2025-05-27

indicators

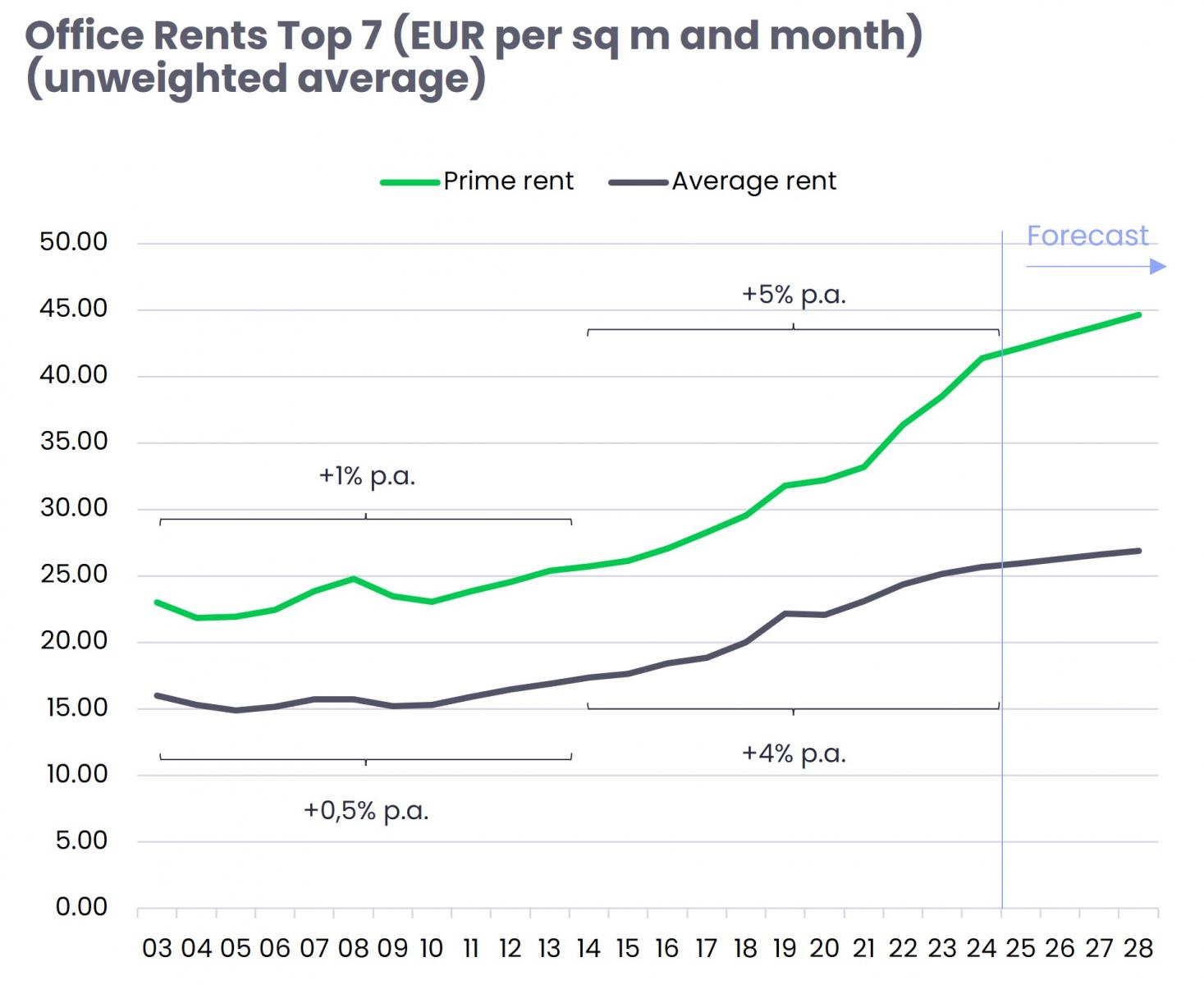

Germany’s real estate market is entering a period of gradual recovery following a period of reduced activity. According to a recent market analysis by neoshare Real Estate, a consultancy specialising in transactions, finance, and valuations, commercial property transactions are expected to reach between €30 and €35 billion in 2025. The company reports signs of stabilisation in capital values and moderate growth in rental income, which are helping to support yields across asset classes. The analysis identifies two key developments contributing to the recovery. First, the gap between buyers’ and sellers’ price expectations is narrowing. Second, financial pressures such as capital outflows, funding constraints, and portfolio restructuring are leading more owners to consider sales. These dynamics are creating conditions for increased market activity, even as capital availability remains limited and broader geopolitical uncertainties persist. Despite the challenging environment, neoshare believes that Germany remains an attractive location for real estate investment, particularly for clearly defined projects and properties that meet long-term sustainability criteria. Managing Director José Martinez noted that while signs of recovery are visible, careful selection of assets remains essential. In the office sector, demand for space has stabilised at lower post-pandemic levels, but a clear divergence has emerged between central and peripheral locations. Core city areas continue to attract strong interest, particularly for modern, flexible, and sustainable offices, while outdated buildings are increasingly struggling to find tenants. The vacancy rate in Germany’s Big 7 cities is expected to rise slightly to 7.2% by the end of 2025 and to 7.5% by 2028. Prime and average office rents are still increasing, though at a slower pace, with prime rents projected to rise by around 2% this year. In the residential market, supply constraints are likely to continue driving rental growth. New building permits have declined by 17% since 2024, and residential completions are down 13%. At the same time, the number of households in the Big 7 cities has grown by nearly 4%, intensifying demand. This imbalance is expected to result in prime residential rents rising by approximately 3% annually through 2028. With yields stabilising, neoshare sees potential for the residential segment to deliver above-average total returns, supported by consistent rental income. Managing Director Piotr Bienkowski noted that affordability pressures may lead to a reversal of the recent trend toward larger per capita living space in major cities. The industrial and logistics segment continues to perform well, with rent levels increasing even in the absence of broader economic momentum. New warehouse completions peaked in 2022 and have since declined, keeping vacancy rates below 5%, close to full occupancy. Over the past five years, prime logistics rents have grown at an average annual rate of 7%, and neoshare forecasts an ongoing increase of 3% annually through 2028. Germany’s retail real estate market remains in a state of structural change. While the number of physical stores continues to decline, retail turnover is projected to reach €677 billion by the end of 2025. Local shopping centres and retail parks remain relatively stable, supported by indexed long-term leases. Food retail properties are still in demand, and despite gradually rising prime yields, investor interest in well-positioned, sustainable retail assets remains steady. The analysis also highlights growth in alternative real estate sectors such as data centres, life sciences, and hospitality. The hospitality segment, in particular, has recovered strongly since the pandemic, with overnight stays increasing and demand concentrated on budget and sustainable hotel formats. In 2024, international investors accounted for more than half of all hotel transaction volume in Germany, a trend not seen since 2017. Prime yields for top-tier hotels were in the range of 5.25% to 5.50% at the end of last year and are expected to remain stable through 2025. Overall, neoshare’s outlook points to a cautiously improving environment for real estate investment in Germany, driven by stabilising values, steady rental growth, and emerging interest in both core and alternative asset classes. While risks remain, particularly related to financing and global economic conditions, the market appears to be regaining its footing. The analysis can be downloaded from the link below: