2025-05-26

finance

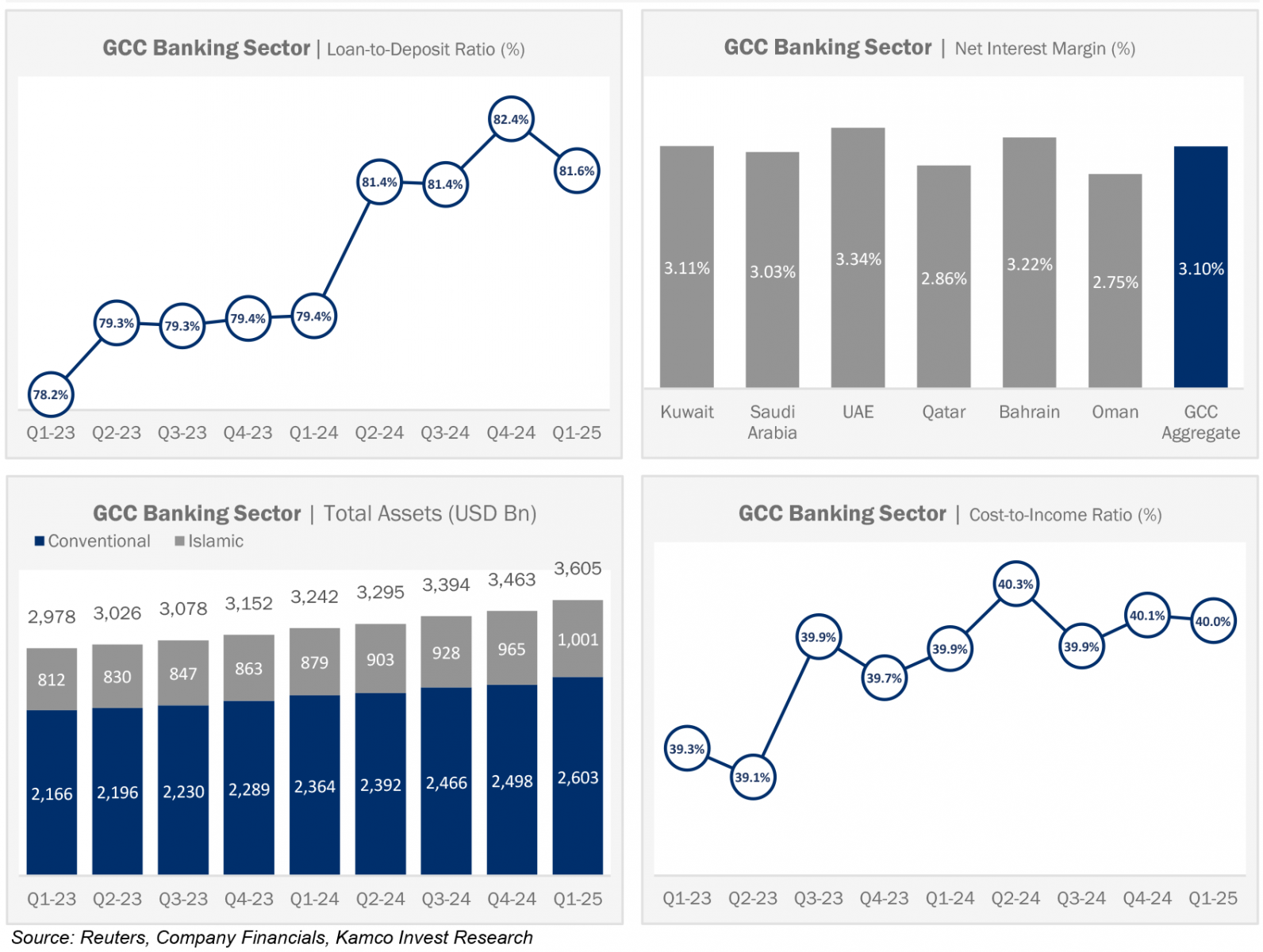

The banking sector across the Gulf Cooperation Council (GCC) began 2025 on a solid footing, achieving record-high profits despite facing pressures from declining interest rates, subdued revenue growth, and persistent global economic uncertainties. According to the latest GCC Banking Sector Report – Q1 2025 by Kamco Invest, listed banks across the region posted a combined net income of USD 15.6 billion in the first quarter of the year. This marks a 7.1% increase compared to the previous quarter and an 8.6% rise year-on-year. Profit Growth Despite Revenue and Margin Pressure The sector’s total revenues stood at USD 34.6 billion—the highest on record—although quarter-on-quarter growth was marginal at just 0.04%. The subdued growth in revenues was mainly due to declines in Kuwait and Oman, which were offset by stronger performance in the UAE, Qatar, and Saudi Arabia. Net interest income, which accounts for a large portion of total revenues, declined for the first time in two years. It fell by 1.7% quarter-on-quarter to USD 22.8 billion, largely reflecting the interest rate cuts implemented in the second half of 2024. The GCC region, closely tied to U.S. monetary policy, had followed the Federal Reserve in easing rates, leading to a decline in lending yields. Despite the overall decline in net interest income, Saudi and Qatari banks posted modest gains. Saudi banks reported a 1.9% quarterly increase, bringing their total to USD 7.9 billion, while Qatari banks recorded a 0.8% rise to USD 3.5 billion. Other markets showed marginal contractions. Strong Non-Interest Income and Lower Costs Drive Earnings Non-interest income remained a key support for overall profitability, rising 2.2% to USD 11.8 billion. This marks the fourth consecutive quarter of growth in this category. The UAE banking sector contributed the most to the increase, followed by Qatar and Saudi Arabia. Non-interest income growth was driven by higher fee income, trading gains, and service-related revenues. Operating expenses fell by 4.3% to USD 13.6 billion after a notable spike in Q4 2024, improving the sector’s cost-to-income ratio to 40.0%. UAE, Saudi Arabia, and Kuwait led the decline in expenses, while Qatar saw a small increase. The improvement in cost efficiency further bolstered profitability during the quarter. Lending Activity Expands Across the Region Total gross loans for the sector reached USD 2.25 trillion, up 3.6% from the previous quarter and 12.5% year-on-year. This represents the strongest quarterly lending growth in almost four years, largely driven by economic expansion in non-oil sectors and continued infrastructure investment across the region. Saudi Arabia led lending growth with USD 801.5 billion in loans, a 5.5% quarterly increase. The UAE followed with 3.2% growth, while Qatar posted a 3.6% increase. Lending also grew in Oman and Bahrain, though at more moderate rates. Kuwait was the only GCC country not to register a quarter-on-quarter rise in loans. Sector-wise, the most significant increases in credit allocation were seen in construction, real estate, healthcare, education, and transport, especially in Saudi Arabia, aligning with national development plans such as Vision 