2025-05-28

indicators

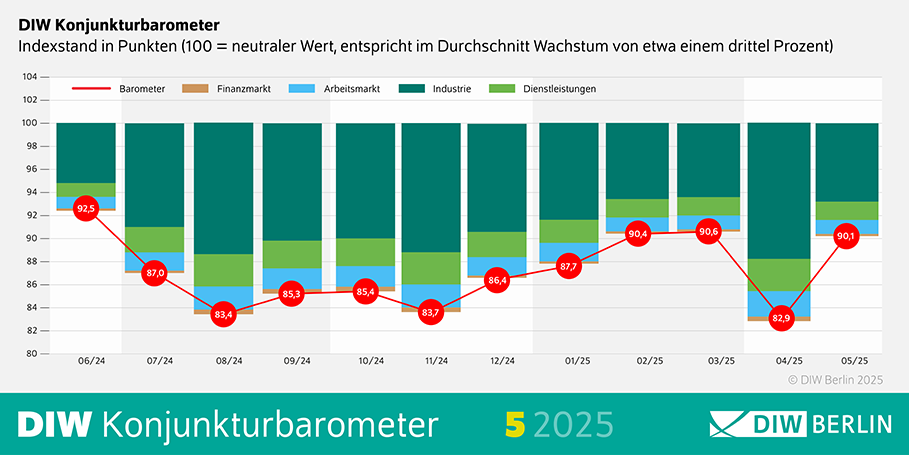

The German economy is showing early signs of recovery, according to the latest Economic Barometer from the German Institute for Economic Research (DIW Berlin). The index rose to 90.1 points in May, gaining more than seven points compared to April and returning to levels seen in February and March. While it remains below the neutral 100-point mark that signals average economic growth, the upward movement suggests a moderate improvement in conditions. “The German economy is picking up somewhat despite increased trade barriers earlier in the year,” said DIW Chief Economist Geraldine Dany-Knedlik. However, she cautioned that the momentum from the first quarter, when GDP grew by 0.4%, is unlikely to be sustained. Part of that early growth was attributed to a shift in exports to March, driven by concerns over tariff hikes. Foreign trade is expected to slow in the months ahead, though improved private consumption is emerging as a positive factor. Political stability, with Germany now having a functioning federal government, is also contributing to a more supportive economic environment. Still, DIW notes that the impact of newly announced measures to boost public and private investment will likely be felt only in 2026. High levels of uncertainty persist among businesses and households following years of weak growth and ongoing geopolitical and trade tensions. In the industrial sector, which has struggled in recent years, sentiment is gradually improving. The ifo Business Climate Index increased in May, with expectations becoming more optimistic and order intake showing signs of recovery. Industrial production rose sharply in March, though this was partly driven by advance exports related to trade policy concerns. Despite this, German industry remains vulnerable to global risks, including elevated U.S. tariffs and a sluggish international economy. “Industry in Germany is currently caught between global trade conflicts and hopes for supportive fiscal policies,” said DIW economist Laura Pagenhardt. She emphasised that greater policy clarity, particularly on public investment, could drive growth in the second half of the year. In the services sector, the picture remains mixed. While business expectations have improved, service providers—particularly those linked to manufacturing—continue to face challenges. Retail, however, has shown signs of strength, with higher spending and a notable drop in the savings rate in the first quarter. Nonetheless, uncertainties about the labour market are affecting consumer confidence. According to GfK’s consumer climate index, sentiment remains cautious, though a slight recovery may have occurred in May. “The German economy is showing initial signs of recovery, supported by the outlook for fiscal policy-driven growth,” said DIW expert Guido Baldi. “But the external environment remains a major source of risk. Further escalations in trade tensions or geopolitical conflicts could threaten this fragile recovery.”