2025-06-02

indicators

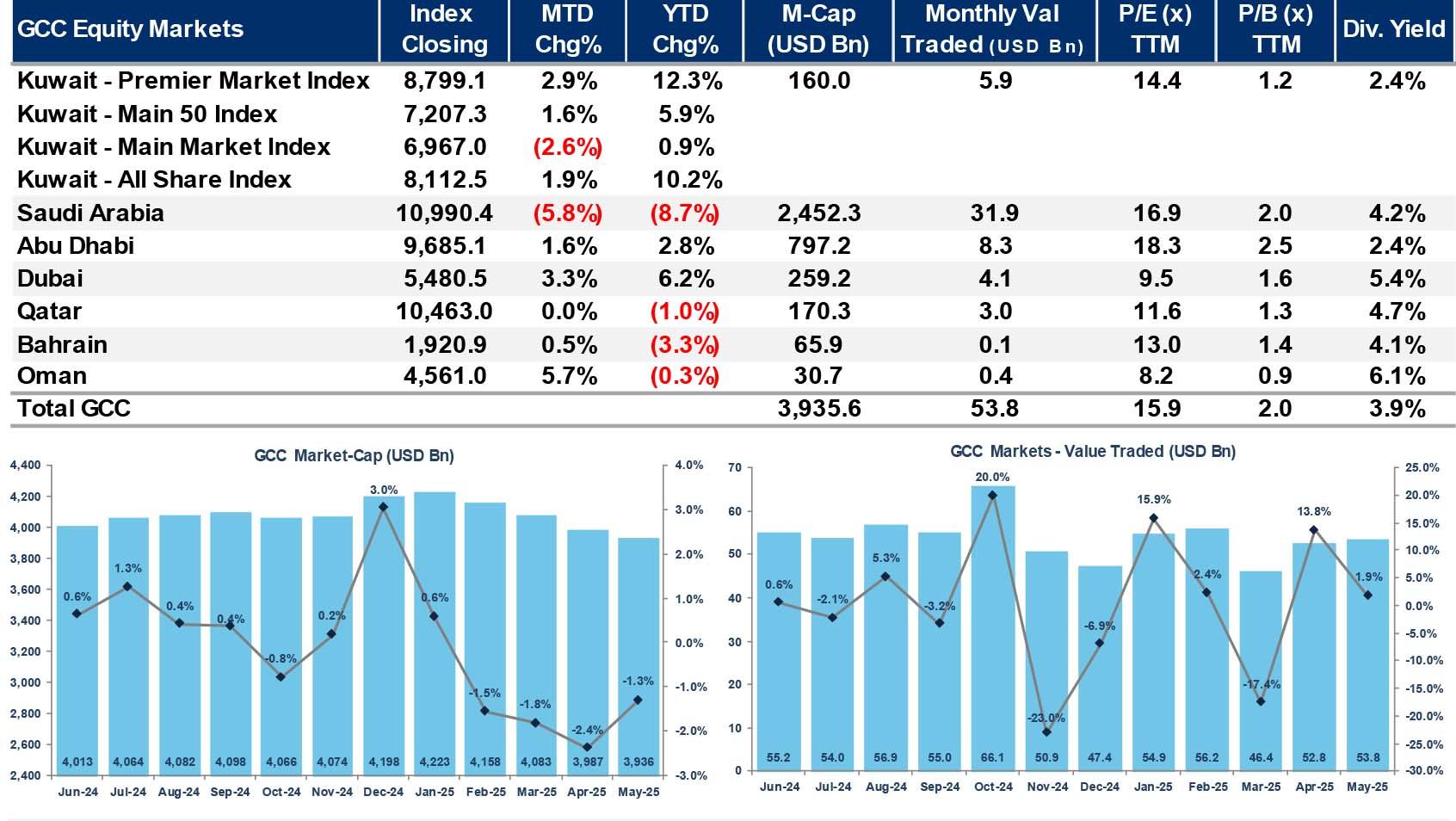

May 2025 proved volatile for equity markets across the Gulf Cooperation Council (GCC) region, reflecting global market instability. Despite some gains in individual markets, the MSCI GCC Index fell 2.6% during the month, driven largely by a 5.8% decline in Saudi Arabia’s TASI. Oman emerged as the region’s strongest performer, posting a 5.7% monthly gain after a series of declines earlier this year. Dubai and Kuwait also reported solid performances, rising by 3.3% and 1.9%, respectively, while Abu Dhabi gained 1.6%. Kuwait’s Premier Market Index led year-to-date results, showing a double-digit gain of 10.2%, followed by Dubai at 6.2% and Abu Dhabi at 2.8%. Meanwhile, Saudi Arabia recorded an 8.7% decline year-to-date, contributing to a 1.6% year-to-date drop for the MSCI GCC Index. Sector-wise, performance was varied. The Utilities sector led declines with a 9.6% drop, followed by Healthcare and Food & Beverages, which fell by 5.2% and 5.0%, respectively. In contrast, Capital Goods, Diversified Financials, and Transportation sectors posted modest gains. On the global stage, equity markets saw gains, with the MSCI World Index rising by 5.5% in May, led by technology-driven advances on the Nasdaq, which climbed 9.6%. Market Highlights: • Kuwait: The Boursa Kuwait All-Share Index gained 1.9%, supported by a 2.9% rise in the Premier Market Index. Consumer Staples led sectoral gains with a 16.2% increase, while Utilities posted the largest sectoral decline at 3.4%. Trading activity saw a decrease in volume and value traded compared to the previous month. • Saudi Arabia: TASI experienced the sharpest decline in the GCC, falling 5.8% to its lowest level since November 2023, primarily due to falling oil prices and geopolitical uncertainties. The Utilities and Media sectors recorded the steepest declines, while only the Capital Goods sector posted gains. • Abu Dhabi: The FTSE ADX Index posted a second consecutive monthly gain, rising 1.6%. Energy and Utilities sectors led the gains, driven by ADNOC Distribution and Abu Dhabi National Energy Co. The total value of traded shares rose by 18.2% month-on-month. • Dubai: The DFM General Index rose 3.3%, with gains across all sectors. The Materials sector was the top performer with a 9.1% increase. Trading value rose 17.5% to AED 15.1 billion, even as volumes declined slightly. • Qatar: The QE 20 Index was almost flat with a marginal 0.03% gain. Real Estate and Banking sectors led the modest advances, while Telecoms and Industrials declined. Trading activity improved with a 24.7% rise in volume and a 31.4% increase in value traded. • Bahrain: The Bahrain All Share Index edged up 0.5%. Gains in Financials and Consumer Discretionary sectors offset declines in Materials and Industrials. Trading activity surged significantly, with a 230.7% jump in volume traded. • Oman: The MSX 30 Index posted a 5.7% gain, reversing a four-month decline. The Industrial sector led with a 10.1% rise. Trading activity saw a 47% increase in value traded compared to April. Despite short-term volatility, optimism remains for the second half of 2025, particularly driven by expectations of stabilizing oil prices and resilient economic fundamentals in the GCC region. Source: Kamco Invest.