2030. Deposit Growth Outpaces Lending Customer deposits rose by 5.1% during the first quarter to reach USD 2.65 trillion, setting a new record. This growth outpaced the expansion of lending, leading to a slight decrease in the aggregate loan-to-deposit ratio, which dropped from 82.4% to 81.6%. The UAE posted the highest quarterly deposit growth at 6.7%, followed by Qatar at 6.1% and Saudi Arabia at 4.8%. Saudi Arabia, however, continues to have the highest loan-to-deposit ratio at 95.5%, indicating tighter liquidity conditions compared to the UAE, which recorded the lowest ratio at 67.3%. Risk Costs Ease as Impairments Drop Loan loss provisions saw a substantial 33% decline from the previous quarter, falling to USD 2.1 billion. This brought the region’s cost of risk down to 0.45%. The UAE recorded the largest drop in impairment charges, partly due to reversals at some of the major banks. Qatar and Saudi Arabia also saw decreases in provisions, while Kuwait posted a 14.8% quarter-on-quarter increase to USD 237.9 million. The reduction in provisions points to improved asset quality and favourable credit conditions. It also contributed significantly to overall earnings growth during the quarter. Margins and Profitability Metrics Despite earnings growth, the sector’s net interest margin (NIM) declined slightly to 3.10% from 3.14% in the previous quarter. UAE banks maintained the highest NIM at 3.34%, while other markets posted slight declines due to the lower interest rate environment. Return on equity (RoE) for the sector came in at 13.6%, just below the 13.7% reported in Q4 2024. UAE banks continued to lead with a RoE of 16.6%, followed by Saudi Arabia and Qatar. Total shareholder equity across the region rose by 0.8% to reach USD 453 billion. Broader Economic Context and Outlook The sector’s strong performance comes despite a complex global backdrop marked by trade tensions, uncertain monetary policy paths in major economies, and inflation volatility. The anticipated delay in further U.S. rate cuts could weigh on interest margins for GCC banks in the coming quarters. Nevertheless, the macroeconomic environment in the region remains broadly supportive. The International Monetary Fund projects average nominal GDP growth of 3.5% across the GCC in 2024, with Saudi Arabia, the UAE, Qatar, and Bahrain leading the way. Continued diversification away from oil dependence, coupled with large-scale infrastructure investment, is expected to sustain credit demand and banking activity. Conclusion The GCC banking sector demonstrated resilience and adaptability in the first quarter of 2025, overcoming challenges posed by lower interest income and global market uncertainties. Strong non-interest income growth, cost reductions, and improved asset quality enabled banks to deliver record earnings. As the year progresses, the sector is expected to face headwinds from interest rate dynamics and global financial volatility. However, stable domestic conditions, continued credit expansion, and regulatory reforms provide a sound foundation for future growth. The outlook for the remainder of the year suggests a continued focus on operational efficiency, strategic lending, and prudent risk management to maintain performance in a changing environment.