2025-06-03

finance

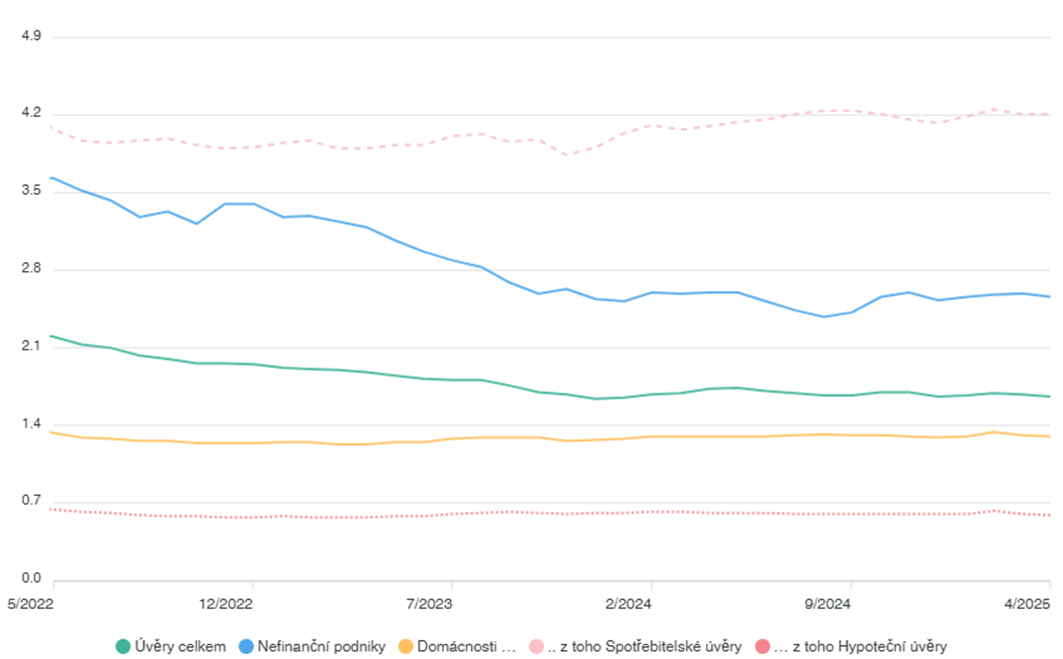

Banking sector data for April 2025 indicate continued stability and modest growth across key segments, according to an analysis by Miroslav Zámečník, Chief Advisor to the Czech Banking Association. In the household sector, the total volume of consumer loans (excluding overdrafts and credit cards) reached CZK 341 billion in March, reflecting a 0.8% month-on-month increase and 9.1% year-on-year growth. The repayment performance remains strong, with non-performing consumer loans at 4.23%, the lowest share recorded in 23 years. Mortgage lending has shown a steady recovery, with a 6.2% year-on-year increase in loans for housing, including building savings loans. In April, CZK 26 billion was issued in new mortgage loans (excluding refinancing), and interest rates continued to decline gradually—from 4.78% in January to 4.65% in April. Non-performing mortgage loans decreased to 0.59%, reaching their lowest level since June 2023. This performance continues to place the Czech mortgage market among the best in Europe in terms of repayment discipline. Among sole traders, April brought further improvement, with the share of non-performing loans dropping to 4.09%, the lowest level in more than two decades. This contrasts with much higher default rates seen historically, even as recently as 2015 when the non-performing loan rate was three times higher. For non-financial sector companies, interest in borrowing has revived, particularly among domestic private firms, which recorded a nearly two percentage-point increase in loan volumes. In contrast, public sector firms saw continued declines, and firms under foreign control reported only slight month-on-month growth. New loans totaled CZK 27 billion in local currency and CZK 22 billion in euro-denominated loans. Average interest rates for new loans stood at 5.2% for crown loans and 4.4% for euro loans. The share of non-performing corporate loans remains low at 2.56%, indicating a relatively healthy corporate sector in international comparison. Deposit trends showed that household deposits grew by 5.4% year-on-year in April, with a month-on-month increase of CZK 26 billion, reaching a historical high of CZK 3.721 trillion. Despite low interest rates, households continue to hold over CZK 1.27 trillion in current accounts. Corporate deposits, characterized by more volatility, remained stable year-on-year. Since the summer of 2020, corporate deposits have consistently exceeded loan volumes, reflecting cautious financial behavior amid global economic uncertainty.