2025-01-09

residential

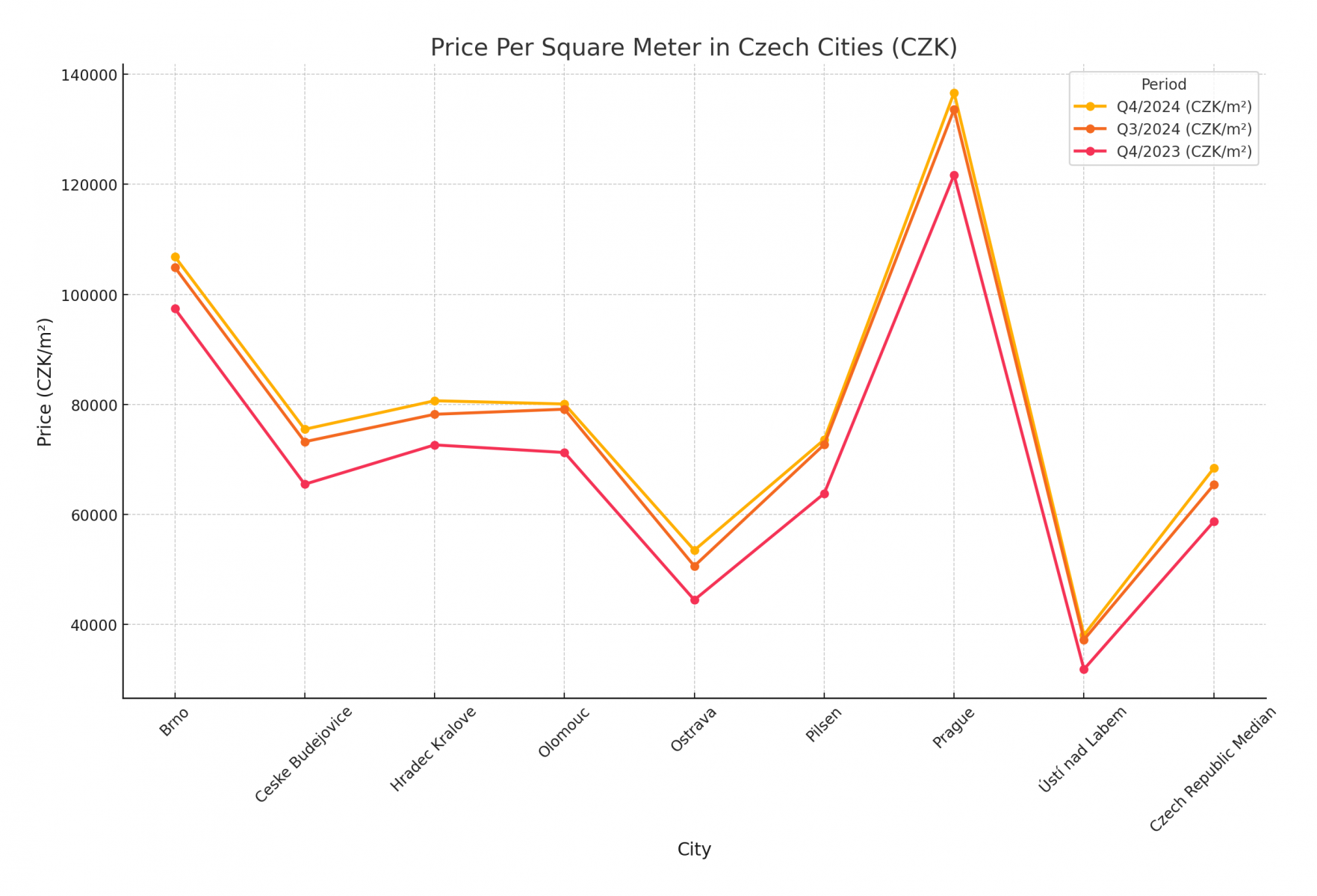

The cost of older apartments in the Czech Republic rose by an average of 17% year-on-year in the final quarter of 2024, reaching a median price of CZK 68,421 per square meter, according to an analysis by real estate platform FérMaklér.cz shared with the Czech News Agency. Prices have continued to climb across all major cities, with no declines observed even in quarter-on-quarter comparisons. The increases are attributed to limited real estate supply and buyers’ willingness to accept higher mortgage costs. The most significant price hikes were seen in Ostrava and Ústí nad Labem, where older apartment prices grew by around 20% year-on-year in Q4 2024. Other cities also experienced notable increases: • Pilsen and České Budějovice: +15% • Prague: +12% • Brno: +10% • Hradec Králové: +11% In absolute terms, Prague remains the most expensive city, with the cost per square meter rising by nearly CZK 15,000 year-on-year to CZK 136,652 at the end of 2024. Brno followed at CZK 106,865 per square meter, with the average price for an 80-square-meter apartment increasing by CZK 756,000 year-on-year. Despite significant growth, Ostrava and Ústí nad Labem remain the most affordable, with square meter prices at CZK 53,509 and CZK 38,119, respectively. However, these cities also saw sharp absolute increases, with an 80-square-meter apartment in Ostrava up by CZK 722,000 and in Ústí nad Labem by CZK 498,000. The rise in apartment prices is primarily attributed to a lack of available properties on the market and a continued willingness among buyers to accept elevated mortgage rates. According to data from ČSOB stavební spořitelna banka, housing loans in 2024 reached CZK 305 billion, CZK 135 billion more than in 2023. Mortgage volumes rose sharply to CZK 256 billion compared to CZK 137 billion the previous year. While the average mortgage rate has slightly declined, reaching 5.13% in January 2025 according to the Swiss Life Hypoindex, it remains high. For a CZK 3.5 million mortgage with 80% loan-to-value (LTV) and a 25-year term, the monthly repayment was CZK 20,730 in January, down CZK 1,000 compared to the same period last year. Experts predict continued demand for real estate in 2025, driven by a combination of low housing construction rates and restricted supply. As a result, prices of older apartments are expected to rise further, albeit at a slower pace, with single-digit percentage increases anticipated. Rising property prices are likely to be accompanied by higher rents, reflecting limited housing availability and increasing demand across both the ownership and rental markets. Source: CTK, FairMaklér.cz and Valuo.cz