2025-04-15

indicators

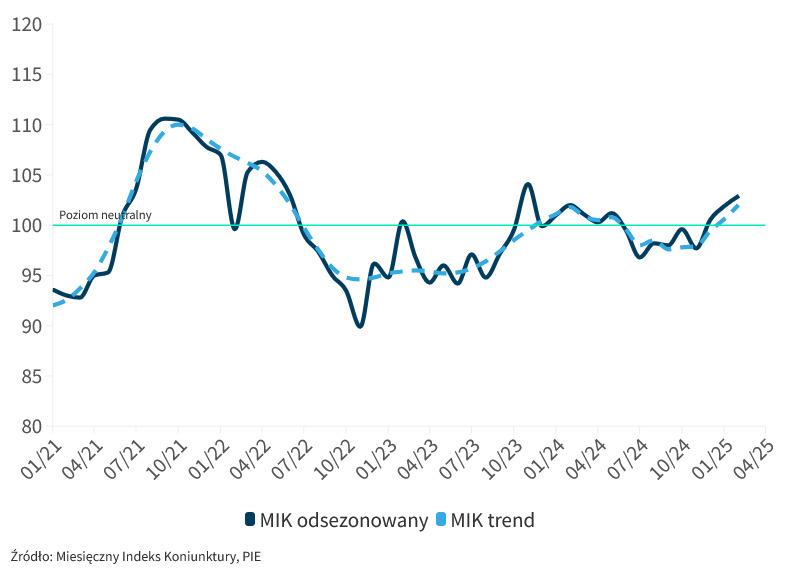

Business sentiment among Polish entrepreneurs improved slightly in April, according to the latest Monthly Economic Index (MIK) published by the Polish Economic Institute. The index rose to 102.9 points, up 1.2 points from March, matching February’s figure and continuing a five-month streak above the neutral 100-point threshold. Compared to April 2024, the index is 2.6 points higher. The April reading reflects a broadly optimistic outlook, with four of the seven measured components—sales value, employment, wages, and financial liquidity—remaining above the neutral level. The data also shows increases in the indicators for sales value, new orders, and investment activity. Gains in Sales and Investment, Despite Mixed Sector Results April’s increase was driven by positive movements in key areas such as sales and investment. The sales value indicator climbed by 7.3 points month-on-month to reach 101.8, its highest since November 2023. New orders rose by 4.9 points to 96.7, while the investment index reached 90.6—its strongest result since November 2023—marking a 5.9-point monthly gain and a year-on-year improvement of over 21 points. Although several indicators remain above the neutral level, others showed declines. The wage index fell by 6.5 points to 110.6, its lowest level so far in 2025. Employment also decreased, dropping 2.4 points month-on-month to 100.8. Financial liquidity dipped slightly, down 2.3 points from March to 121.1. Sectoral Breakdown and Economic Context According to Dr. Katarzyna Zybertowicz from the Polish Economic Institute’s foresight team, current MIK readings suggest economic stability. She points to a steady unemployment rate (5.4% in February), and real wage growth outpacing inflation (4.9% in March) as signs of resilience. The industrial sector’s PMI of 50.7 also indicates moderate improvement. Sector-wise, companies in manufacturing, construction, and transport-logistics (TSL) reported more positive sentiment. However, service and trade sectors recorded MIK readings below the neutral threshold, reflecting lower activity and weaker demand in early 2025. Operating Costs Remain Primary Challenge Rising employee costs continue to be the most commonly reported challenge for businesses, cited by 69% of respondents—unchanged from March. Other concerns saw slight increases: economic uncertainty was mentioned by 60% of firms, unavailability of staff by 45%, payment delays by 44%, and financing costs by 34%. Energy prices were less of a concern in April, with the share of firms flagging it as a barrier falling by 4 percentage points to 51%. Similarly, complaints about product unavailability dropped slightly to 17%. Industry-specific responses revealed differences: TSL companies more frequently cited high employee costs, uncertainty, payment delays, and financing costs. Service firms expressed particular concern over energy prices (64%), while construction firms were more affected by staff shortages (60%). Manufacturing (24%) and retail (21%) were least concerned about personnel availability. Source: PIE