Union Investment Real Estate: Market correction expected this year

There are still no signs of easing in the transaction markets, with investors either short of capital or unable to find the right property. That is also the key finding of a recent survey by Union Investment of 150 property companies and institutional real estate investors in Germany, France and the UK. Some 84 per cent of the European real estate investors surveyed state that their lack of liquid funds is currently the main factor affecting their investment decisions. 85 per cent say their investment decisions are being influenced by the availability of suitable investment properties.

“A lot of equity-rich players are sitting tight at the moment because interest rate hikes have not yet been fully priced in, and consequently they are unable to find suitable properties. Many potential vendors are also waiting until prices stabilise,” said Olaf Janßen, head of real estate research at Union Investment.

According to the survey, purchase prices are likely to adjust to higher interest rates in the course of this year. 42 percent of respondents expect to see a corresponding market correction over the coming three to six months. 40 per cent expect the adjustment phase to last at least until the end of this year. “Transaction markets are then likely to recover somewhat because equity-rich investors will re-emerge,” said Janßen.

A substantial 38 per cent of survey participants believe the US will be the first market to see transaction volumes pick up again. 25 per cent expect a recovery to occur in Europe first, while 9 per cent believe it will commence in the Asia-Pacific region. The remaining respondents expressed no view. Of those who believe that transaction volumes will pick up first in Europe, around 30 per cent expect the UK investment market to lead the way. 27 per cent thought that Northern Europe would be first out of the blocks, while 24 per cent cited Germany.

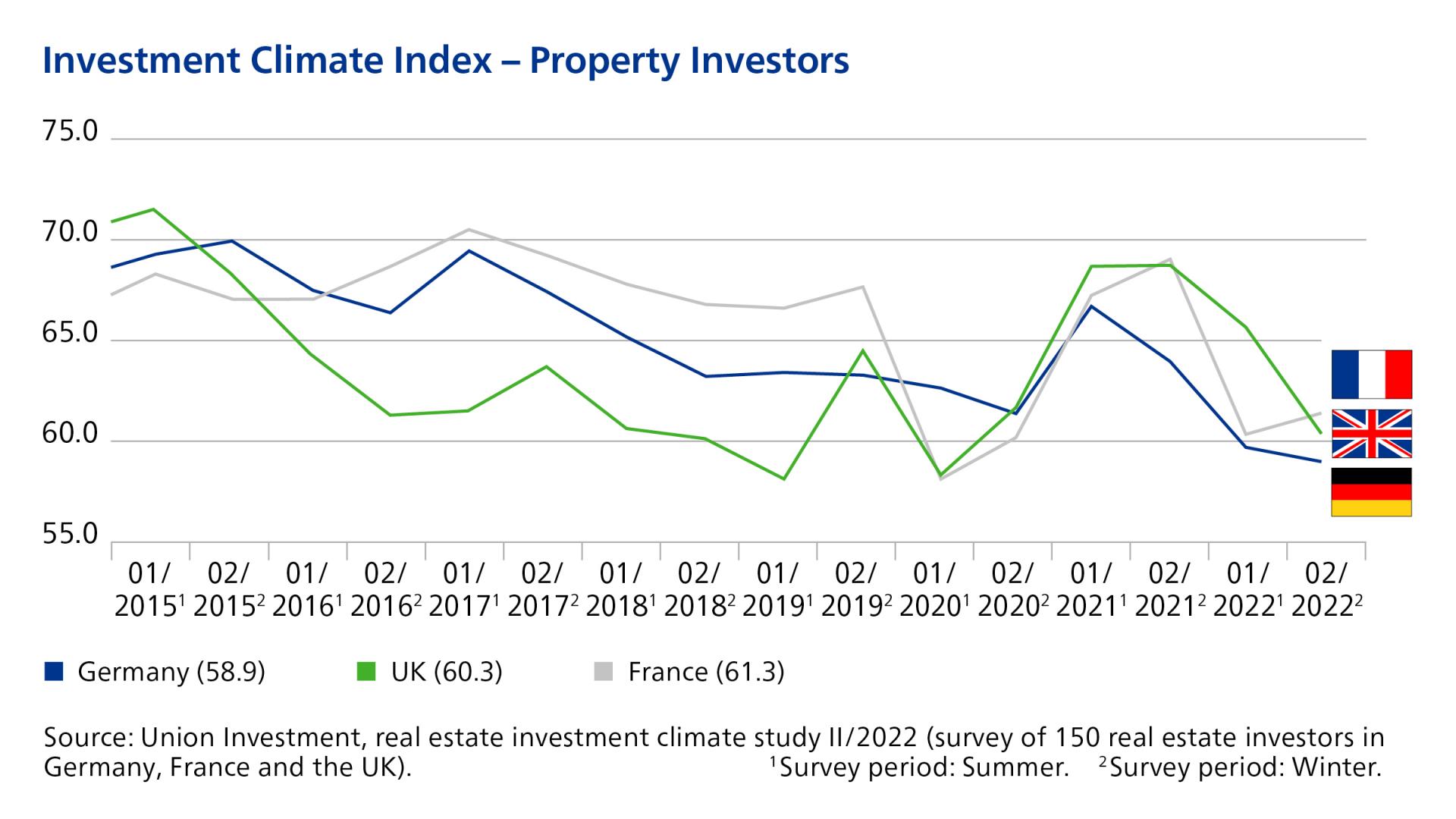

Investment climate: Light at the end of the tunnel.

Uncertainty regarding the future direction of interest rates, energy costs and the economy continues to weigh on sentiment among European real estate investors. However, there is light at the end of the tunnel. While the Real Estate Investment Climate Index compiled by Union Investment showed another sharp fall for the UK in the second half of 2022, down 5.3 points to 60.3, the reading in Germany declined by just 0.8 points to 58.9. In France, the Index actually rose slightly, moving up from 60.3 to 61.3 points. “This shows that the real estate markets may be bottoming out and there is reason to hope they will have fully adjusted to the new interest rate reality by mid-2023,” said Janßen.