2025-04-08

markets

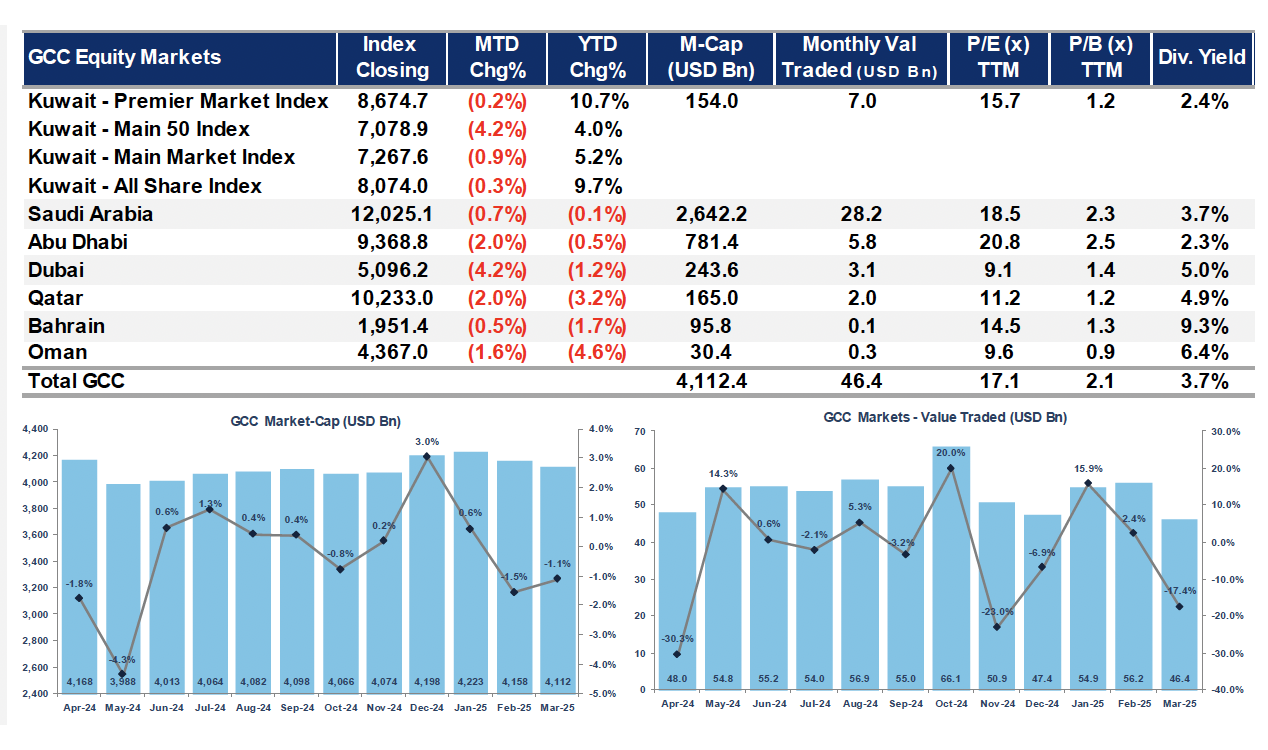

March marked a turbulent month for GCC equity markets, mirroring global investor concerns over trade tensions and economic slowdown. March 2025 saw continued pressure on global equity markets, with the GCC markets reflecting the same sentiment as regional exchanges posted mostly negative returns. Rising concerns over U.S. trade policies and a potential economic slowdown triggered a flight to safety, with investors gravitating towards gold and government bonds. According to Kamco Invest’s latest GCC Markets Monthly Report, the MSCI GCC Index edged down 0.4% in March, as all seven GCC exchanges registered declines. Dubai led the losses, falling by 4.2%—its first decline in ten months—while Abu Dhabi and Qatar both shed 2.0%. Saudi Arabia, Kuwait, Oman, and Bahrain also posted marginal losses. Kuwait: Resilient Q1 Performance Despite March Dip Boursa Kuwait saw a mixed performance in March, with the Main 50 Index falling 4.2%, while the All Share Index slipped only 0.3%. However, for Q1 2025, Kuwait emerged as the best-performing GCC market with a 9.7% gain. The banking sector, buoyed by strong Q4 earnings and “higher for longer” interest rate expectations, recorded modest gains. Notably, Oula Fuel Marketing Co. led stock performance with an 18.3% rise. Saudi Arabia: Tadawul Stays Afloat Amid Earnings and IPO Activity Tadawul’s TASI Index dipped 0.7%, affected by declining oil prices and geopolitical uncertainty. However, sector performance was balanced, with banks and real estate gaining 3.2% and 2.5%, respectively. IPO activity remained strong with listings from Derayah Financial Co. and Umm Al Qura. Dar Alarkan Real Estate Development Co. was the top gainer, up 19.7%. UAE: Abu Dhabi and Dubai Suffer Setbacks The ADX General Index fell 2.0% in March, led by a steep 8.2% decline in the Consumer Discretionary sector. The sole bright spot was the Utilities sector, which gained 15.5%, driven by Abu Dhabi National Energy Co. Meanwhile, Dubai’s DFM Index posted the sharpest drop in the GCC at 4.2%. The Financials and Consumer Discretionary sectors led the slide, while National Cement Co. rallied 29.8% on strong earnings. Qatar: Broad-Based Decline Despite Strong Transport Sector Qatar’s QE 20 Index declined 2.0%, marking its second consecutive monthly drop. However, the Transportation sector bucked the trend with a 3.8% gain, led by Qatar Navigation QSC. Overall trading activity decreased, with a 14.1% drop in value traded. Estithmar Holding was the top-performing stock, up 12.1%. Bahrain: Stability Amidst Mixed Sector Moves The Bahrain All Share Index registered a minor 0.5% decline, as losses in Materials and Financials outweighed gains in Real Estate and Consumer Discretionary. Trading activity plummeted, with value traded down 92.1% month-over-month. Khaleeji Commercial Bank BSC saw the highest gain at 18.5%. Oman: MSX Sees Continued Weakness The Muscat Stock Exchange extended its decline for a third straight month, falling 1.6% in March. The Industrial Index dropped 4.9%, pressured by double-digit losses in Oman Cement and SMN Power. However, Muscat Insurance Company surged 60.3% after returning to profitability. Trading volumes and value both fell by over 40%. Outlook: Macro Headwinds to Continue Steering GCC Markets The report notes that while large-cap sectors like banking and utilities offered some support, the region remains sensitive to external shocks. Economic forecasts for the region are optimistic—with the UAE, Qatar, and Bahrain projecting GDP growth between 2.8% and 5.7% in 2025—but equity performance will likely depend on the pace of global economic recovery, oil price stability, and investor sentiment.