0/m² per month and a vacancy rate of 4%. The Emonika Shopping Center, currently under construction, is set to deliver 24,500 m² of new retail space, while Loberia Retail Park is undergoing its second phase of expansion.

Several notable investment transactions took place in 2024, including the sale of Planet Tuš Koper, the Quadra portfolio (featuring four Tuš centers), and the Nama portfolio. High-street retail rents continue to vary significantly depending on location, with prime spaces commanding between €40.0/m² and €60.0/m² per month.

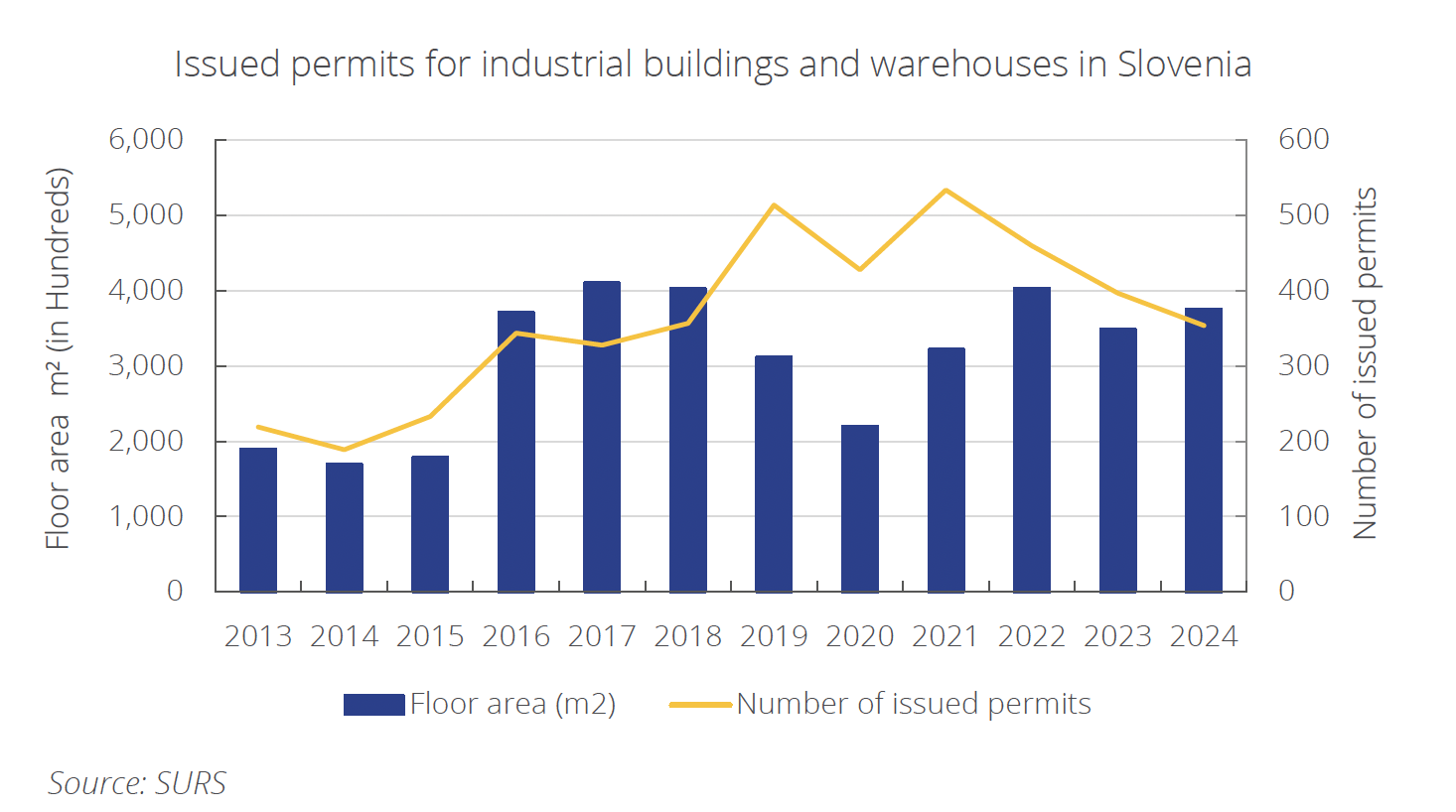

Industrial & Logistics: Strong Development Pipeline

The industrial and logistics sector remains a key driver of real estate activity in Slovenia, with a focus on modern Class A warehouse developments that meet ESG requirements. Prime headline rents in this segment range between €7.0 and €10.0/m² per month.

In 2024, two major logistics projects were completed:

• Kobal Transporti in Zalog (40,000 m²)

• Harvey Norman Logistics Center in Zlatoličje (17,000 m²)

The upcoming development pipeline includes 120,000 m² of logistics space, with major projects such as Log Center Adria in Sežana (60,000 m²), LOGspot in Logatec (26,000 m²), Spar LDC expansion in Letališka (25,000 m²), and DHL’s new facility in Brnik (8,400 m²).

Tourism & Hospitality: Strong Performance and Expansions

Slovenia’s tourism sector has outpaced European trends, reinforcing its reputation as a green hospitality destination. Tourist arrivals increased by 6.3%, while overnight stays rose by 4.5% in 2024. The North American market recorded an 18% increase in overnight stays compared to 2023, reflecting growing international interest.

Hotel developments have also been active, with the 4-star Hotel Habakuk in Maribor set to rebrand under the Hard Rock Hotel chain. Additionally, the Emonika project is under construction and will feature two hotels—a 4-star hotel with over 200 rooms and a 3-star hotel with 180 rooms.

Residential Market: Rising Prices but Declining Transactions

In Q3 2024, the prices of dwellings rose by 7.9% year-on-year, but the market saw the lowest number of existing home sales in the last 14 years. The total value of transactions in the first three quarters of 2024 was 16% lower compared to the previous year.

Construction costs for new residential buildings increased by 1.5%, reflecting ongoing inflationary pressures. However, the residential market is expected to stabilize, with future pricing trends dependent on economic conditions and the rate of new developments. Key projects currently under construction include Novi Bežigrad (245 apartments) and Emonika (187 apartments).

Outlook for 2025: Cautious Optimism

Looking ahead, Slovenia’s real estate market is expected to stabilize in 2025, supported by:

• Economic recovery with GDP growth projected at 2.5%

• Moderating inflation, expected to remain near the European Central Bank’s target

• Continued demand for logistics and high-quality office spaces

• Sustained international interest in Slovenia’s tourism sector

Despite geopolitical risks and uncertainties in foreign trade, Slovenia maintains an investment-grade credit rating, positioning it as a resilient and attractive market for real estate development in 2025.

Source Colliers Slovenia